Articles

What expenses trigger corporate income tax & how to claim VAT refunds in Estonia

Doing business in Estonia as an international entrepreneur or e-resident requires understanding the local tax system, particularly corporate income tax obligations and VAT refund rules for expenses incurred across borders. This article provides clear examples of payments that trigger Estonian corporate income tax and explains how to claim VAT refunds on cross-border business expenses, helping foreign entrepreneurs stay compliant and optimize their tax position.

Read more

Can I use my Estonian company to work as a freelancer or contractor abroad?

One of the most common questions we hear from e-residents is whether they can use their Estonian company to work as a freelancer or contractor for clients abroad. The short answer is yes, but the long answer is more nuanced, and it depends on how you structure your work, where your clients are based, and what your local tax obligations look like.

At Unicount, we’ve helped thousands of e-residents launch Estonian companies for remote work. Many of them are developers, designers, consultants, marketers, and other professionals who want to invoice international clients without the complexity of local bureaucracy. Estonia’s e-Residency program makes this possible, but it’s important to understand the legal and tax implications before you get started.

Read more

Understanding Estonian taxable payments. Guide for businesses

Estonia’s unique corporate income tax system stands apart from traditional taxation models worldwide, offering businesses exceptional flexibility and growth opportunities. Unlike classical corporate tax systems that tax annual profits, Estonia operates on a distribution-based taxation model where corporate income tax is only triggered when profits leave the company or when non-business-related payments are made.

Read more

Expert Answers about dividends, accounting, and taxation in Estonia.

Earlier this week, Unicount hosted a live webinar for e-residents. The session was called E-Residency Can Power Your Business, and it brought together our business expert to answer real questions from real founders.

During Q&A, we covered everything from dividend payments and tax obligations to accounting workflows and intellectual property rights. The questions were sharp, the concerns valid, and the insights worth sharing. So in this blog, we’re highlighting the most important takeaways, especially for e-residents planning their businesses or navigating cross-border taxation.

Read more

How to scale your Estonian company as an e-Resident: From solo founder to small team

Starting a business as an e-resident in Estonia is refreshingly simple. You register your company online, manage it remotely, and enjoy the benefits of a transparent tax system and digital-first infrastructure. But what happens when your business starts to grow? When you move from being a solo founder to building a small team, the landscape changes, and so do your responsibilities.

Scaling is exciting, but it also requires structure. You’ll need to consider employment contracts, labor taxes, payroll reporting, and potentially adjustments to your company’s legal structure. At Unicount, we’ve seen this transition happen often. Many of our clients start lean and digital, then expand into something more substantial. This blog is for those founders, the ones ready to take the next step.

Read more

How to change board members or shareholders in your Estonian company: A practical guide

As your business grows, so does your team. Whether you’re bringing in new talent, restructuring ownership, or simply updating your company’s records, knowing how to properly change board members or shareholders is essential for staying compliant in Estonia.

At Unicount, we regularly assist e-residents with company amendments. These changes may seem procedural, but they carry legal weight, and when done correctly, they help protect your business, clarify responsibilities, and ensure smooth operations.

This guide walks you through the key steps, legal requirements, and practical considerations involved in updating your Estonian OÜ’s management board and shareholder structure.

Read more

Closing your Estonian company: What e-Residents need to know about liquidation

Liquidation isn’t something most entrepreneurs plan for when they launch a business. But for some e-residents, closing a company becomes a necessary step, whether due to shifting priorities, changing markets, or simply the natural end of a venture.

At Unicount, we’ve noticed a growing number of clients entering the liquidation process in Estonia. It’s a trend we take seriously, and we want to ensure that e-residents have access to clear, accurate information and professional support when making this decision.

This guide outlines the key steps, options, and considerations involved in liquidating a private limited company (OÜ) in Estonia. Whether you’re ready to dissolve your business or just exploring your options, we’re here to help.

Read more

Estonia’s e-Residency revenue doubled in 2025. What this means?

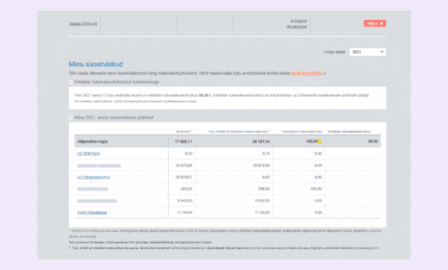

In the first half of 2025, Estonia’s e-Residency program generated €68 million in direct economic impact, nearly twice the projected figure. This surge in revenue, driven largely by tax contributions from e-resident companies, marks a turning point in the program’s evolution and signals a new era of opportunity for global founders.

For entrepreneurs seeking a streamlined, EU-based business environment, Estonia is no longer a hidden gem. It’s a proven platform for building lean, compliant, and scalable companies entirely online.

Read more

Why your Estonian company might lose EU VAT number?

For many e-residents, obtaining an EU VAT number is a key step in running a cross-border business through Estonia. It enables smoother invoicing, especially within the EU, and signals that your company is active and compliant.

In 2025, however, some e-resident companies have encountered challenges when applying for or maintaining their VAT registration. These cases are not due to sudden legal changes, but rather a more consistent application of existing rules by the Estonian Tax and Customs Board.

Read more