Every Estonian company has to submit annual accounts (annual report) to the Estonian Business Register 6 months after the end of the financial year. The annual accounts for small companies include your company’s balance sheet, Profit & Loss statement and management report about the performed activities with some mandatory notes such as labour expenses and related parties transactions. The report is more straightforward for micro and small enterprises and has less mandatory information to disclose. Even if your company hasn’t started trading yet, submitting the annual accounts is the one thing you need to do to ensure your company and its board are compliant with Estonian laws and not fined.

Unhappy government

Estonian Ministry of Justice deputy undersecretary Viljar Peep mentioned in a 2021 press release that only 60% of legal persons in Estonia submit their annual accounts on time. 20% submitted it late, and 20% did not submit it at all. This last 20% has annoyed the Estonian government for some time, and now the government has finally acted. The Estonian tax office is now enforcing late filing penalties for non-compliant companies. The Tartu County registration department still controls the submissions through the e-Business Register. Recent legislative changes have also made it easier for the court to delete companies that do not submit annual accounts on time. Your company can be deleted three months after you have missed the deadline. An additional deadline for submission with a deletion warning is now processed automatically.

The cost of not being compliant

Complying with the annual accounts submission requirement is something that many small companies have neglected. The bad news for Estonian e-residents having companies in Estonia with annual reports is that starting in 2022, the court has begun sending fines for each overdue annual accounts. These fines may end up payable by the board member who did not comply with the requirement of submitting annual accounts 6 months after the end of the financial year. In 2024, the first fines started coming in as late as 5 November, which was 4 months of extra time with no penalties imposed.

For companies registered through the Unicount API service, the financial year is always stated in standard articles as a calendar year. This means that the deadline for submission for a company registered before 1 July is 30 June. Companies registered on or after 1 July can submit their annual reports for the first 18 months of their first financial year. This would mean one year later than the companies registered on 30 June 2021.

Basics of the annual accounts

The official advice of Unicount for any Estonian company owner trying to figure out how to prepare and submit their company’s annual report has always been straightforward: get a qualified accountant to do it for you. Because Unicount has many dormant companies registered with us, we have previously produced a dormant accounts manual to help you do it yourself at your own risk. Here is the link to the manual. Dormant company accounts is an unofficial term; legally, they are micro companies accounts with simplified annual accounts that are applicable if the company has only one natural person shareholder, and board member. Officially, Estonia has no dormant accounts or companies, so you would submit accounts for a company that did not trade at all.

How do the fines work?

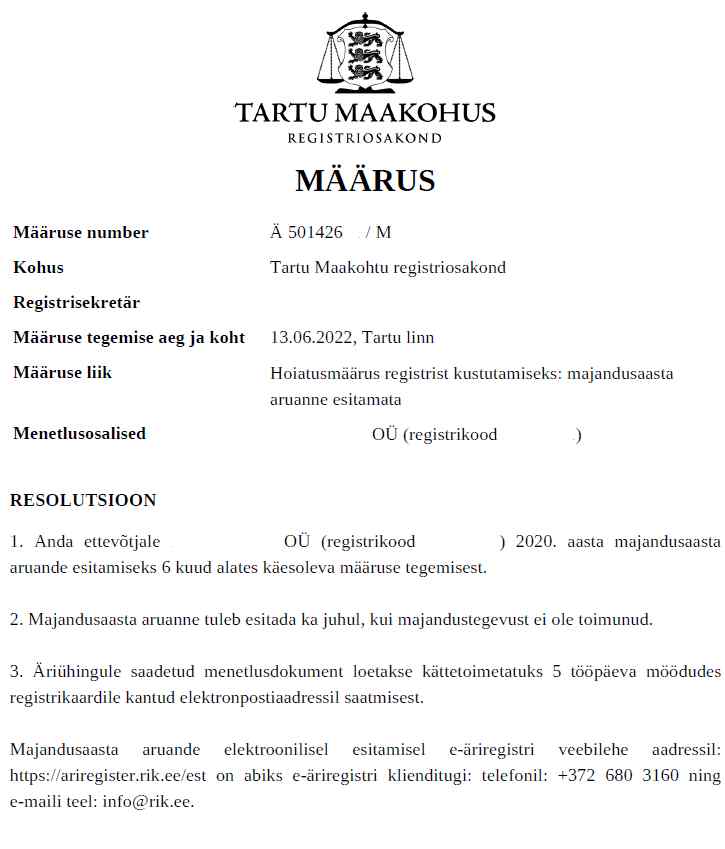

You will first get an email warning with a new submission deadline. This is what it looks like in Estonian. You will only receive it if you have a working email registered as your official company email on the Business Register. Unicount clients usually receive these notifications with unofficial translations to their Client Dashboard. This applies if the company’s public email is set to mailmycompany0@gmail.com to avoid spam and to let Unicount process all the official email notices from government agencies.

This penalty warning is very kind as it offers several months for the board to submit the overdue annual report, but we have also seen warnings giving you 15 or 30 days to submit an annual accounts. After ignoring this warning, you would soon receive the actual fine, which the Estonian Tax and Customs Board or even court bailiff can enforce in Estonia. A bailiff can arrest personal and business bank accounts to get the fine and additional service charges to be paid by the company or its board member.

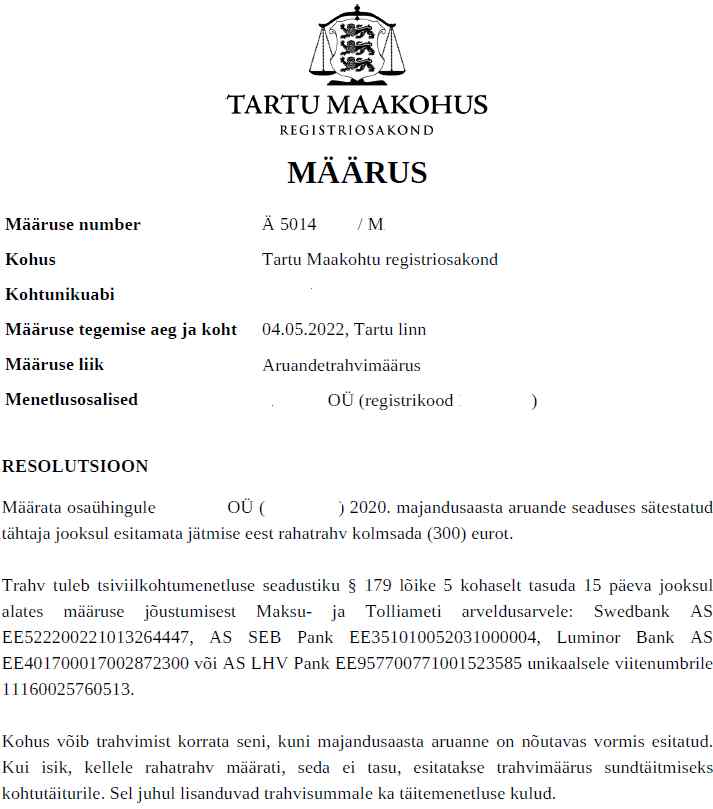

This is what the fine would look like. It includes the Ministry of Finance’s bank accounts and reminds you that the fine can be repeated until the annual accounts are submitted. Paying the fine does not mean that you do not have to submit the annual report anymore. Here is a sample fine of 300 euros. Please note that the fine can be anything between 200-3200 euros.

Hiring an accountant

Considering the cost of micro accounts from a professional accounting firm, you most probably pay more as a fine than you would for the actual accounts made in time. If you need help, feel free to contact our accounting team or purchase the annual accounts minimum fee product from your Unicount Client Dashboard accounting menu to start the process of annual accounts preparation. We will assess the volume and give you an additional quote if we cannot prepare your accounts within the minimum fee.

Other consequences

If you are an Estonian e-resident board member and have not been compliant with Estonian laws, the Police and Border Guard can and will probably ask about it when you try to renew your e-resident card. If you want to stay an Estonian e-resident, you must submit the overdue annual accounts under time constraints and straightforward questions about your non-compliance from the police.

Stay Informed with Unicount

At Unicount, we’re committed to updating our clients on legislative changes affecting e-residents and Estonian business owners. We’ll continue to monitor these proposed tax reforms and provide guidance on adapting to the new tax structure. If you have any questions about these upcoming changes or need help navigating Estonia’s regulatory environment, please get in touch with us.

To stay informed about these tax updates, ensure you’re signed up for our newsletter or check our blog for the latest insights.

Thanks for reading

We hope you enjoyed this article. If you have more questions, check out Unicount’s extensive support articles here.