Articles

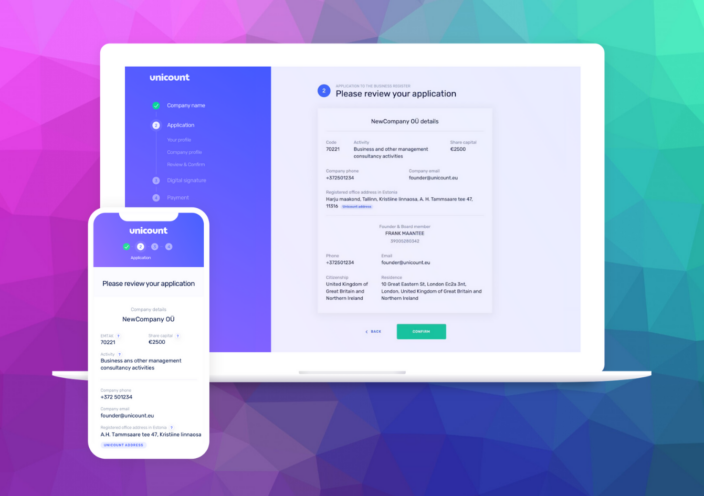

How Unicount company formation works

Building a business can be tough, but starting a company should be simple. If you can register a domain name for your company in a few minutes then why not your company too?

That’s why Unicount was created. Unicount is the simplest way to register an Estonian company. It’s also the simplest way to start a paperless EU company from anywhere in the world. It takes just five minutes. Unicount is used by citizens and residents of Estonia, but also a growing number of people around the world because all you need is an Estonian digital ID, which can be obtained by citizens of other countries living outside Estonia through e-Residency.

Read more

Estonian annual report 2026: Deadlines, tax changes and what e-Residents need to know

If you own a company registered in Estonia, 2026 is a year to pay closer attention than usual. The annual report deadline has not changed. The obligation has not changed. But the tax environment your company is now operating in has, and that affects what goes into your report, how your numbers look, and what compliance decisions you need to make before 30 June.

This guide covers everything: the annual report deadline for 2026, what the report must contain, the tax changes that came into force at the start of this year, what they mean for e-residents and foreign founders, and how to handle the filing process without last-minute surprises.

Read more

Company formation in Estonia vs the rest of Europe: Why founders keep choosing Tallinn

Every year, tens of thousands of entrepreneurs look for the best country to form a company in Europe. They compare Ireland, the Netherlands, Germany, the UK, Portugal. Then they find Estonia, and most of them stop looking.

This is not a post about how Estonia has “a great digital infrastructure” or is “business-friendly”; you’ve read those lines before. This is a head-to-head look at what company formation in Estonia actually costs, how long it takes, and how it compares to the alternatives founders most commonly consider. If you want to open a company in Europe and run it from anywhere in the world, the numbers here will likely make your decision for you.

Read more

Estonian company incorporation in 2026: What international founders must know before registering an OÜ

Estonia company incorporation continues to attract international founders in 2026. Entrepreneurs search for terms like open a company in Estonia online, Estonia OÜ for non residents, or Estonia zero corporate tax, expecting a fast and fully remote EU company setup.

The digital part is accurate.

The simplicity requires context.

The legal obligations are real.

How to create a compliant sales invoice in Estonia (Guide for OÜ and e-residents)

If you run an Estonian OÜ, issuing compliant invoices is not optional. Estonian invoice requirements are defined by the VAT Act (§37) and the Accounting Act, and mistakes can lead to rejected accounting entries, VAT corrections, or unnecessary questions from the Tax and Customs Board (EMTA).

Whether you are VAT-registered or not, whether you invoice EU or non-EU clients, every Estonian company must follow specific invoicing rules. This 2026 guide explains exactly what must be included on an invoice, when invoices must be issued, how reverse charge works, and how long invoices must be stored.

Read more

Legal address vs contact person in Estonia

When you need each and how it works for e-residents

When setting up and running an Estonian company as an e-resident, two terms appear early and often: legal address and contact person.

They are related, but they are not the same and misunderstanding the difference is a common cause of compliance issues later.

This guide explains when a legal address is sufficient, when a contact person is mandatory, and how these requirements apply in practice for e-resident companies in 2026.

Read more

Dormant vs active company in Estonia: How the Tax Board actually decides

For many e-resident founders, the concept of a “dormant company” in Estonia sounds simple. No sales, no invoices, no business. In practice, this is one of the most misunderstood areas of Estonian compliance and one of the most common reasons founders receive warnings, fines, or unexpected accounting costs later.

The Estonian Tax and Customs Board does not rely on labels or intentions. It looks at facts. Whether your company is considered dormant or active depends on what actually happened during the financial year, not on whether you planned to operate or not.

This distinction matters because it determines how your annual report must be prepared, what documentation is required, and whether simplified reporting is even allowed.

Read more

Annual accounts of an Estonian company: What e-residents need to know and how to submit them

If you are running an Estonian OÜ as an e-resident, submitting your annual accounts is not a formality that can be ignored or postponed indefinitely. Every Estonian company must file an annual report, regardless of turnover, profit, or even business activity. In 2026, this obligation remains unchanged, but the expectations around accuracy, documentation, and digital submission are stricter than many founders realise.

This guide explains what Estonian annual accounts are, what must be submitted in 2026, and how e-resident founders can prepare without last-minute pressure or unnecessary risk. All examples and requirements below apply to annual reports submitted in 2026 for the previous financial year.

Read more

Estonian accounting terms every e-Resident founder should know (and what they mean)

Running an Estonian company as an e-resident means dealing with accounting terms that often look familiar but work a little differently in practice. Words like “revenue”, “profit”, or “annual report” exist everywhere, yet in Estonia they follow specific rules, formats, and legal meanings.

This guide explains the most important Estonian accounting terms every e-resident founder should understand, using plain language and real examples. You do not need an accounting background to read this. You just need to know what these terms mean when they appear in your reports, emails from accountants, or notices from the Business Register.

Read more

Annual report planning for Estonian companies in 2026: What e-resident should prepare early

For many founders, the Estonian annual report feels like something that belongs to late spring. The deadline appears distant, and it is easy to assume there is plenty of time to deal with it later. In reality, the quality, speed, and cost of your annual report in 2026 depend far more on what you clarify early in the year than on the official submission date.

Companies that prepare in advance usually submit calmly and on time, without unnecessary follow-ups. Companies that wait often find themselves reacting under pressure, answering repeated questions, or correcting issues that could have been avoided.

Read more