Estonian companies were required a minimum share capital of €2500 until 31 January 2023. This was an investment in your company that could then be spent on developing your business, but you were and are obliged to preserve equity (company assets minus liabilities) on the level that is at least half of the share capital as described in the Estonian Commercial Code § 176.

Until 31 January 2023, Estonia also had a system that allowed you to postpone this investment when registering a company as a natural person founder. The only catch was that your company could not pay out dividends until your share capital had been registered, but you could start trading and even pay out salaries before then.

When you start a company in Estonia through Unicount formation service, your default share capital is 1 euro starting from 1 February 2023. The minimum share capital was reduced to 1 euro cent then compared to the 2500 euros that were the minimum shareholder capital contribution for years. For companies registered before 1 February 2023, we recommend registering your postponed share capital payment with the Business Register to be able to modify your share capital and also to pay out dividends. So here’s our guide for registering share capital for your Estonian company registered before 1 February 2023.

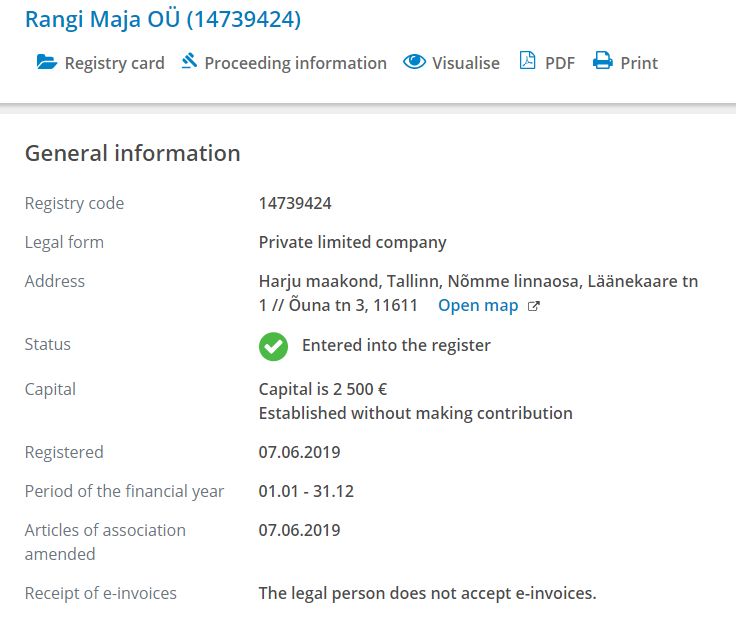

As you can see above, Estonian limited companies registered without paying in their share capital are recorded in the Estonian Business Register as “established without making contribution” on the company’s registry card.

In addition to not being able to pay out dividends (or adding a new shareholder through the method of raising share capital), registering share capital gives your company a slightly more credible impression to potential partners and customers when they look up your company in the Estonian Business Register.

According to the Estonian Commercial Code, share capital contributions by shareholders can be made in either monetary or non-monetary assets. By far the easiest option though is to simply make a single payment from your personal bank account to your company’s bank account for the total share capital amount.

Making a monetary payment

In order to make a share capital payment, you must transfer the exact amount in euros corresponding to your percentage of the share capital as outlined in your company’s Articles of Association. This should be transferred from your personal bank account to the company’s account.

We sometimes get asked if it is possible to pay the share capital in multiple instalments. This is technically possible, but we don’t recommend this because it creates extra hassle and potentially some confusion too, yet for no real gain. You only get the benefits of paying in share capital once the total amount is registered so you might as well keep your money until you are ready to pay it all in.

In order to make the payment, you will obviously need your company’s banking account already set up. Until relatively recently, the Estonian Commercial Code stated that share capital had to be paid into an Estonian credit institution, such as LHV Bank. The e-Residency programme worked hard to change that law though in order to open up banking and improve ease of business for everyone, particularly e-residents. As a result, the Estonian Commercial Code now states that you can register share capital with any credit or payment institution in the European Economic Area. That’s the EU, plus Switzerland, Norway and Iceland. This means, for example, that you can now use Wise business account for all your business activity. Despite being an Estonian-born company, their euro IBAN accounts are in Belgium and they are an authorised payment institution, with passporting rights across the EEA. So their account couldn’t previously be used for registering share capital for those two reasons, but that has now changed.

You may have noticed earlier that I used the slightly odd phrasing for ‘banking account’. That’s because payment institutions like Wise can legally describe their services as ‘banking’, but not themselves as a ‘bank’. There’s often a debate in the e-resident community about which credit or payment institution is best, but they all have pros and cons and there is no right answer for everyone. On a personal note, I mostly use Wise business account for my own Estonian company.

By default, all companies registered before 1 February 2023 had a minimum share capital of 2500 euros, unless you had a reason to increase this amount. If there are several shareholders, each shareholder should make a contribution in the amount corresponding to the nominal value of their share. Any investments into the company by shareholders above their nominal share value should be made as separate transactions for clarity. Increasing the share capital before registration is not possible.

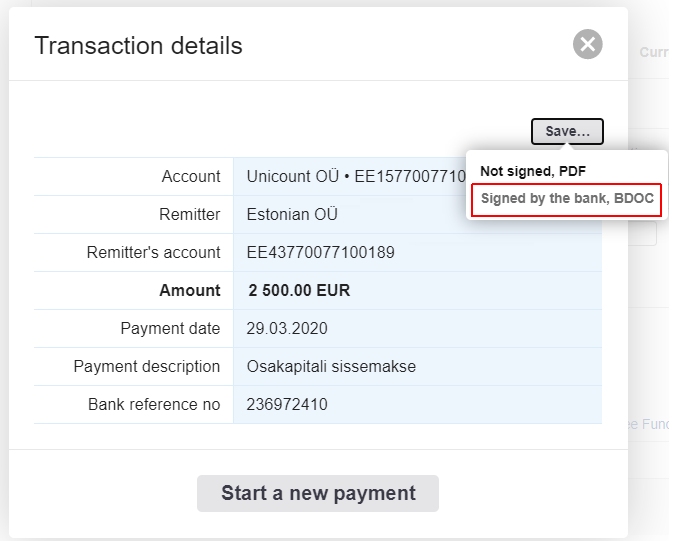

The payment description can be written in English or Estonian as either “share capital contribution” or “osakapitali sissemakse”.

The next crucial step was to prove to the Estonian Business Register that you made the payment. For this, you were required to ask your company’s payment institution for proof of the deposit or multiple deposits. The easiest way is to submit it online so there is no point in asking for a paper document. Starting from 1 February 2023 you are lucky not to need the proof if the amount deposited is not more than 50 000 euros.

When using an Estonian business bank account, you are usually able to download it straight from your online account with a digital stamp as a .bdoc file. If you receive an encrypted .cdoc document from an Estonian bank then it must first be decrypted with the DigiDoc program before submitting it to the Business Register otherwise only you can see it. Please note that the payment confirmation always needs to be downloaded from your business account.

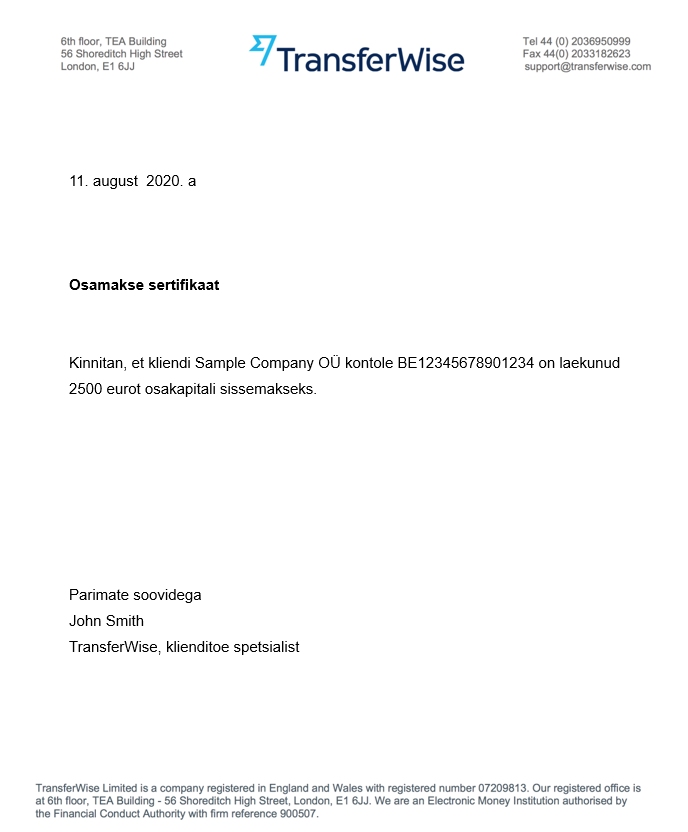

In addition, payment institutions such as Wise, Paysera or Payoneer also issue share capital certificates on request. If your payment institution cannot do that then you should ask for help from the Estonian e-Residency programme or switch to another service. Please remember that your payment institution needs to hold a licence in the EEA (European Economic Area). Here is an example of odt document included in .asice container signed by Wise customer support specialist using Estonian e-resident card.

Since 1 February 2023, the certificate is required to be submitted to the Estonian Business Register through their online service only if the deposit is above the 50 000 euro limit. For any amount below this, you can start a petition to change company share capital data after logging in with your e-resident digital ID card without having the financial institution digitally signed deposit certificate. NB! When registering deposits above 50 000 euros you need to upload a digitally signed .asice or .bdoc file container that includes the financial institution’s digital signature. PDF files with handwritten signatures and all other formats will end up being rejected by the court.

The state fee for submitting a change entry like this is 25 euros, which can be paid from the company’s banking account or Visa and MasterCard bank cards.

If no errors are found in the documents then you will receive a notification from the Registry Department of Tartu County Court within five working days and the share capital is then officially registered. If there are any problems then you’ll instead receive a ‘ruling on the elimination of deficiencies’, which will tell you what needs correcting and resubmitting within the time period specified by the court so that you don’t have to pay the state fee again.

After this, one common area of confusion is what a company can actually do with this money that’s now in their company account. Put simply, it can be used for any business activity but not returned to the shareholder. So you can also use it to pay any suppliers, make investments, and even give out loans (although not to the shareholder). Dividends, however, can only be paid out from annual profits.

Non-monetary contributions

A company established online through Unicount is not allowed to receive non-monetary contributions based on their initial standard articles of Association. These Articles of Association are ideal for single shareholder company owners, but you can change them if you want, including if you do want to pay share capital through non-monetary contributions.

In order to do that, an application to amend the articles of association must first be submitted to the Estonian Business Register online. Clause 1.5 of the Articles of Association has to be amended so that non-monetary contributions would be allowed.

After the court has accepted your amendment to the articles of association, a new application for amendment can be made to register the share capital. For this you would need a digitally signed shareholders resolution, the agreement on the transfer of the non-monetary assets, and the assessment of the management board regarding the value of the assets when below 25 000 euros. Assets beyond this threshold would need an auditor’s assessment.

If you want to use Estonian real estate as a shareholder contribution then you also need an extract from the Estonian Land Register. If it is a car or similar vehicle registered in Estonia then an extract from the Estonian Road Administration is required.

Offsetting with dividends

In theory, the share capital contribution can also be made by offsetting it against dividends owed to shareholders. However, this would be a non-monetary contribution and must therefore be first permitted by the Articles of Association. Unicount always recommends making a monetary payment whenever possible due to its relative ease. You also don’t gain anything because the share capital contribution at the expense of undistributed dividends requires the payment of dividend tax anyway.

Declaration of share capital payment to the Estonian tax office

If you do not have an accountant yet you can wait until your first annual report to register your share capital. Reason being the requirement to declare any changes in company share capital by submitting a tax declaration by the 10th of the next calendar month. Not doing it or doing it later is technically speaking presenting false data to the tax office. You might not get in trouble, but any accountant would advise you to report in time.

Your company’s monthly income and social tax declaration (TSD) Annex 7 would need to include any share capital contributions and dividend distributions. When liquidating the company, your paid-up share capital can then be paid out to the shareholders tax free.

Please note that you should distribute dividends only after annual accounts with a shareholder decision that is taken when submitting annual accounts to the Business Register.

More detailed guide for registering your share capital online via Business Register can be found here.

Thanks for reading

We hope you enjoyed this article. If you’d like to start your own Estonian company then Unicount is the simplest way to do it. Check it out at unicount.eu.

We have a user-friendly online company formation service that’s been developed for citizens, residents and e-residents of Estonia. It takes just 3 minutes to get a company set up.

For accounting in Estonia, we have monthly accounting plans. The starting price is 99 euros per month plus VAT and annual accounts preparation from 199 euros plus VAT.