Unicount’s landing page states, “registering a company should be as easy as registering a domain.” When I first read this, I remember feeling really confused. Neither registering a company nor a domain seemed simple to me at that time. However, after registering a company in Estonia a few years ago, I can now explain why you can trust this statement.

I am from Türkiye, where the company registration process involves extensive bureaucracy, paperwork, and hidden expenses. Additionally, I needed a company that I could manage online and invoice customers in European countries. In 2021, I came across the Estonian e-Residency program. Despite being skeptical about the simplicity of the company formation process, I decided to give it a try. Entering the e-Residency system starts with obtaining an e-resident card for non-Estonian residents. You can read my previous blog post on how to obtain an Estonian e-resident card for more information.

There are a couple of ways to register a company in Estonia for e-residents. All registrations can be done via the e-Business Register. Alternatively, there is Unicount’s company formation API service, which is an easier solution for single founder/shareholders whom also acts as the sole board member. My company had another board member besides me back then, so I established it via the e-Business Register.

The first thing to do for a non-Estonian resident founder is to make sure you have an Estonian address and contact person for your company. All Estonian companies managed from abroad need to have an address in Estonia and a contact person per the Estonian Commercial Code. Non-residents may get a virtual office address and contact person with a multitude of service providers.

The first step for a non-Estonian resident founder is to ensure you have an Estonian address or contact person for your company. All Estonian companies managed from abroad need an address in Estonia or a contact person if they would like to register company address outside of Estonia according to the Estonian Commercial Code.

Estonian e-residents can get a virtual office address or contact person from a variety of service providers. My service provider was Unicount as I stated during my e-resident card application. Unicount has an annual virtual office address or contact person subscription at competitive prices. Also, they have a very comprehensive support articles collection that answered many of my questions before starting my application. After subscribing to the virtual office services of Unicount, I started company formation on the e-Business Register.

I also registered for a Smart-ID, which I find more efficient than using an ID card. Smart-ID is a very practical method compared to the e-resident ID card for logging in and signing documents. With Smart-ID, you do not need to connect your card to your device; you just need to enter the PIN1 and PIN2 codes created during Smart-ID registration. This avoids potential problems related to hardware and browser plugins. It works perfectly with Unicount as well. While you can log in to the e-Business Register with Smart-ID, signing applications is not possible yet.

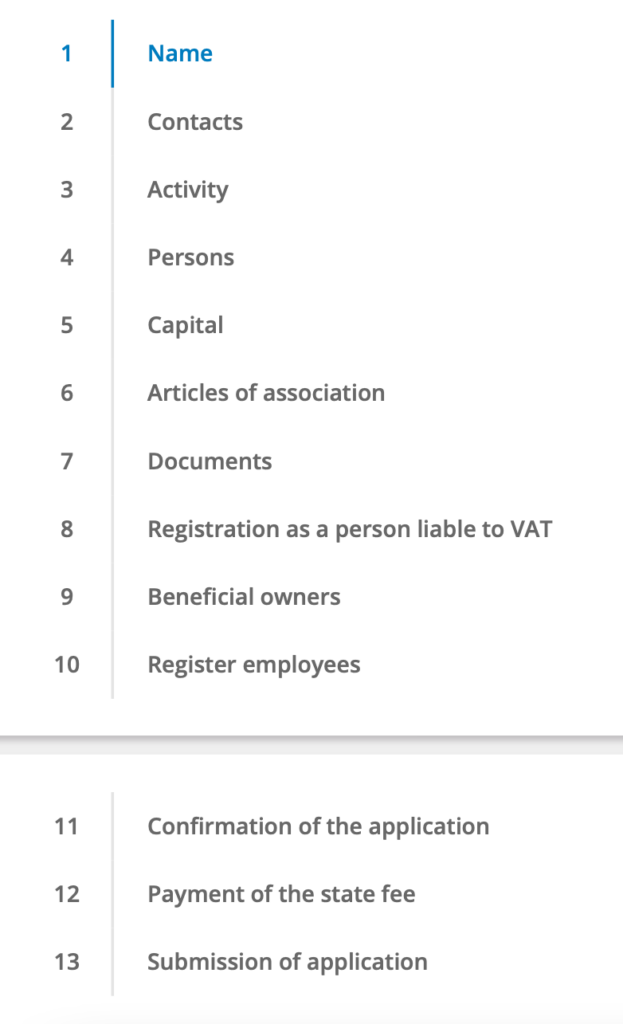

Registering a limited liability company involves 13 steps. I found a step-by-step guide by Unicount extremely helpful in filling out these steps on my application. I highly recommend referring to their guide as it explains each step clearly.

In the first step, you select a company name. If there are other names similar to the one you selected, they will appear in red, indicating a possibility of rejection by the registration department of the Tartu County Court in Estonia. If your name is rejected, you can change it and resubmit the application without any extra fees.

In the second step, you enter your company’s office address and email address. As I received service from Unicount, I used the virtual office address and company email address provided by them. I do not recommend using your personal email address because you would receive a lot of spam emails. Unicount’s email with the eesti.ee extension is spam-proof and mails are forwarded to the Client Dashboard. If you want to activate your eesti.ee email address for your own company, you can refer to Unicount guide.

The third step involves selecting the activity code (EMTAK) according to your company’s main field of activity. This can be confusing for companies with multiple activities since only one activity code can be selected in the Estonian Business Register. The selected code cannot be changed later. However, there is no need to panic. When you submit your annual accounts, the EMTAK code is automatically updated according to your main source of income. If you do not engage in an activity requiring a license, you can choose the activity code you think is most appropriate. The financial year duration and dates are set by default and should not be amended without a good reason.

In the fourth step, you add the details of the company’s board members, founders, and contact members. Your “personal identification code” must be the ID number on your e-resident card, not your Turkish or any other national ID number. The country selection should be Estonia as it issued your e-resident card with a national ID number. The system auto-fills your details as a board member because you are the founder. If you have more than one board member like I do or founders, you need to know their full legal names and their Estonian ID number or e-resident ID card number. Please note that your board members and company founders must have a valid Estonian ID card and be able to sign the application with their card. Under “Term of office,” you can define the term of board member rights to represent the company as well as the term for your contact person. In the founder selection, add your information as the founder and any other partners who will contribute to the company’s share capital. Provide your full address at this step if you are not an Estonian resident. Under the “Other roles” option, do not forget to add your “Contact person” information, which is mandatory per the Estonian Commercial Code if you are using an address outside of Estonia. Also, if you have a board member or founder residing in Estonia, you do not need to add a contact person.

The fifth step is about the payment of the share capital. The minimum share capital payment is 0,01 Euros but I was recommended to register minimum 1 euro. However, I did not have a business bank account for my non-existing company at that time to make this transaction during my company formation. I have contacted Unicount Support on this matter, and they advised me to register my company and then open my business bank account to deposit the share capital amount.

In the sixth step, you draft the company’s articles of association. I followed Unicount’s guide for this. The only change I made was to the “legal reserve” option. To avoid accounting issues related to the dividend ratio specified in this article, I set my company’s legal reserve ratio to 0%. Additionally, I listed the Business Register fee of 265 Euros under “foundation expenses” to make it a company expense.

In the seventh step, you select the documents you need to add, such as proof of the right to use a specific trademark as your company name.

The eighth step involves the voluntary VAT registration of your company. Estonian companies must register for VAT when their annual taxable turnover exceeds 40,000 Euros. You can register immediately if your company will be tax-resident in Estonia. My company was not yet operational, so VAT registration was not required.

In the ninth step, you add the beneficial owners of the company. As the sole owner, I added my information as a natural person. For companies with natural person founders, the correct choice is direct ownership for each shareholder holding more than 25% of the shares.

The tenth step is about pre-registering your company’s future employees residing in Estonia. If you will have employees from other countries, leave this registration to your accounting and tax specialist.

In the eleventh, twelfth, and thirteenth steps, you approve the application, pay the state fee, and sign the application. I encountered an issue as I did not have a Euro account to wire transfer the 265 Euro state fee payment. Fortunately, Unicount Support offered a solution by charging the state fee amount from my saved payment method on Unicount’s system and wire-transferring the state fee to the Business Register on my behalf. This saved me time and money. As a result, my company was registered on the same day.

If your company has additional board members, note that all board members’ digital signatures are necessary for company formation applications. Therefore, do not add board members who cannot sign digitally with their Estonian ID card via DigiDoc4 software.

My experience registering a company in Estonia was made easy by the help of the great Unicount team. The Estonian government processes applications in one or two business days. Considering I did not use Unicount’s fast company formation API, registering a company in less than four hours with the e-Business Register was a great experience. Later, I learned that Unicount has a record of registering a company in less than five minutes. This no longer surprises me.

Thank you for reading!

I hope you enjoyed learning about my company creation journey with Unicount, and I wish you the best with your own business formation endeavors.