Every Estonian company has to submit annual accounts (annual report) to the Estonian Business Register 6 months after the end of the financial year. On 1 February 2023, a new Estonian Commercial Code and an entirely new law, the Commercial Register Act, came into force, making it easier for the court to delete a company that has not submitted annual accounts.

Before that, companies that did not submit their annual accounts managed to stay on the register for years without problems. This annoyed the Ministry of Justice and private sector stakeholders, who saw it as an unfair business environment with no sanctions for non-compliant companies. Now, it is nearly an automatic process, with fines imposed on board members who failed to perform their legal responsibility of submitting annual accounts.

Court can now delete your company automatically

Starting 1 February 2023, Estonian companies can be deleted from the register if they have not submitted their annual accounts. Commercial Register Act § 61 (2). says, “A legal person may be deleted from the register if the legal person has not submitted an annual report within the time limit set by the registrar and at least three months have passed since the due date for submission provided by law”.

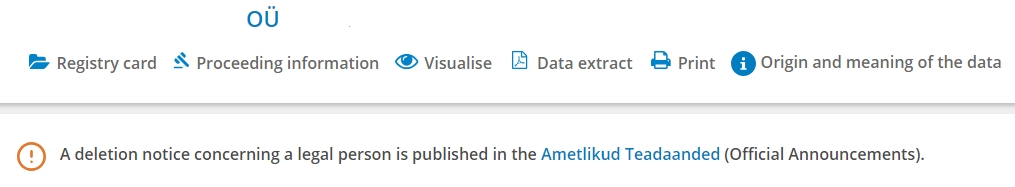

In reality, this means that some months after the due date has passed, you will receive a warning email with a PDF court resolution (as seen below). The e-Business Register also displays the same warning when you try to log in to access your company details. There, you can also apply enhanced machine translation to those Estonian language court resolutions to understand what they are about. We saw the first emails coming in December 2023 for accounts that were due 30 June 2023. The last of June is the due date for annual accounts for all the companies with a standard financial year that overlaps with the calendar year (1 January – 31 December).

The notice is considered delivered when sent to your company’s public email address. Unicount will forward those official emails to your Client Dashboard if you use our spam-protected @eesti.ee email. If you use your own email, make sure that you react when registriosakond@kohus.ee sends you an email.

A deletion notice will also be published in the official gazette and shown in your company’s details on the e-Business Register. Below is a sample of how it looks.

You can get an extension once

In the first warning, there is normally an additional three-month deadline to submit annual accounts, and you can still avoid deletion if you manage to submit annual accounts before the new deadline given by the court. You can apply for an extension once, and the court can add some more time should you have a good reason to be late. If you did not apply for an extension and did not submit annual accounts, you could get a fine of 200 euros about one month after the new deadline passed.

We also see that almost immediately after the three-month deadline has passed, your company will be deleted by the court.

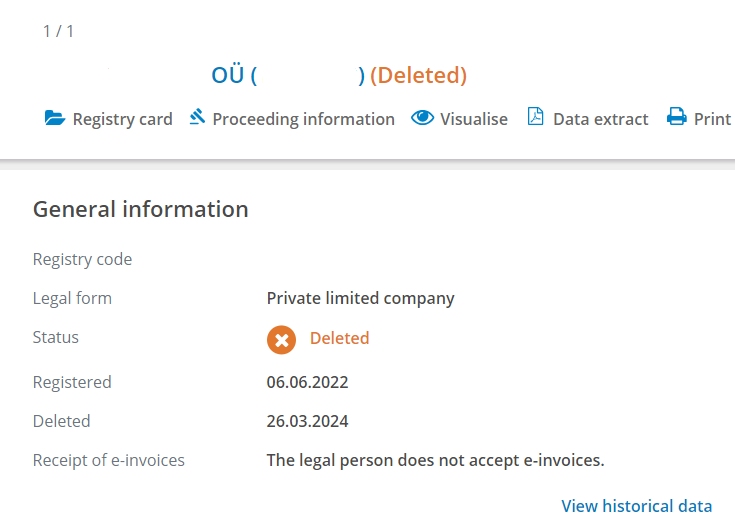

Reinstating your company is possible within three years of deletion

If you still did not manage to submit annual accounts in time and the court deleted your company, you have three years from the deletion date to apply for reinstatement in the register. Estonian Business Register has a detailed manual available in English with Estonian screenshots. This is what a deleted company looks like on the register.

To reinstate your company, you should prepare an application in the e-Business Register as a board member, submit your annual accounts, sign the application, and pay a state fee of 200 euros before submitting the application.

We do have a free manual for submitting dormant accounts on your own. Still, even if you do manage to submit your dormant accounts without any help from a professional accountant, you would need to pay a 200 euro state fee for reinstating your deleted company, while registering a new company has a state fee of 265 euros. So we’d imagine that not all companies are worth reinstating.

Thanks for reading

We hope you enjoyed this article. If you have more questions, check out Unicount’s extensive support articles here.