Wenn Sie eine OÜ (private Gesellschaft mit beschränkter Haftung) in Estland betreiben, ist die Einreichung Ihrer Jahresabschlüsse eine wesentliche Aufgabe, um sicherzustellen, dass Ihr Unternehmen den estnischen Gesetzen entspricht. Wahrscheinlich hat Ihr Dienstleister Ihnen bereits einige Monate vor der eigentlichen Frist Warnungen geschickt, um Strafen wegen verspäteter Einreichung zu vermeiden.

Dieser Leitfaden erklärt, was Jahresabschlüsse sind, warum sie wichtig sind und wie Sie sie ordnungsgemäß vorbereiten, um den guten Ruf Ihres Unternehmens zu bewahren. Jahresabschlüsse sind öffentliche Dokumente, die beeinflussen, wie Geschäftspartner und andere Personen, die Ihre Finanzen prüfen, Ihr Unternehmen beurteilen.

Was sind die Jahresabschlüsse?

Jahresberichte (oder Jahresabschlüsse, wie wir sie unseren Kunden erklären, auf Estnisch „aastaaruanne“) sind verpflichtende Finanzinformationen, die alle estnischen Unternehmen einreichen müssen. Diese Abschlüsse bieten ein detailliertes Bild der finanziellen Aktivitäten Ihres Unternehmens im letzten Geschäftsjahr und sind kostenlos über das estnische Handelsregister öffentlich zugänglich. Transparenz ist ein zentraler Wert in Estlands Geschäftsumfeld, und der öffentliche Zugang zu diesen Informationen stärkt das Vertrauen potenzieller Geschäftspartner, Gläubiger und Investoren.

Selbst wenn Ihr Unternehmen nicht aktiv war, bleibt die Einreichung der Jahresabschlüsse unerlässlich. Diese gesetzliche Verpflichtung geht nicht nur darum, Geldstrafen oder die Löschung zu vermeiden, sondern auch darum, den Ruf und den Compliance-Status Ihres Unternehmens zu wahren. Sie werden schnell feststellen, dass ein qualifizierter Buchhalter wahrscheinlich nicht bereit ist, Ihre Jahresabschlüsse auf Basis des Kontoauszugs einzureichen. Der Grund ist, dass das estnische Rechnungslegungsgesetz verlangt, dass Sie alle Unterlagen sieben Jahre nach Ende des Geschäftsjahres aufbewahren und alle Ausgaben mit Belegen belegen. Wir empfehlen die Verwendung guter Online-Software zur Ausgabenverwaltung wie Envoice.

Darüber hinaus bietet die pünktliche Einreichung des Jahresberichts Vorteile, die über die Einhaltung der Vorschriften hinausgehen. Beispielsweise können Dividenden nur nach Einreichung der Abschlüsse ausgeschüttet werden, sodass eine frühzeitige Bearbeitung die Finanzplanung erleichtern kann.

Estnische Gesetzgebung

Der estnische Handelskodex definiert den rechtlichen Rahmen für die Einreichung der Jahresabschlüsse. Laut Gesetz muss jedes in Estland registrierte Unternehmen Jahresabschlüsse einreichen, unabhängig davon, ob es im Laufe des Jahres Geschäftstätigkeiten ausgeübt hat. Die Verantwortung liegt bei den Vorstandsmitgliedern des Unternehmens, die persönlich für die Nichteinhaltung haftbar gemacht werden können.

Der Detaillierungsgrad, der in den Berichten erforderlich ist, hängt von der Größe des Unternehmens ab:

- Mikro- und Kleinunternehmen: Können vereinfachte Berichte einreichen.

- Mittelständische und große Unternehmen: Müssen vollständige Berichte einreichen, die zusätzliche Finanzberichte und Anmerkungen enthalten.

Alle estnischen OÜs müssen ihre Jahresabschlüsse innerhalb von sechs Monaten nach Ende des Geschäftsjahres beim estnischen Handelsregister einreichen. Das bedeutet, dass die meisten Unternehmen, deren Geschäftsjahr dem Kalenderjahr entspricht, bis zum 30. Juni einreichen müssen.

Die verspätete Einreichung kann zu Strafen führen, angefangen bei Geldstrafen und möglicherweise bis zur Löschung des Unternehmens aus dem Handelsregister. Vorstandsmitglieder könnten persönliche finanzielle Konsequenzen wie Bußgelder von 200 € bis 3200 € erleiden.

Was ist in den Jahresabschlüssen enthalten?

Der Umfang der Jahresabschlüsse variiert je nach Größe und Art Ihres Unternehmens. Die Anforderungen an die Berichterstattung sind für Mikro- und Kleinunternehmen vereinfacht, aber die Schlüsselelemente bleiben konsistent.

Geschäftsbericht

Dieser Bericht bietet eine Übersicht über die Aktivitäten Ihres Unternehmens, einschließlich Investitionen, Entwicklungsaktivitäten und wesentlichen Ereignissen, die die zukünftige Leistung beeinflussen könnten. Geschäftsberichte sind für Mikro-Unternehmen nicht obligatorisch, wir empfehlen jedoch trotzdem, einen zu schreiben, wenn Sie denken, dass jemand daran interessiert sein könnte, wie sich Ihr Unternehmen entwickelt. Selbst ein Satz ist ausreichend.

Zwei obligatorische Finanzberichte

Bilanz

Eine Bilanz (im e-Business-Register als „Statement of Financial Position“ bezeichnet) ist eine Momentaufnahme der Vermögenswerte, Verbindlichkeiten und des Eigenkapitals Ihres Unternehmens am Ende des Geschäftsjahres. Zum Beispiel könnten Ihre Umlaufvermögen Bargeld auf dem Bankkonto, an der Börse gehandelte Aktien oder Forderungen umfassen, wie z. B. Rechnungen, die Kunden Ihnen noch nicht bezahlt haben, und Nicht-Umlaufvermögen könnten langfristige Investitionen oder Immobilien sein.

Gewinn- und Verlustrechnung

Eine Gewinn- und Verlustrechnung (im e-Business-Register als Ertragsrechnung bezeichnet) zeigt die jährlichen Einnahmen und Ausgaben Ihres Unternehmens und hilft, die Rentabilität zu beurteilen. Einnahmen abzüglich Betriebsausgaben wie Rohstoffe und andere Aufwendungen ergeben den Betriebsergebnis (Verlust). Hinzufügen von Zinserträgen oder anderen finanziellen Gewinnen ergibt den Ergebnis (Verlust) vor Steuern.

Weitere Finanzberichte

Kapitalflussrechnung

Eine Kapitalflussrechnung ist für die Konten von Mikro- und Kleinunternehmen nicht obligatorisch. Sie gibt einen Überblick darüber, wie Geldmittel in Ihr Unternehmen fließen und es wieder verlassen, und umfasst operative, investierende und finanzierende Aktivitäten. Für viele Investoren ist sie eine zuverlässige Informationsquelle zur Analyse von börsennotierten Unternehmen, da sie zeigt, wie es dem Unternehmen tatsächlich geht. Der Grund ist, dass die Bilanz und die Gewinn- und Verlustrechnung großer Unternehmen viele subjektive Meinungen und Schätzungen enthalten können, z. B. wie nicht bezahlte Rechnungen von Kunden bewertet werden, wie privat gehandelte Vermögenswerte bewertet werden und wie Kapitalinvestitionen wie Maschinen und Software abgeschrieben werden. Ein treffendes Zitat, das diese subjektiven Entscheidungen beschreibt, lautet: „Geld ist eine Tatsache, Buchhaltung ist eine Meinung“.

Anmerkungen zu den Finanzberichten

Anmerkungen bieten zusätzliche Informationen und Kontext zu den finanziellen Zahlen und müssen bestimmte obligatorische Angaben enthalten, wie vorgeschriebene Bilanzierungsmethoden, Arbeitskosten und Transaktionen mit verbundenen Parteien. Transaktionen mit verbundenen Parteien können alles umfassen, von Aktionärsdarlehen an Unternehmen und Personen, die mit dem Aktionär oder Direktor verbunden sind, bis hin zu Geschäftstransaktionen zwischen Unternehmen, die den gleichen Aktionären gehören.

Bericht des Wirtschaftsprüfers

Größere Unternehmen oder Unternehmen, die der Pflicht zur Prüfung unterliegen, müssen einen Prüfungsbericht beifügen, um die Richtigkeit der Finanzberichte zu überprüfen.

Verständnis und Vorbereitung der Jahresabschlüsse

Die ordnungsgemäße Vorbereitung Ihrer Jahresabschlüsse beginnt mit der Erfassung und Organisation aller relevanten Finanzdaten. Hier erfahren Sie, wie die beiden wichtigsten Finanzberichte erstellt werden, und wir verwenden Beispiele zur Erläuterung spezifischer Elemente und Berechnungen. Bitte beachten Sie, dass alle Zahlen immer in Euro angegeben werden. Wenn Sie andere Währungen halten oder handeln, müssen Sie diese am Bilanzstichtag in Euro umrechnen. Die Originalkonten müssen auf Estnisch eingereicht werden, aber Sie können englischsprachige Kopien erstellen, indem Sie diese im e-Business-Register auswählen.

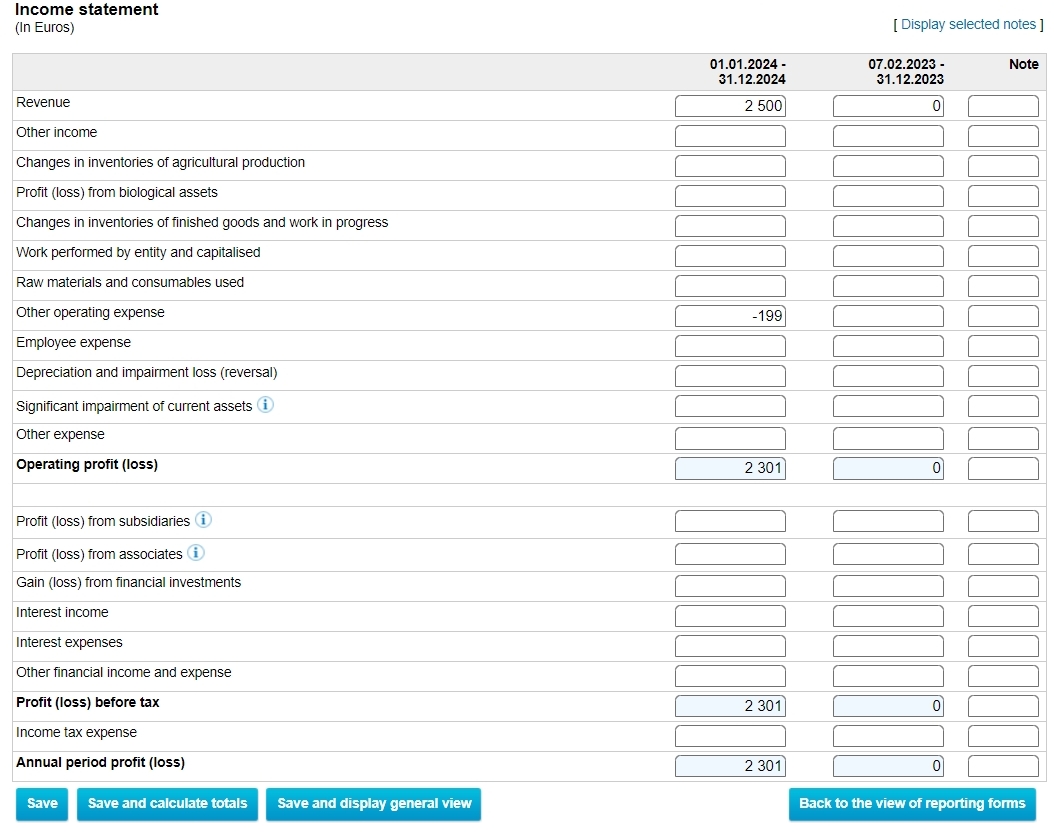

Gewinn- und Verlustrechnung (Ertragsrechnung)

Diese Rechnung fasst die Einnahmen und Ausgaben Ihres Unternehmens zusammen. Die Schlüsselelemente sind Einnahmen, Wareneinsatz, Lohnkosten usw.

Das Betriebsergebnis wird berechnet, indem die Einnahmen abzüglich aller Betriebsausgaben den Betriebsergebnis ergeben.

Das Hinzufügen von Zinseinnahmen/-kosten und anderen finanzierungsbezogenen Posten ergibt das Ergebnis vor Steuern, das erheblich höher sein kann, wenn Sie Zinsen erzielen oder Kapitalgewinne haben, oder umgekehrt.

In diesem Beispiel für eine Gewinn- und Verlustrechnung hat unser Beispielunternehmen eine Verkaufsrechnung über 2500 Euro verbucht (aber möglicherweise noch nicht erhalten), aber auch die ersten Ausgaben für das virtuelle Büro in Höhe von minus 199 Euro. Das Betriebsergebnis beträgt somit 2500 Euro abzüglich der ersten verbuchten Ausgaben, die wahrscheinlich bereits mit der Firmenkarte bezahlt wurden. Das Gesamtergebnis vor Steuern beträgt daher 2500-199=€2301. In Estland gibt es keine jährliche Körperschaftssteuer, daher bleibt das Jahresergebnis steuerfrei.

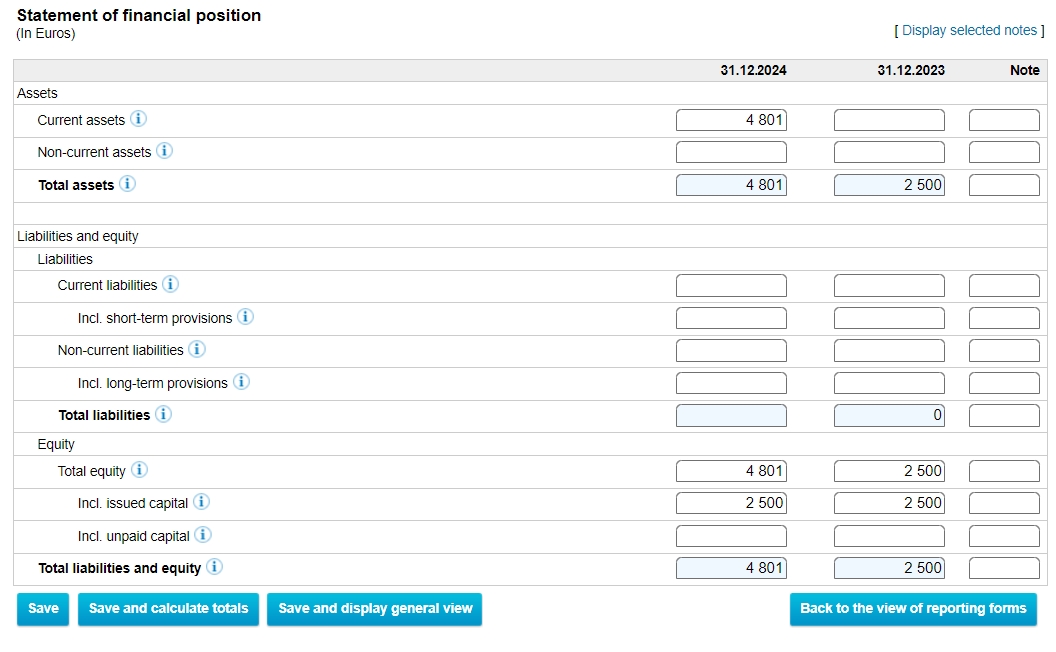

Bilanz (Statement of Financial Position)

Dieser Bericht zeigt, was das Unternehmen besitzt (Vermögenswerte) und schuldet (Verbindlichkeiten) sowie das Eigenkapital der Aktionäre. Die Schlüsselelemente sind Umlaufvermögen und Nicht-Umlaufvermögen, die sich als Gesamtvermögen summieren.

Eigenkapital umfasst das gezeichnete Kapital und die einbehaltenen Gewinne und sollte dem Gesamtvermögen abzüglich der Verbindlichkeiten entsprechen. Verbindlichkeiten können Aktionärsdarlehen, Kreditkartenschulden oder unbezahlte Rechnungen Ihrer Lieferanten sein.

In diesem Beispiel einer Bilanz haben wir ein Unternehmen, das ein gezeichnetes Kapital von 2500 Euro gezahlt hat, eine Verkaufsrechnung von 2500 Euro verbucht (aber möglicherweise noch nicht erhalten), und die ersten Ausgaben für das virtuelle Büro in Höhe von 199 Euro verbucht.

Umlauf- und Gesamtvermögen wären 2500 Euro, die der Aktionär auf das Bankkonto des Unternehmens für die Anteile eingezahlt hat, plus 2500 Euro, die der erste Kunde des Unternehmens zahlen muss, abzüglich 199 Euro für die erste verbuchte Ausgabe, die wahrscheinlich bereits mit der Firmenkarte bezahlt wurde.

Das Betriebsergebnis, das den einbehaltenen Gewinnen in diesem Beispiel entspricht (2500-199=€2301), würde das Gesamteigenkapital ohne Verbindlichkeiten auf 2500+2301=€4801 erhöhen. Das Eigenkapital ist einfach der Nettovermögenswert des Unternehmens für seine Aktionäre.

Eine Bilanz hilft, die finanzielle Gesundheit Ihres Unternehmens zu beurteilen. Der Vorstand ist dafür verantwortlich, die Zahlungsfähigkeit des Unternehmens aufrechtzuerhalten. Die Bilanz des Jahresabschlusses ist die Art und Weise, wie die Öffentlichkeit weiß, ob das Unternehmen insolvent wird. Das Melden eines Eigenkapitals unterhalb der Hälfte des eingetragenen Kapitals löst die Forderung des Gerichts aus, die Zahlungsfähigkeit des Unternehmens durch die Einbringung zusätzlichen Kapitals zu verbessern.

Was kann schiefgehen?

Der häufigste Fehler besteht einfach darin, die Meldefrist zu versäumen. Dies kann zu Geldstrafen und zur Löschung des Unternehmens führen. Setzen Sie sich Erinnerungen und beginnen Sie den Prozess einige Monate vorher mit Ihrem Buchhalter. Überprüfen Sie alle Zahlen, stellen Sie sicher, dass Ihre Konten korrekt abgeglichen sind, und geben Sie Ihrem Buchhalter alle Bankkonten an. Fehlende Kontoauszüge können dazu führen, dass falsche Daten im Register eingereicht werden, selbst wenn Ihr Buchhalter sein Bestes gegeben hat.

Bleiben Sie organisiert und bewahren Sie das ganze Jahr über alle Finanzunterlagen auf, um Probleme vor dem Fälligkeitsdatum zu vermeiden. Erwägen Sie die Verwendung einer Buchhaltungs- oder Ausgabenverwaltungssoftware, um den Prozess zu automatisieren und Fehler zu minimieren.

Im Zweifelsfall kann ein professioneller Buchhalter Ihnen Zeit sparen und Genauigkeit sicherstellen, insbesondere wenn Sie keine Kenntnisse im Bereich Steuer- und Unternehmensfinanzen in Estland haben.

Outsourcing vs. Eigene Erstellung der Jahresabschlüsse

Die Entscheidung, ob Sie Ihre Jahresabschlüsse selbst erstellen oder die Aufgabe auslagern, hängt von mehreren Faktoren ab, einschließlich der Komplexität Ihrer Finanzsituation und Ihrer Vertrautheit mit den estnischen Buchhaltungsstandards.

Outsourcing: Einen Buchhalter beauftragen kann Ihnen Zeit und Stress ersparen, insbesondere wenn Ihr Unternehmen aktiv gehandelt hat. Buchhalter, die mit estnischem Recht vertraut sind, stellen sicher, dass alles korrekt erledigt wird und helfen Ihnen, Fehler zu vermeiden, die zu Geldstrafen führen könnten.

Selber machen: Wenn Ihr Unternehmen nicht aktiv war oder Sie eine einfache Finanzstruktur haben, können Sie die Einreichung anhand unseres Handbuchs selbst durchführen. Beachten Sie jedoch, dass selbst kleinere Fehler zu einer Straftat wegen Falschmeldung führen können, also gehen Sie vorsichtig vor.

Zusammengefasst

Die Einreichung Ihrer Jahresabschlüsse ist entscheidend, um die Compliance Ihrer estnischen OÜ aufrechtzuerhalten. Egal, ob Sie es selbst machen oder einen Buchhalter beauftragen, stellen Sie sicher, dass Ihr Bericht korrekt und pünktlich eingereicht wird, damit Ihr Unternehmen in gutem Ansehen bleibt und kostspielige Strafen vermieden werden. Die Konsultation eines Profis ist immer eine kluge Entscheidung, wenn Sie unsicher sind.

Mit diesen Richtlinien können Sie den jährlichen Berichterstattungsprozess sicher durchlaufen und Ihr Unternehmen auf Kurs halten.

Vielen Dank fürs Lesen!

Wenn Sie weitere Fragen haben, lesen Sie die umfangreichen Support-Artikel von Unicount oder kontaktieren Sie uns direkt für eine persönliche Beratung.