On Wednesday 12 April, the Estonian parliament voted in favour of the new coalition government. One of the concerning items in the coalition agreement is changing Estonian tax rates to increase state revenue and thereby reduce government deficit spending. It is good to know though that Estonia currently is at the low end of tax-to-GDP ratio in the EU and has the lowest debt-to-GDP ratio. This has made Estonia a great place to build your global business.

Here is what we can read from the coalition agreement published on 8 April. It is important to note that none of it has been adopted by the Estonian parliament and a lot can change in the political process.

In a nutshell

On 12 April 2023, the newly elected Estonian parliament voted in favour of the new coalition government composed of the Reform Party, Social Democrats and Eesti 200. These parties agreed to form a new coalition government for the election period of 2023-2027 led by prime minister Kaja Kallas.

According to the published coalition agreement, the standard VAT rate would be raised on 1 January 2024 and income tax on 1 January 2025. The income tax rate change would apply both to personal income tax paid on wages and the corporate income tax you pay when distributing dividends from your Estonian company.

An overview of the looming tax changes agreed upon in the coalition agreement published on 8 April:

- Starting from 1 July 2025, the VAT rate is planned to be raised to 24 percent. This means that all the VAT-excluded services you buy in Estonia would be 2% more expensive unless you can deduct outgoing VAT. This is possible when your company has Estonian or EU VAT registration.

- The lower VAT rate for accommodation service providers will be abolished from January 1, 2025. This means that the VAT on your hotel stays in Estonia will rise.

- A brand new car tax will be introduced from July 1, 2024. No specifics have been published yet.

- 14% reduced income tax rate on “regular” dividends paid to legal person shareholders will be abolished based on the comments made to the public.

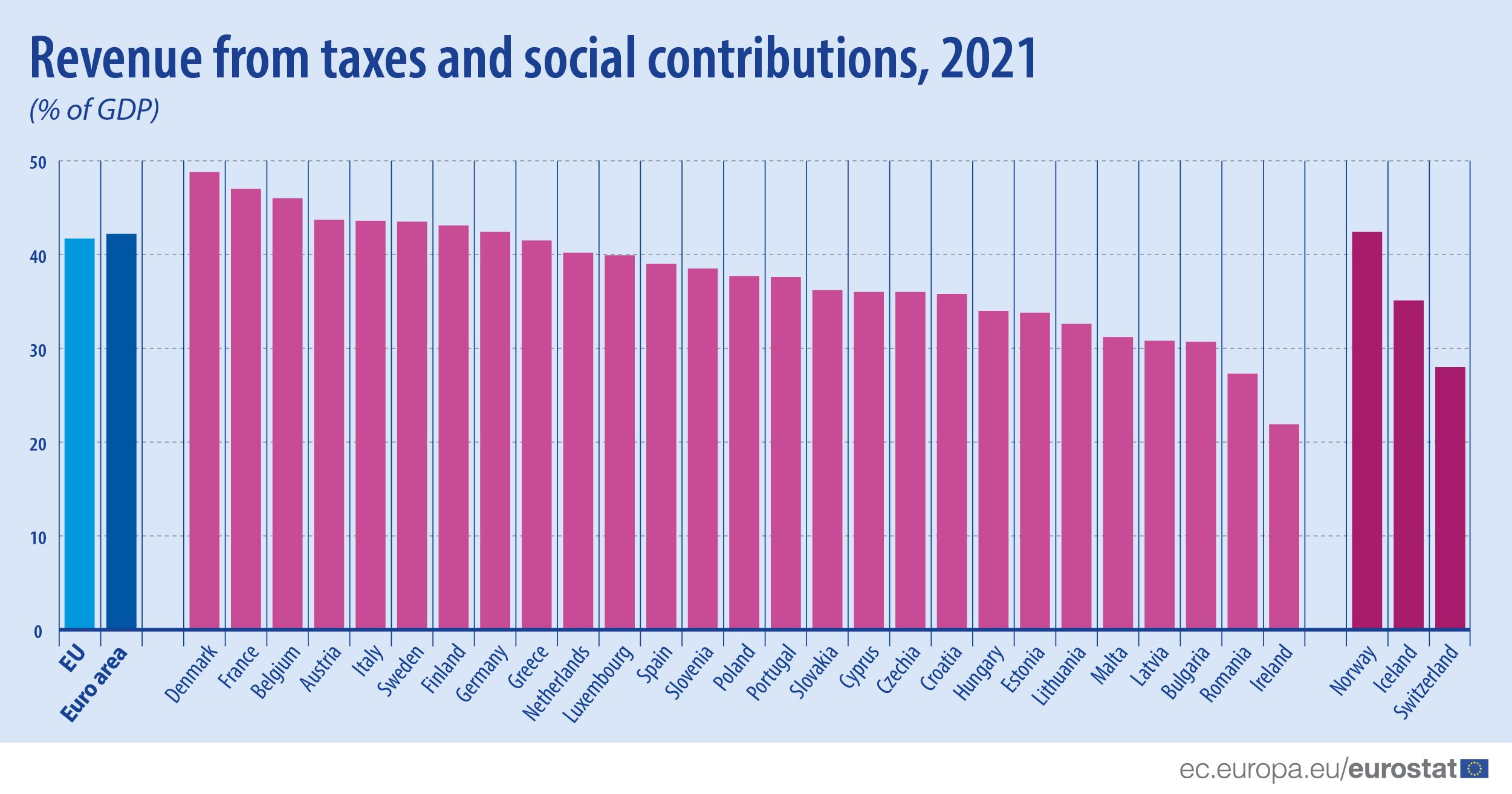

To put things into context, according to Eurostat the ratio of 2021 tax revenue to GDP was the highest in Denmark (48.8 %), France (47.0 %) and Belgium (46.0 %), followed by Austria (43.7 %), Italy (43.6 %), Sweden (43.5 %) and Finland (43.1 %).

The lowest ratio of 2021 tax revenue to GDP was recorded in Ireland (21.9 %), Romania (27.3 %), Bulgaria (30.7 %), Latvia (30.8 %), Malta (31.2 %) and Lithuania (32.6 %) and Estonia (33.8 %). By OECD standards, Estonia has the most competitive tax system in the world.

VAT standard rate raised to 24% in 2025

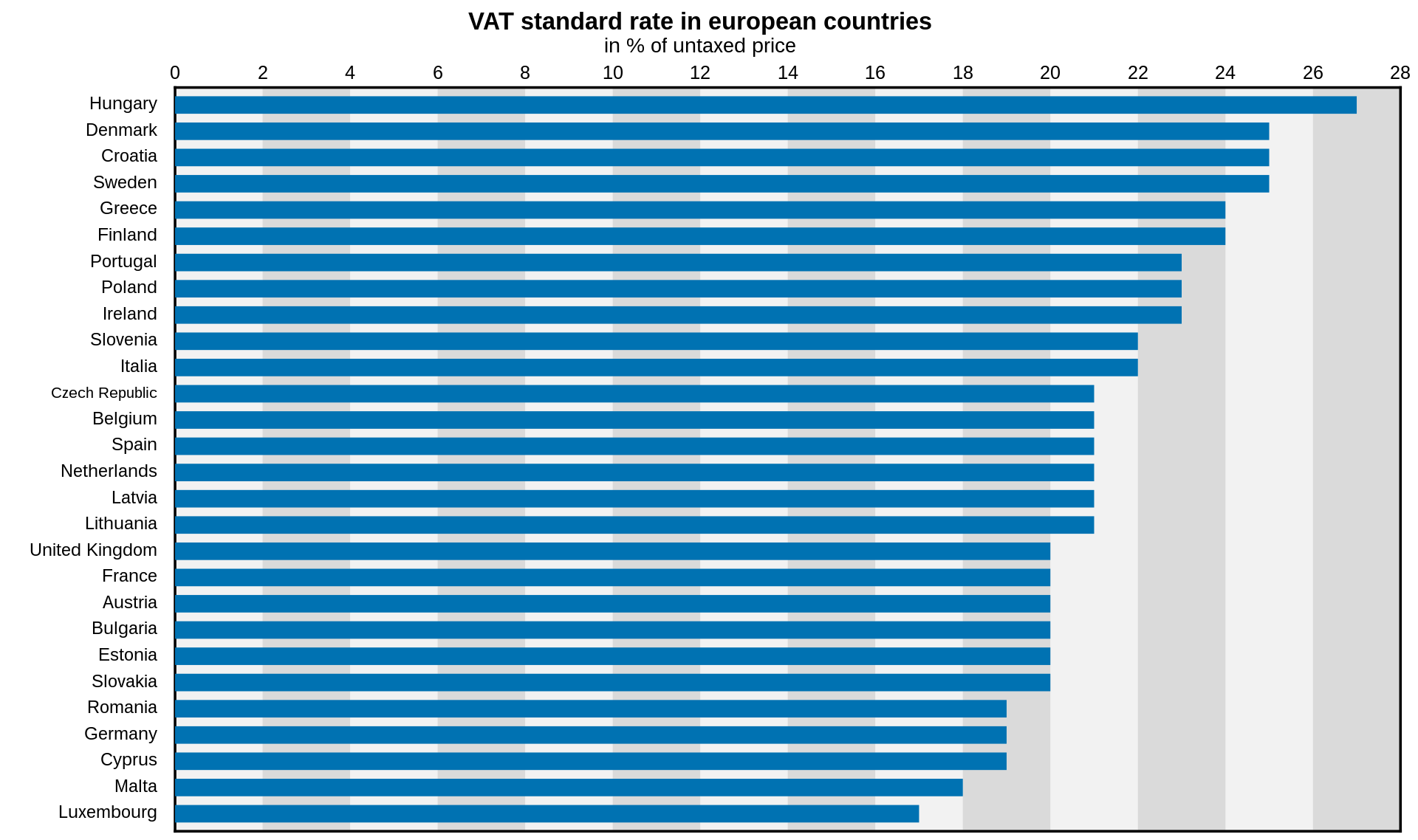

The Estonian standard VAT rate was last changed in the 2009 economic crisis turmoil. It used to be 18% until 2009. The current standard VAT rate of 20 percent in Estonia. Estonia ranks 18th-22nd place among the EU member states. Four other countries have the same VAT rate as Estonia – Bulgaria, Slovakia, Austria and France. Five EU countries have lower VAT rates than Estonia – Germany, Cyprus, Romania, Malta and Luxembourg.

The income tax rate raised to 22% in 2025

The Estonian income tax rate was last changed in 2015 when it was dropped by the Reform Party led coalition government by 1%. It used to be 21% until 2015. Before that, it was even higher until 2008 when it was reduced to 21% from 22%. Historically, it was 26% in the nineties without the possibility to avoid paying tax on reinvested or retained profits, an innovation that got rolled out in 2000.

As a fun fact, the same Reform Party promised to reduce income tax to as low as 12% by 2015 in the 2007 economic boom era elections. This was stopped by the 2009 economic crisis at the then-standing 21% level. There was a half-hearted attempt to reduce the 33% social tax on employment income by half a percent in 2017. This was unwinded before coming to force. To conclude, Reform Party led governments traditionally have not aimed at increasing income tax and this was a surprise to the public. No word of it got mentioned before the elections.

Estonian income tax applies similarly to both personal incomes such as employment or capital gains when investing, and to dividends paid to shareholders by Estonian companies. Estonia still has no annual corporate income tax, a rare exception in the EU.

Thanks for reading!

We hope you enjoyed this article. If you have more questions check out our extensive collection of support articles.