Every Estonian company has to submit an annual report to the Estonian Business Register. This document is an overview of your company’s finances and activities in its previous financial year. All citizens, residents, and e-residents of Estonia that own companies are subject to the same rules, although the reports are simplified for micro and small enterprises.

Even if your company hasn’t started trading yet then submitting the annual report is the one thing you need to do to ensure your company doesn’t get deleted from the Estonian Business Register.

The official advice for any Estonian company owner trying to figure how to prepare and submit their company’s annual report has always been very simple: get a qualified accountant to do it for you. More on that later.

In this article though, I’m going to show you the opposite: How to submit your Estonian company’s annual report online by yourself.

There’s one big disclaimer here though. This advice is only useful if you have a micro company that has no employees, no assets, no recorded expenses, and has not started any business activities.

The complexity of your company’s annual report depends primarily on the complexity of its balance sheet and profit & loss statement, but even a small amount of trading or investment activity can possibly create enough complications that should be handled only by an accountant with knowledge of Estonian accounting rules.

This do-it-yourself guide can still help a lot of people though. It means you can get your Estonian company registered yourself (like here in 3 minutes through Unicount) and then not worry about any additional expenses until your business is ready to operate. If you are an e-resident then your only expense in those circumstances would probably be a virtual office subscription. Many people start paying for an accountant monthly way too early when they are not yet ready to do business or they put off registering the company, which means trying to pitch a business with less credibility or building a business around a planned name that might not even be available at a later date.

As it happens, in addition to working here at Unicount, I personally own two Estonian companies. One is trading and one has never traded. So I will use my own companies as real examples for this article. Our passion here at Unicount is to make the process of starting an Estonian company as simple as possible – whether you are a citizen, resident, or e-resident of Estonia – and we also love sharing advice about simple ways to manage those companies. As entrepreneurs ourselves, we think it’s really important that our guidance is always based on telling others about exactly the same thing that we do ourselves with our own companies.

When do Estonian companies have to submit their annual report?

First, let’s just clarify when you have to do your annual report.

According to the Estonian Commercial Code, the annual report must be submitted within six months of your company’s financial year ending. For most Estonian companies, including those established here through Unicount, the financial year is defined in their Articles of Association as being from 1 January to 31 December. That’s the default and the simplest way to do it (and we like to keep everything simple here). So that means the annual report deadline would ordinarily be 30 June.

One more thing. If you are reading this article then I’m guessing you are probably thinking about how to submit your very first annual report. Bear in mind that annual reports don’t have to be submitted if the actual financial period is less than six months. In that case, you can submit an annual report the following year covering a period of up to a year and a half.

That basically means that if you use the standard financial year then you have to submit an annual report the following year if you register your Estonian company on 30 June, but not if you register it on 1 July.

Why annual reports are important

You might be imagining all these annual reports getting filed away in some dusty drawer at a government office. That’s not how it works in e-Estonia though.

This data is gathered to build up a picture of our business environment, which is then used by the state to make better policy decisions. It’s also available to the public so that entrepreneurs can use it to better understand the market and their partners.

In fact, every annual report is made publicly available online through the Estonian Business Register to anyone who’s interested in seeing it. That transparency is really important for preserving the trusted nature of our business environment, which then gives more confidence to customers, partners, creditors, investors, and other stakeholders interested in helping your business grow.

How to submit an annual report if your company has been trading

As mentioned, the official advice is to always let your accountant submit your company’s annual report. In fact, I used to be one of the officials giving that advice and I still have debates online with Estonian company owners who think they can do it themselves.

A good accountant is worth every cent and most are particularly good value-for-money in Estonia. If you have a regular accountant looking after your company books then the annual report could be included in their monthly fee. Even if you don’t have a monthly accounting subscription, which is possible for microenterprises that aren’t registered for VAT, then hiring an accountant to do your annual report should be your one-off annual expense. The price varies substantially. Just bear in mind that you are usually paying by the hour for an accountant so one of the biggest factors affecting cost is how well organised you’ve kept your own sales invoices and expense documents throughout the year and how easily the accountant can access them, whether it’s through a cloud folder or software such as Envoice.

If you are not a qualified accountant and not familiar with all of Estonia’s reporting rules then preparing your own annual report is not just a lot of hassle, but could end up costing you far more.

Without an accountant, it’s easy to make a mistake in your report and that is an offence (Commercial Register Act § 66). Once you’ve chosen your accountant, you need to appoint them in the Estonian Business Register as someone who has permission to enter the data and file your annual report after you have signed as a board member. Simply log into the Business Register here and find the tab for “Submission or a report” and then “Defining persons entering data”. You just need to know your accountant’s ID code (isikukood), which is their unique national identification number given to all citizens, residents, and e-residents. If you have any problems, you can check out this whole article on our support pages we made about this specific process.

Unicount will request access or statements from your business bank accounts, and e-Tax, and will provide you with accounting software and expense management software.

Unicount prioritises their existing clients who trust them for monthly accounting and so their annual report is part of that service. We are happy to prepare and submit annual reports for our virtual office clients when we have the capacity, but this is often not the case close to 30 June. As you can imagine, a lot of accountants in Estonia get a sudden rush of requests for help before 30 June.

How to submit an annual report by yourself if your company hasn’t been trading

I’ve had a lot of debates on social media about whether Estonian company owners can submit their own annual reports, particularly in the Facebook groups for e-residents of Estonia and Expats in Tallinn/Estonia.

In one recent discussion, I conceded that if your company isn’t yet trading then you don’t need an accountant. I then realised that there’s no guide for those people so that’s what prompted me to write this article – especially as I have my own company to try it with. Others still argue that a relatively small amount of trading also doesn’t need an accountant, but I’m not going to recommend that.

Note that every Estonian company owner does have at least one business expense from the start. You paid to establish the company and, if you are residing outside Estonia, then you likely also paid for a virtual office. You could legitimately expense that to the company. However, that would mean the company should present those expenses in the annual report. You should leave these expenses you paid for from your own pocket out of the report though if you want to use the free advice here.

Both myself and Ivar, the founder of Unicount, have each gone through the annual report submitting process separately on the Estonian Business Register and we noticed slight inconsistencies in our experiences, as well as a few bugs and mistranslations on the English side, which we’ve reported in the hope they will be fixed. To be fair, the user interface is OK for Estonian-speaking accountants and there’s just never really been an expectation that anyone else would use it.

So if anything in this guide doesn’t match your experience or is still confusing then let us know then we can investigate and update this article. As with all our advice here at Unicount, we love to write it in collaboration with our readers because we are all entrepreneurs figuring these things out together.

As mentioned, I have a microbusiness that has never traded, has no employees, no revenue, no expenses, no expenses, no registered share capital, nada. I registered it in June last year and haven’t yet needed it, but I will do it in future. So it’s perfect for this example.

In case you’re wondering, a microbusiness is defined in law as a one-person company with assets less than €175,000 and an annual taxable turnover in a single financial year of up to €50,000. A small enterprise, meanwhile, can have two out of three for the following: Assets of up to €4 million, an annual turnover of up to €8 million, and up to 50 salaried employees in the financial year. In both cases, the annual reporting process has already been simplified.

So here’s how I prepared and submitted the annual report. By the way, if you’d like less text and more screenshots then you can follow this guide on our support section instead.

Step 1. Log in to the Estonian e-Business Register

You will need to use the link above, which is the same one you can use to register a company, register share capital, or alter your Articles of Association. You will need to use your Estonian digital ID or Smart-ID to log in and sign.

Step 2. Add new report

Click on the blue tab that says ‘Annual reports’ then click on the lower tab that says ‘Reports to be submitted’. You can then click the blue button for ‘Add new report’. You will then see a dropdown menu where you can select the company you are submitting an annual report for.

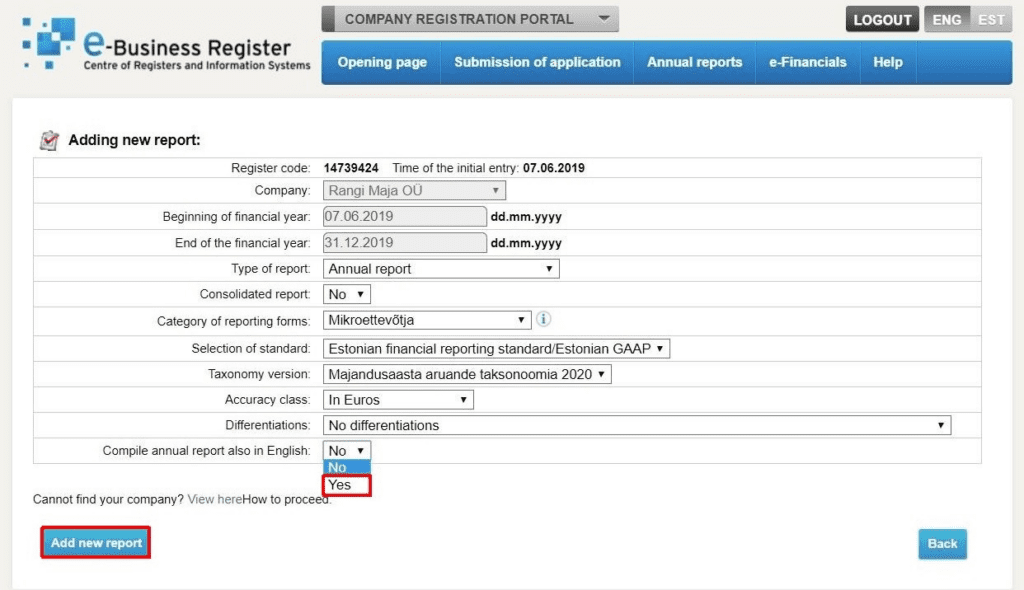

Step 3. Defining the report

The date that this report covers should already be selected as from 1 January to 31 December of the previous year. However, if this is your first annual report then you need to put the date that the company was founded, which might be later if you established it before the end of June or earlier the previous year if you started it after the start of July. Click also on ‘Type of report’ then select ‘Annual report’. More options will now appear, some of them confusingly in Estonian even if you are going through the process in English. The only additional thing you need to change is select ‘yes’ which asks if the report should be compiled also in English.

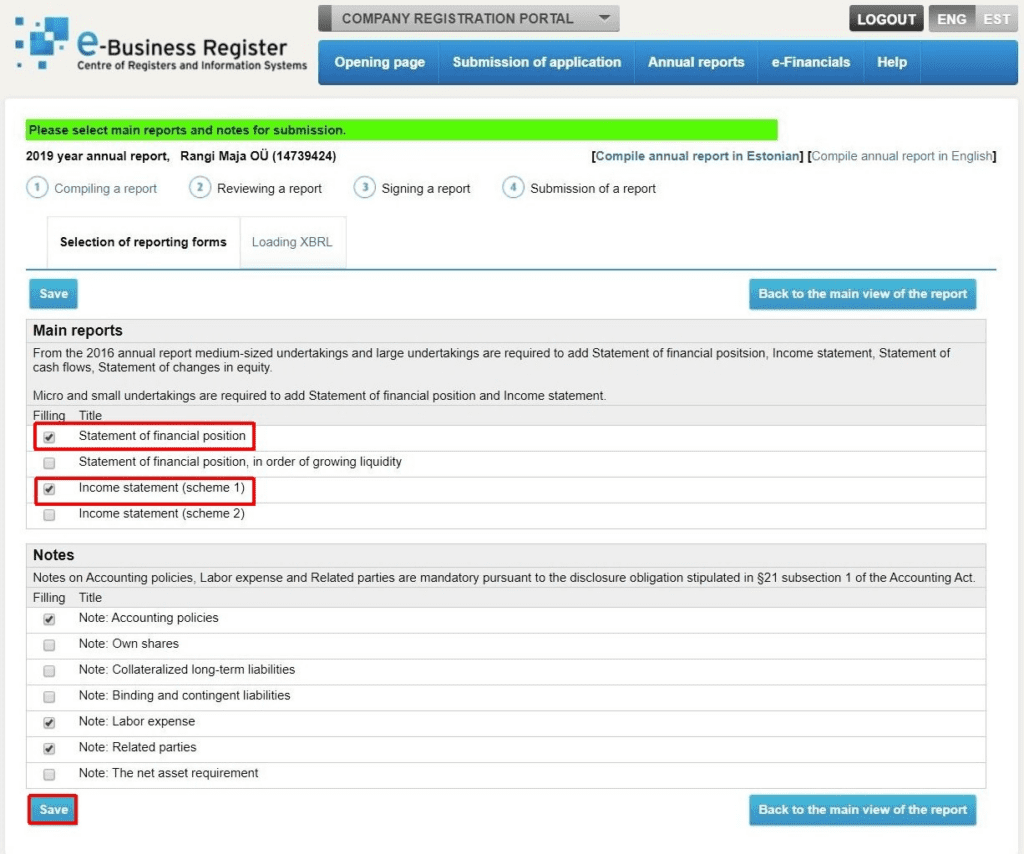

Step 4. Filling in reporting forms

The next screen is called ‘General view of the report’ on which we need to change a few things, first by clicking the blue button that says ‘Filling in reporting forms’. On the next page from that, we just need to tick two extra boxes before clicking save. We need to add two mandatory forms under the ‘Main reports’ section so click the first box that says ‘Statement of financial position’ and also the third box that says ‘Income statement (scheme 1)’. In English, those are more commonly known as a balance sheet and a profit and loss statement.

Main reports

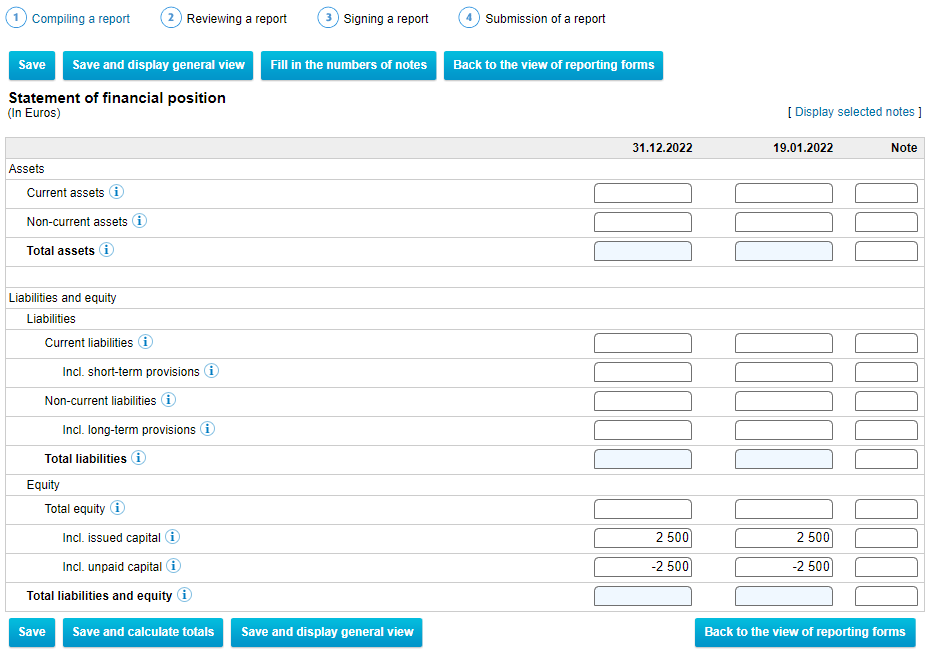

You will next get the opportunity to fill those out. Click the blue ‘Enter’ button next to them, starting with the one called ‘Statement of Financial position’.

That will open up a complicated-looking form where you can enter lots of numbers. All you need to do though is enter ‘0’ as your equity for both the start and end date, enter ‘2500’ as your issued share capital for the start and end date, and also ‘-2500’ as your unpaid capital on the balance start and end date. That’s assuming you’ve used the standard minimum share capital of €2,500 when starting your company. You don’t need to enter anything under assets or liabilities.

Finally, for this section, click ‘Save and calculate totals’. If everything is correct, the totals will calculate, there will be no error messages, and you can then click ‘Back to the view of reporting forms’.

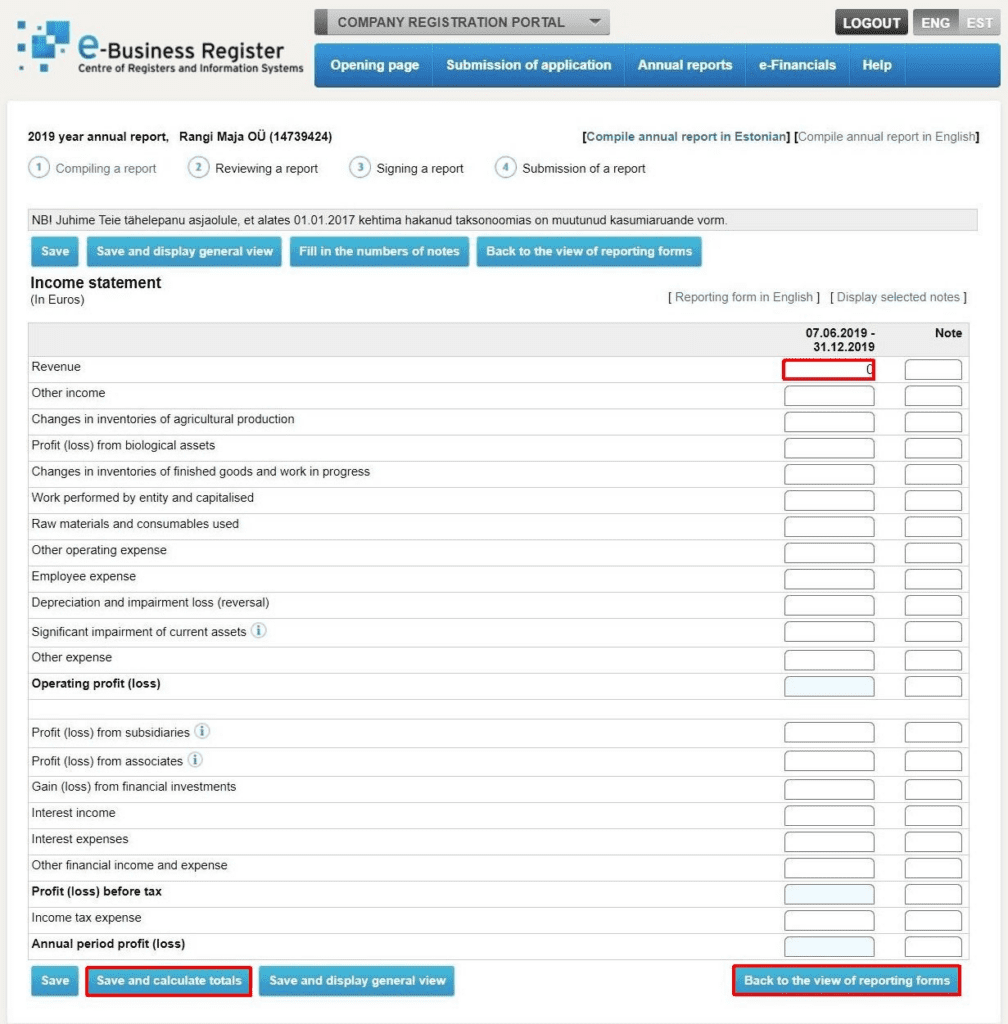

Now let’s do the profit and loss statement. Click the blue ‘Enter’ button next to that and you’ll find another complicated-looking form. This is even simpler though. Just write ‘0’ in that first box next to ‘Revenue’ then click ‘Save and calculate totals’.

Ok. We’ve completed this section so now click ‘Back to the view of reporting forms’.

Notes

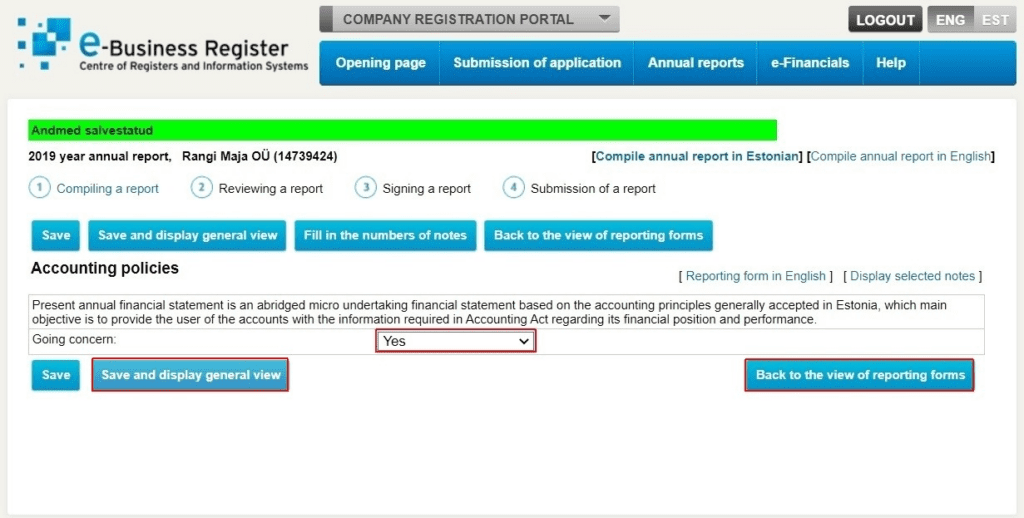

This will actually take you to an additional section after ‘Main reports’, which is called ‘Notes’. Here, there are three mandatory notes that need to be submitted: ‘Accounting policies’, ‘Labor expense’ and ‘Related party [transactions]’. Click that blue enter button to open them, starting with ‘Accounting policies’.

‘Accounting policies’ is really simple. You just select ‘Yes’ from that dropdown menu then ‘Back to the view of reporting forms’. The question you are answering has actually been mistranslated into English (which we’ve reported), but it’s supposed to be asking if your company is still active (ettevõte on jätkuvalt tegutsev in Estonian).

Now let’s do ‘Labour expense’. Here you literally do nothing besides adding zeros to both rows. Just click ‘Save’ then ‘Back to the view of reporting forms’.

Finally, ‘Related parties’. Here you need to insert ‘2500’ under ‘Receivables’ at both the end and start date. (Again, that’s if your company has the minimum share capital of €2,500). Then click ‘Save and display general view’.

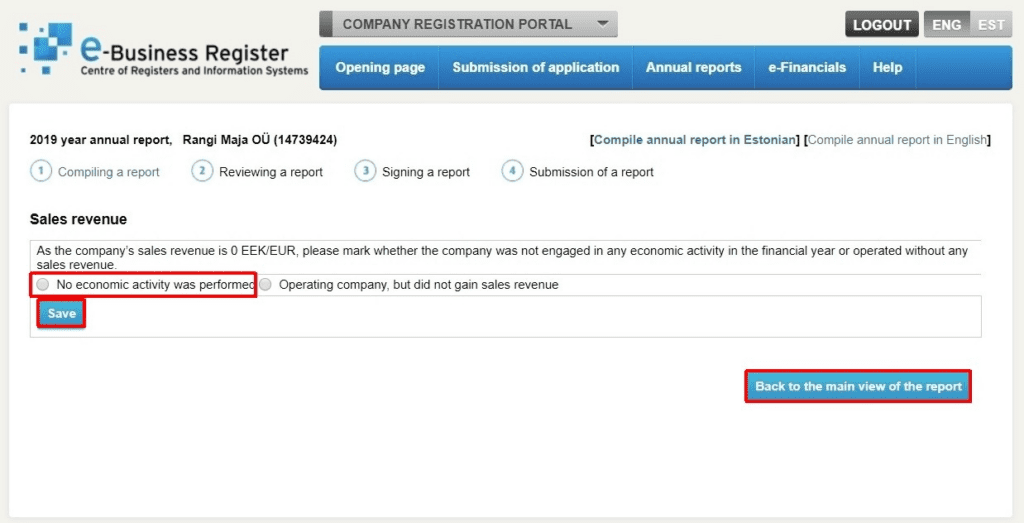

Step 5: Clarify the company isn’t operating

You are now back in the main section and have all the mandatory report forms completed. You can’t proceed to the next step though without clarifying that lack of revenue. The state wants to know whether you just haven’t made any sales or whether you haven’t been operating at all. So click ‘Enter the breakdown of sales revenue’.

If you haven’t been operating at all (which is the only reason I think we should be completing this ourselves in case I haven’t made that clear), then click ‘No economic activity was performed’. Then click ‘Back to the main view of the report’.

Bonus tip: Amendments

By the way, you can use your annual report to make some amendments to your company. Some of these can be made at any time anyway, but some like changing the field of activity can only be changed through the annual report. This is something I wanted to do for my company, but it was a bit tricky. This should be kept accurate anyway, but I also wanted to change the name of the company but my chosen name clashed with another company and so could only be registered if it was in a different field. After a bit of trial and error, I realised I could only enter the new field of activity by first selecting that the company was operating but didn’t have any sales revenue. After entering the field of activity code, I then changed it back to ‘No economic activity was performed’.

Step 6: Reviewing the report

You can now click ‘Continue to the next step’. On the next page, first click that button that says ‘Generate the final PDF in Estonian and English’. Then also tick the box that says you give access to the Statistics Office of Estonia. My colleague saw this tickbox written in Estonian (even on the English side), while I saw it in English. Either way, it’s the only tickbox on the page. You can then click ‘Send the report to signing’.

On the next page, you need to click to enter the date the report was completed before clicking ‘save’. Then you can click the blue button to ‘Add a digital signature to the report’. After using your Estonian digital ID or Smart-ID to enter a digital signature, click the blue button for ‘Continue to the next step’.

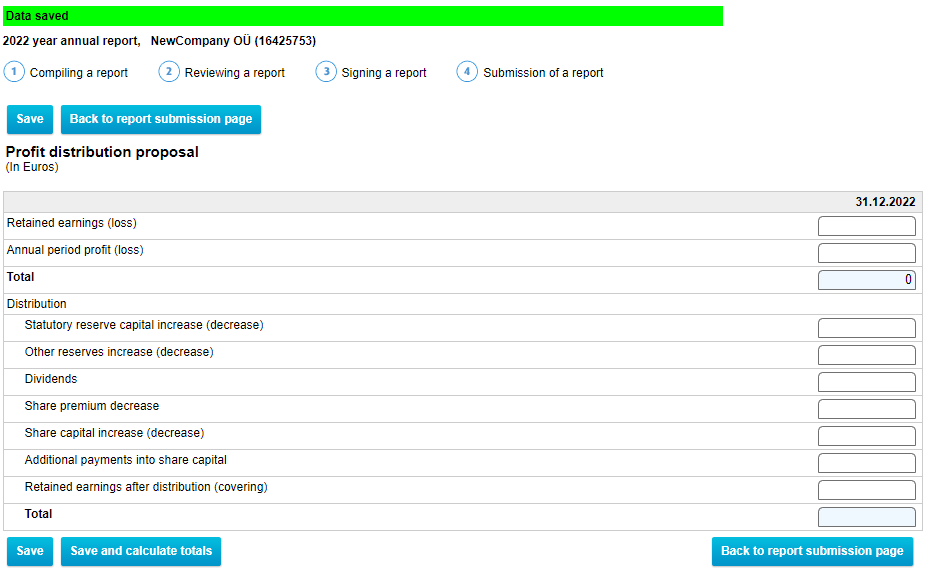

Step 7: Submit your annual report

You are not ready to download the signed report in Estonian and English and then submit it to the Estonian Business Register. Before you can do that you need to fill in a Profit distribution or loss covering resolution which will be just zeros. When the submission is successfully submitted you should get an email confirmation and a display notification in general report view.

That’s your annual report done! Congratulations. How long did it take you? It took me about 30 minutes, but I’d love to know how it was for you reading this.

Thanks for reading

We hope this article was useful for you. If you’d like to start your own Estonian company then Unicount is the simplest way to do it. We have a user-friendly online company formation service that’s been developed for citizens, residents and e-residents of Estonia. It takes just 3 minutes to get a company set up. Check it out at unicount.eu.