Articles

How Unicount company formation works

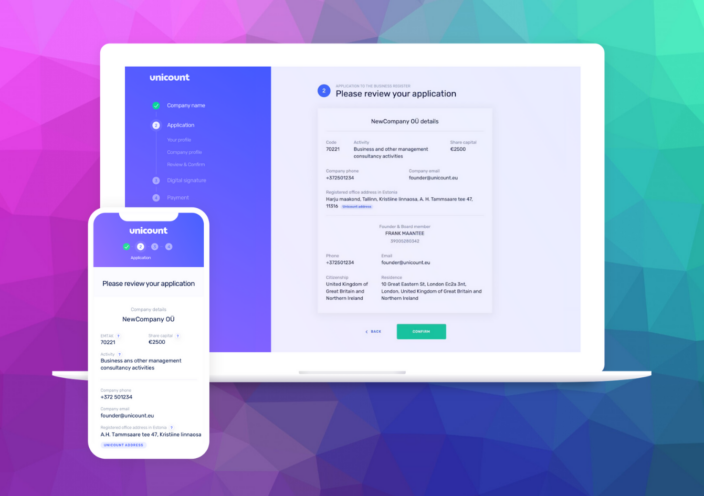

Building a business can be tough, but starting a company should be simple. If you can register a domain name for your company in a few minutes then why not your company too?

That’s why Unicount was created. Unicount is the simplest way to register an Estonian company. It’s also the simplest way to start a paperless EU company from anywhere in the world. It takes just five minutes. Unicount is used by citizens and residents of Estonia, but also a growing number of people around the world because all you need is an Estonian digital ID, which can be obtained by citizens of other countries living outside Estonia through e-Residency.

Read more

What are the field of activity codes in Estonia?

Choosing your main area in the field of activity codes in Estonia might be the second most challenging part of company registration with Unicount. The first would be figuring out a unique name with available web domains.

The Estonian Classification of Economic Activities (EMTAK) is the Estonian version of the international harmonised NACE statistical classification of economic activities in the European Union. EMTAK is the basis for determining your company’s type of activities and is an essential source of statistics for the Estonian government and EU. You don’t need to overstress when picking your field of activity code when registering a company; we’ll explain why.

Read more

How to pay taxes in Estonia?

As an e-resident, you’re probably already familiar with Estonia’s reputation as one of the world’s most digitally advanced and business-friendly countries. However, once your company is up and running, learning how the Estonian tax system works is inevitable. Don’t worry—we’re here to guide you through the essentials of paying taxes in Estonia as an e-resident founder.

Read more

Estonian company information: How to find company details

If you’ve set up an Estonian company, it’s essential to know where and how to find your Estonian company information. Whether you’re looking for your registration number or tax number or simply need an English version of your registration certificate, this guide will walk you through everything you need to know.

After registering your company in the Estonian Business Register, you will receive an email from the court with your company registration code (8 digits) and other registration details. The registry code (registrikood in Estonian) is your Estonian company number, and no other identification is used in Estonia to identify legal entities.

Read more

Annual Accounts of Estonian company: What Are They and How to Submit Them

If you’re running an OÜ (private limited company) in Estonia, submitting your annual accounts is a crucial task that keeps your business compliant with Estonian laws. Your service provider has probably started bombarding you with warnings a few months before the actual deadline to avoid any late filing penalties.

This guide will explain annual accounts, why they matter, and how to prepare them properly, ensuring your company stays in good standing. Annual accounts are public documents affecting how business partners and anyone else checking on your finances assess your company.

Read more

Potential Tax Hikes in Estonia: What e-Resident Founders Need to Know

As Estonia navigates the challenges of recession, high inflation, and increased defence spending, the new coalition government is considering significant changes to its tax policies. These adjustments are part of the coalition agreement aimed at balancing the state budget and ensuring alignment with the eurozone deficit requirements of 3%. For future e-resident founders looking to start their companies in Estonia, understanding these potential tax hikes may be relevant before making the expenses.

Read more

Legal Responsibilities of the Board Members of an Estonian Limited Company

Estonian e-Residency enables anyone to set up a company in Estonia online. Registering a company is impossible without appointing board members (company directors). If you are the sole founder, you most probably serve as a sole board member of your company. Board members of an Estonian limited company (OÜ) have a lot of responsibilities to ensure the company operates legally and maintains good governance. Below is our comprehensive guide detailing these responsibilities, with links to relevant Unicount blog posts.

Read more

Now you can reserve company names in Estonia

As an Estonian e-resident, securing a business name before officially registering your company in Estonia was impossible before March 2024. Now, you can do that to ensure that your desired name is kept for your business whenever you plan to register it. Here’s a comprehensive guide on how to reserve your business name in Estonia.

Read more

Estonian Business Register recently deleted over 26 000 companies

Estonian Business Register recently deleted more than 26 000 companies for not submitting their annual accounts on time. In 2023, 121 654 companies missed the annual accounts deadline. Of those 26 681 were deleted from the register in 2024, and another 13 100 were fined.

Knowing that non-submission can result in company deletion, it has been widely used to evade debts and tax liabilities. Currently, having debts does not prevent deletion unless legal actions are already in progress. The Estonian Ministry of Justice stresses that deletion does not absolve directors’ legal responsibilities for unlawful acts or inactivity.

Expert Insights on Dividends, Accounting, and Taxation in Estonia

On 7 May, Unicount held its first webinar for its e-resident clients. Our Managing Director, Ivar Veskioja, and our accounting team member, Malle, shared valuable information related to e-residency, Estonian company formation with Unicount, accounting, and taxes. We received questions about various topics, including dividend payments, taxes and accounting in Estonia for non-residents, setting up a bank account in Estonia, and more. In this blog post, we will highlight some of our in-depth answers.

Read more