Articles

Single vs multi‑shareholder Estonian OÜ: Which is better for e‑Residents in 2025?

Choosing the right shareholder structure is one of the first real strategy decisions when you start an Estonian company as an e‑resident. Should you keep things simple and launch a single‑shareholder OÜ, or bring in co‑founders and register a multi‑shareholder company from day one? This guide explains how both options work in Estonia, what the share capital rules look like in 2025, and how Unicount helps you set everything up correctly.

Read more

VAT registration for Estonian e-Resident companies in 2025

Navigating VAT registration is a key step for every Estonian e-resident establishing a company. In 2025, understanding when and how to register, what rules apply, and how Unicount supports you through the process is essential for compliance and tax efficiency.

Who needs VAT registration in Estonia?

When you launch your OÜ (private limited company) in Estonia as an e-resident, VAT liability is not automatic. You must register for VAT only when your taxable turnover in Estonia exceeds €40,000 within a calendar year.

Read more

How to open a business bank account for your Estonian company as an e-Resident in 2025

A practical guide for founders using Revolut and Unicount

Opening a business bank account is one of the first important steps after setting up your Estonian company. Every company needs an account to accept payments, pay suppliers, transfer share capital, and manage day-to-day operations.

For e-residents this part may feel unclear at first, because Estonia allows you to register a company online, but banking depends on strict European rules. In 2025 more founders are choosing digital banking solutions instead of traditional Estonian banks. This is the reason Unicount works closely with Revolut to help clients open business accounts quickly and remotely.

This guide explains how banking works for e-residents, what documents you need, and why Revolut is usually the most practical choice.

Read more

Estonian e-Residency penalties: What happens if you don’t comply?

Last week, we outlined the key responsibilities of Estonian e-residents in 2025 and how Unicount helps you stay compliant. But what happens if an e-resident, or the director of an Estonian OÜ, misses their legal and business duties?

Estonian e-Residency offers entrepreneurs a chance to run a trusted EU company fully online, but with that freedom comes responsibility. Failing to comply with Estonia’s legal and accounting requirements can lead to serious consequences, from administrative fines to losing your e-Residency digital ID altogether.

Suppose you are an e-resident in Estonia or plan to apply in 2025. In that case, this comprehensive guide from Unicount explains what happens if you do not meet your obligations and how to avoid penalties that could harm your business and digital status.

Read more

Key responsibilities of Estonian e-Residents in 2025.

Becoming an Estonian e-resident gives you access to a unique digital identity that unlocks a world of business opportunities across the EU. But with this digital privilege comes a set of responsibilities to ensure the trust and transparency of Estonia’s e-services. In this guide, we explain what every e-resident must know about their legal and practical duties.

Read more

How to get started with your Estonian e-Residency digital ID: Guide for 2025

Becoming an Estonian e-resident opens the door to managing your EU-based company fully online. Central to this digital empowerment is your e-Residency digital ID, a secure tool enabling you to authenticate yourself and digitally sign documents anywhere in the world. This guide walks you through setting up and using your digital ID, including the modern alternative, Smart-ID, so you can confidently access Estonia’s e-services and grow your international business.

Read more

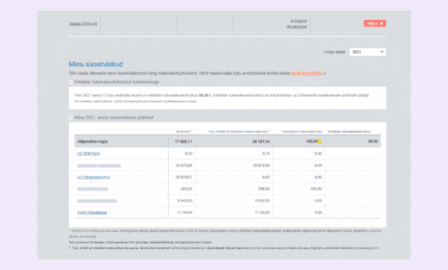

What expenses trigger corporate income tax & how to claim VAT refunds in Estonia

Doing business in Estonia as an international entrepreneur or e-resident requires understanding the local tax system, particularly corporate income tax obligations and VAT refund rules for expenses incurred across borders. This article provides clear examples of payments that trigger Estonian corporate income tax and explains how to claim VAT refunds on cross-border business expenses, helping foreign entrepreneurs stay compliant and optimize their tax position.

Read more

Can I use my Estonian company to work as a freelancer or contractor abroad?

One of the most common questions we hear from e-residents is whether they can use their Estonian company to work as a freelancer or contractor for clients abroad. The short answer is yes, but the long answer is more nuanced, and it depends on how you structure your work, where your clients are based, and what your local tax obligations look like.

At Unicount, we’ve helped thousands of e-residents launch Estonian companies for remote work. Many of them are developers, designers, consultants, marketers, and other professionals who want to invoice international clients without the complexity of local bureaucracy. Estonia’s e-Residency program makes this possible, but it’s important to understand the legal and tax implications before you get started.

Read more

Understanding Estonian taxable payments. Guide for businesses

Estonia’s unique corporate income tax system stands apart from traditional taxation models worldwide, offering businesses exceptional flexibility and growth opportunities. Unlike classical corporate tax systems that tax annual profits, Estonia operates on a distribution-based taxation model where corporate income tax is only triggered when profits leave the company or when non-business-related payments are made.

Read more