Estonya şirketlerinin 31 Ocak 2023 tarihine kadar minimum 2500 Euro sermayeye sahip olması gerekiyordu. Bu, işinizi geliştirmek için şirketinize harcanabilecek bir yatırımdı. Ancak, Estonya Ticaret Kanunu 176. maddede tanımlandığı gibi sermayenin en az yarısı olan bir seviyede öz sermayeyi (şirket varlıkları eksi yükümlülükler) korumakla yükümlü ve buna mecburdunuz.

31 Ocak 2023’e kadar Estonya’da da bir şirketi gerçek kişi kurucu olarak kurduktan sonra bu hisse katkısını ertelemenize izin veren bir sistem vardı. Tek sorun, şirketinizin sermayeniz yatırılana kadar temettü ödeyememesiydi. Ancak sermayeyi yatırmadan ticarete başlayabilir ve hatta maaşlarınızı ödeyebilirdiniz.

Unicount şirket kurma hizmeti aracılığıyla Estonya’da şirket kurduğunuzda, 1 Şubat 2023 tarihinden itibaren varsayılan sermayeniz 1 Euro olacaktır. Asgari sermaye, yıllarca asgari hissedar sermaye katkısı olan 2500 Euro’ya kıyasla 1 Euro cent’e düşürülmüştür. 1 Şubat 2023’ten önce kayıtlı şirketler için, sermayenizi değiştirebilmek ve ayrıca temettü ödeyebilmek için ertelenmiş sermaye ödemenizi Ticaret Siciline kaydetmenizi öneririz. Bu makale, 1 Şubat 2023’ten önce kurulmuş olan Estonya şirketinizin sermaye kaydı kılavuzudur.

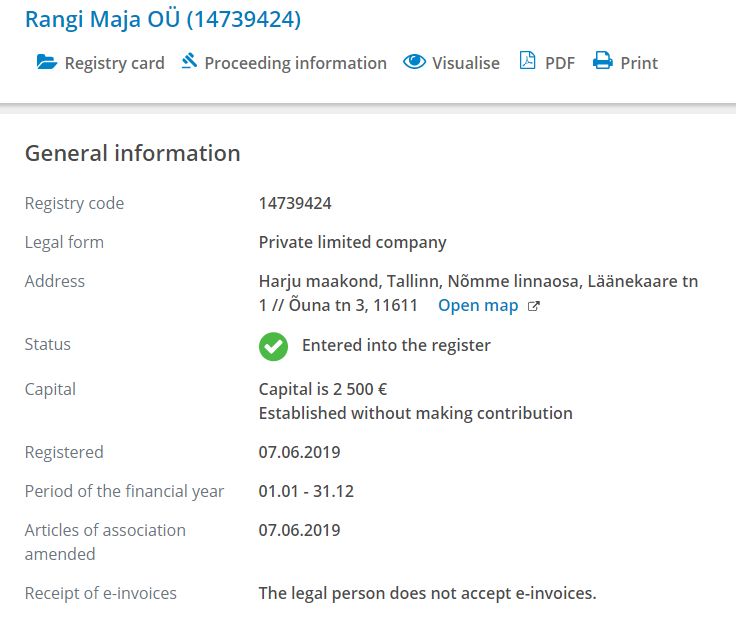

Yukarıda da görebileceğiniz gibi, sermayeleri ödenmeden tescil edilen Estonya limitet şirketleri, Estonya Ticaret Siciline şirketin sicil kartında hisse katkısı bulunmadan kurulmuş olarak kaydedilir.

Yukarıda da görebileceğiniz gibi, sermayeleri ödenmeden tescil edilen Estonya limitet şirketleri, Estonya Ticaret Siciline şirketin sicil kartında hisse katkısı bulunmadan kurulmuş olarak kaydedilir.

Temettü ödeyememenin (veya sermaye artırma yöntemiyle yeni bir hissedar eklemenin mümkün olmamasının) yanı sıra sermaye kaydı, şirketinize Estonya Ticaret Sicilinde, potansiyel ortaklar ve müşterilerin bakış açısından daha güvenilir bir izlenim sağlar.

Estonya Ticaret Kanunu’na göre, hissedarlar tarafından hisse sermayesi katkıları para veya para dışı varlıklarla yapılabilir. Ancak en kolay seçenek, sadece şirketinizin banka hesabına kişisel banka hesabınızdan tek bir ödeme yapmaktır.

Para ödemesi yapmak

Para ödemesi yapmak için, Şirketinizin Ana Sözleşmesinde belirtildiği gibi, hisse sermayesi yüzdesine karşılık gelen tam miktarı Euro olarak kişisel banka hesabınızdan şirketin hesabına transfer etmeniz gerekmektedir.

Bazı durumlarda pay sermayesi taksitle ödenebilir mi diye sorulabilir. Bu teknik olarak mümkün olsa da, ek zahmet ve olası bazı karışıklıklar yaratır ve gerçek bir kazanç sağlamaz. Hisse sermayesi ödemesinin avantajları, yalnızca toplam tutar kaydedildiğinde elde edilir, bu nedenle paranızı tümünü ödemeye hazır olana kadar elinizde tutabilirsiniz.

Ödemeyi yapmak için, açıkçası şirketinizin banka hesabının olması gereklidir. Yakın bir geçmişe kadar, Estonya Ticaret Kanunu, hisse sermayesinin LHV Bankası gibi bir Estonya kredi kuruluşuna yatırılması gerektiğini belirtiyordu. Ancak e-Residency programı, bankacılığı açmak ve herkes için iş yapmayı kolaylaştırmak için bu yasayı değiştirmek için çalıştı. Sonuç olarak, Estonya Ticaret Kanunu şimdi, Avrupa Ekonomik Alanı’ndaki herhangi bir kredi veya ödeme kuruluşunda pay sermayesi kaydedilebileceğini belirtmektedir. Avrupa Birliği, İsviçre, Norveç ve İzlanda bu alana dahildir. Bu, örneğin tüm iş faaliyetleri için Wise işletme hesabını kullanabileceğiniz anlamına gelir. Estonya merkezli bir şirket olmalarına rağmen, Euro IBAN hesapları Belçika’da ve EEA’da pasaport hakları olan yetkili bir ödeme kuruluşudur. Bu nedenle, önceden bu iki nedenle hesapları pay sermayesi kaydetmek için kullanılamazdı, ancak bu durum artık değişti.

Daha önce kullandığımız “banka hesabı” ifadesi biraz garip gelebilir. Bu, Wise gibi ödeme kuruluşlarının hizmetlerini yasal olarak “bankacılık” olarak tanımlayabilecekleri, ancak kendilerini “banka” olarak tanımlayamayacakları anlamına gelir. E-Residency topluluğunda genellikle hangi kredi veya ödeme kuruluşunun en iyi olduğu konusunda tartışmalar olur, ancak hepsinin artıları ve eksileri vardır ve herkes için tek bir doğru cevap yoktur. Kişisel olarak, kendi Estonya şirketim için çoğunlukla ben de Wise işletme hesabını kullanıyorum.

Varsayılan olarak, 1 Şubat 2023’ten önce kaydedilen tüm şirketlerin asgari pay sermayesi, bu tutarı artırmak için bir nedeniniz yoksa 2500 Euro’ydu. Birden fazla hissedar varsa, her hissedar payının nominal değerine karşılık gelen tutarda bir katkı yapmalıdır. Hissedarlar tarafından nominal pay değerinin üzerinde yapılan herhangi bir yatırım, netlik için ayrı işlemler olarak yapılmalıdır. Hisse kaydından önce pay sermayesi artırımı mümkün değildir.

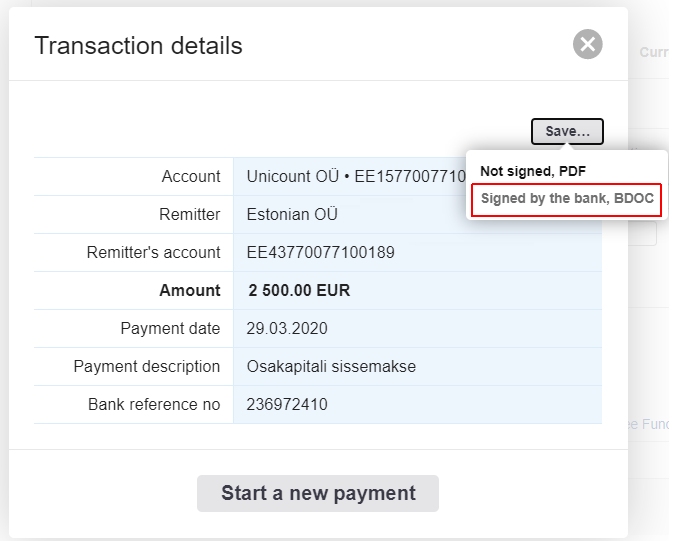

Ödeme açıklaması İngilizce veya Estonyaca olarak “share capital contribution” veya “osakapitali sissemakse” şeklinde yazılabilir.

Bir sonraki önemli adım, ödemeyi yaptığınızı Estonya Ticaret Siciline kanıtlamaktı. Bunun için, şirketinizin ödeme kuruluşundan yatırımın veya birden fazla yatırımın kanıtını istemeniz gerekiyordu. En kolay yolu ise çevrimiçi olarak doküman sunmaktır, bu nedenle kâğıt belge talep etmenin bir anlamı yoktur. 1 Şubat 2023’ten itibaren, yatırılan tutar 50.000 Euro’dan az ise, kanıt gerekli olmayacak, bu yüzden şanslısınız.

Estonya ticari banka hesabı kullandığınızda, genellikle dijital bir mühür olarak .bdoc dosyası şeklinde çevrimiçi hesabınızdan ödeme kanıtını doğrudan indirebilirsiniz. Eğer bir Estonya bankasından şifreli bir .cdoc belgesi alırsanız, önce DigiDoc programı ile şifresi çözülmelidir. Aksi takdirde, sadece siz görüntüleyebilirsiniz. Ödeme onayının her zaman ticari hesabınızdan indirilmesi gerektiğini unutmayın.

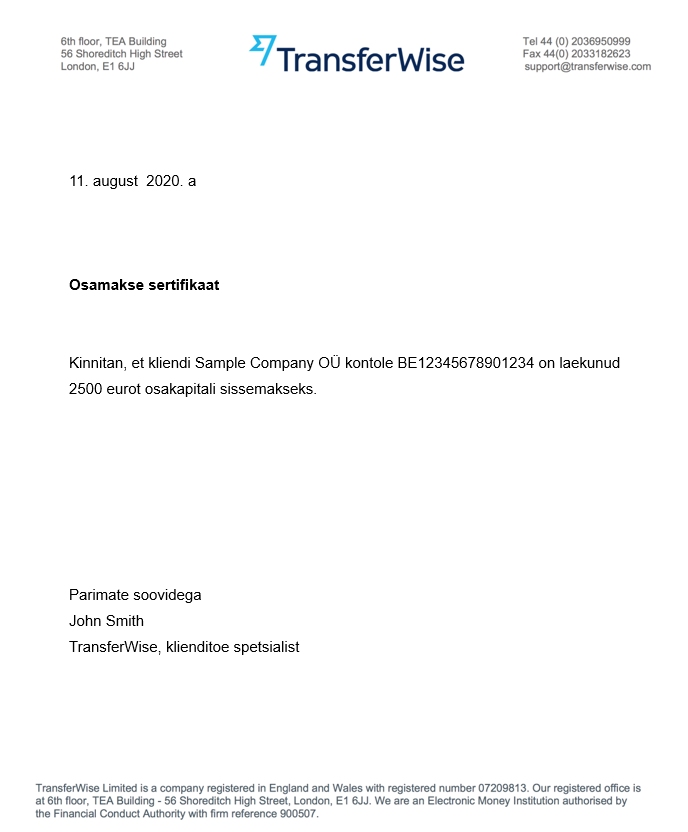

Ayrıca, Wise, Paysera veya Payoneer gibi ödeme kuruluşları da istek üzerine pay sermayesi sertifikaları düzenlerler. Eğer ödeme kuruluşunuz bunu yapamazsa, Estonya e-Residency programından yardım istemeli veya başka bir hizmete geçmelisiniz. Lütfen unutmayın ki, ödeme kuruluşunuzun Avrupa Ekonomik Alanı’nda bir lisansa sahip olması gerekmektedir. Aşağıda, Estonya e-resident kartı kullanarak Wise müşteri desteği uzmanı tarafından imzalanan .asice konteyner içinde yer alan odt belgesinin bir örneği bulunmaktadır.

1 Şubat 2023’ten itibaren, hisse yatırımı 50.000 Euro sınırının üzerindeyse, sertifikanın Estonya Ticaret Siciline çevrimiçi hizmetleri aracılığıyla beyan edilmesi gerekmektedir. Bu sınırın altındaki herhangi bir tutar için, finansal kurumun dijital olarak imzalanmış yatırım sertifikası olmadan e-resident dijital kimlik kartınızla giriş yaparak şirket pay sermayesi verilerini değiştirmek için bir başvuru başlatabilirsiniz.

Not: 50.000 Euro’nun üzerindeki yatırımları kaydederken, finansal kurumun dijital imzasını içeren .asice veya .bdoc dosya konteynırını yüklemeniz gerekmektedir. El yazısıyla imzalı PDF dosyaları ve diğer tüm formatlar, mahkeme tarafından reddedilecektir.

Bu başvurunun sunulması için devlet bedeli 25 Euro’dur ve bu miktar şirketin banka hesabından veya Visa ve MasterCard banka kartlarından ödenebilir.

Eğer belgelerde hata bulunmazsa, beş iş günü içinde Tartu İlçe Mahkemesi Kayıt Departmanından bir bildirim alacaksınız ve hisse sermayesi resmen kaydedilecektir. Herhangi bir sorun varsa, onay yerine eksikliklerin giderilmesi üzerine bir karar verilir ‘ruling on the elimination of deficiencies’ ve mahkemenin belirttiği süre içinde düzeltilmesi ve yeniden sunulması gereken konuları size bildirecektir, böylece devlet bedelini yeniden ödemeniz gerekmez.

Bundan sonra ise konu şirketin hesabındaki bu para ile gerçekten ne yapabileceğidir. Basitçe söylemek gerekirse, herhangi bir ticari faaliyet için kullanılabilir, ancak hissedara geri ödenemez. Bu nedenle, herhangi bir tedarikçiye ödeme yapmak, yatırım yapmak ve hatta kredi vermek (ancak hissedara değil) için bile kullanabilirsiniz. Kar payı yalnızca yıllık karlardan dağıtılabilir.

Parasal olmayan katkılar

Unicount üzerinden çevrimiçi olarak kurulan bir şirket, ilk standart Şirket Ana Sözleşmesine dayanarak parasal olmayan hisse katkıları alamaz. Bu Şirket Ana Sözleşmeleri, tek hissedarlı şirket sahipleri için idealdir. Ancak, parasal olmayan katkılarla hisse sermayesi ödemek istiyorsanız bunları değiştirebilirsiniz.

Şirket Ana Sözleşmeleri değiştirmek için öncelikle Estonya Ticaret Sicilinde çevrimiçi başvuru yapılması gerekmektedir. Parasal olmayan katkıların kabul edilmesine izin verilmesi için Şirket Ana Sözleşmesinin 1.5. maddesi değiştirilmelidir.

Mahkeme Şirket Ana Sözleşmesi değişikliğinizi kabul ettikten sonra, hisse sermayesi kaydı için yeni bir değişiklik başvurusu yapılabilir. Bunu yapmak için, dijital olarak imzalanmış bir hissedar kararı, parasal olmayan varlıkların transferine ilişkin anlaşma ve yönetim kurulunun varlıkların değeri konusundaki değerlendirmesi gereklidir. Varlıkların değeri 25.000 Euro’nun altında ise, değerlendirme yönetim kurulunca yapılabilir. Bu eşik değerinin üzerindeki varlıkların ise bir denetçi tarafından değerlendirilmesi gerekmektedir.

Eğer bir hissedar katkısı olarak Estonya’da gerçek mülk kullanmak istiyorsanız, Estonya Arazi Kaydından bir çıktıya da ihtiyacınız olacaktır. Eğer Estonya’da kayıtlı bir araba veya benzeri bir araç ise, Estonya Yol Müdürlüğünden bir çıktı gereklidir.

Temettü ile ödeme

Teoride, hisse senedi sermayesi katkısı, hissedarların temettüleri karşılığında düşülebilir. Ancak bu bir para dışı katkı olacağından önce Şirket Ana Sözleşmesi tarafından izin verilmesi gerekir. Unicount her zaman parasal katkıların yapılmasını önerir çünkü daha kolaydır. Ayrıca, dağıtılmamış temettülerin maliyetiyle hisse senedi sermayesi katkısının karşılanması hiçbir şey kazandırmaz çünkü vergi ödemesi gerektirir.

Estonya vergi dairesine sermaye ödemesi beyanı

Eğer henüz bir muhasebeciniz yoksa, hisse sermayenizi kaydetmek için ilk yıllık raporunuza kadar bekleyebilirsiniz. Bunun nedeni, şirket hisse sermayesinde herhangi bir değişikliği, vergi beyannamesinin takip eden takvim ayının 10’una kadar sunularak bildirmeniz gerekliliğidir. Bunun yapılmaması veya daha sonra yapılması, teknik olarak vergi dairesine yanlış veri sunmak anlamına gelir. Sorun yaşamayabilirsiniz, ancak muhasebeciler zamanında rapor vermenizi önerir.

Şirketinizin aylık gelir ve sosyal vergi beyannamesi (TSD) Ek 7’sine, hisse sermayesi katkıları ve temettü dağıtımları dahil edilmelidir. Şirketin tasfiyesi sırasında, ödenmiş sermayeniz vergisiz bir şekilde hissedarlarınıza ödenebilir.

Lütfen unutmayın, temettü dağıtımını, yıllık hesaplar Ticaret Siciline sunulduğunda alınan hissedarlar kararıyla yapmanız gerekmektedir.

Ticaret Sicili aracılığıyla hisse sermayenizi çevrimiçi olarak beyan etmeniz için ayrıntılı bir kılavuzu burada bulabilirsiniz.

Okuduğunuz için teşekkürler

Umuyoruz ki bu makaleden keyif aldınız. Kendi Estonya şirketinizi kurmak isterseniz, bunu yapmanın en kolay yolu Unicount’tur. Unicount.eu adresinden göz atın.

Vatandaşlar, mukimler ve Estonya e-resident üyeler için geliştirilmiş kullanıcı dostu bir çevrimiçi şirket kurma hizmetimiz bulunmaktadır. Şirket kurmak sadece 3 dakika sürmektedir.

Estonya’da muhasebe için aylık muhasebe planlarımız bulunmaktadır. Başlangıç fiyatı aylık 99 Euro artı KDV’dir ve yıllık hesaplar hazırlığı için ücretler 249 Euro artı KDV ile başlamaktadır.