On 1 February 2023, a new Estonian Commercial Code came into force. This law regulates the share capital requirements of Estonian limited companies.

The minimum required share capital of 2500 euros was deleted and the clause that allowed you to postpone your share capital deposit when registering a company was also removed. In this article, I will explain the details and provide some suggestions to the founders who had an Estonian company registered before 1 February.

Generally, the changes add a lot of flexibility for the e-resident founders even though one controversial aspect is detected by e-Residency experts. Not worrying about depositing and registering share capital of 2500 euros makes it much easier to start a limited company for residents and e-residents alike.

Share capital requirements for new companies

1 February 2023 brought us a radical change in the minimum required share capital for Estonian private limited companies (OÜ). Most Estonian entrepreneurs have lived their entire lives knowing that a share capital of 2500 euros is needed for a limited company. Since the first Estonian Commercial Code of 1995, the share capital requirement has been 40 000 Estonian crowns which was converted to 2556 euros when Estonia adopted the euro in 2011. Later it was rounded to 2500 euros.

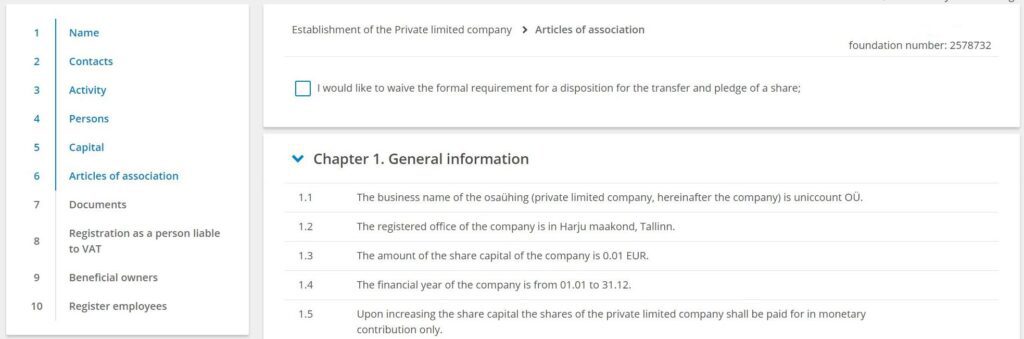

Starting from 1 February 2023 the founders and later the shareholders need to assess the amount of share capital necessary to start and run a private limited company. As the minimum nominal value (face value) of a share is one euro cent according to § 148 (1) of the Commercial Code, the share capital of an Estonian limited company can now in fact be one euro cent if it has a single founder and shareholder. This is also the default amount displayed in the e-Business Register.

Each additional shareholder would therefore mean at least 1 more euro cent of share capital. At Unicount we have set our company formation service default share capital amount to 1 euro. It is a hundred times more than the new minimum but 1 euro looks better than 1 cent when someone checks your registration details in the e-Business Register.

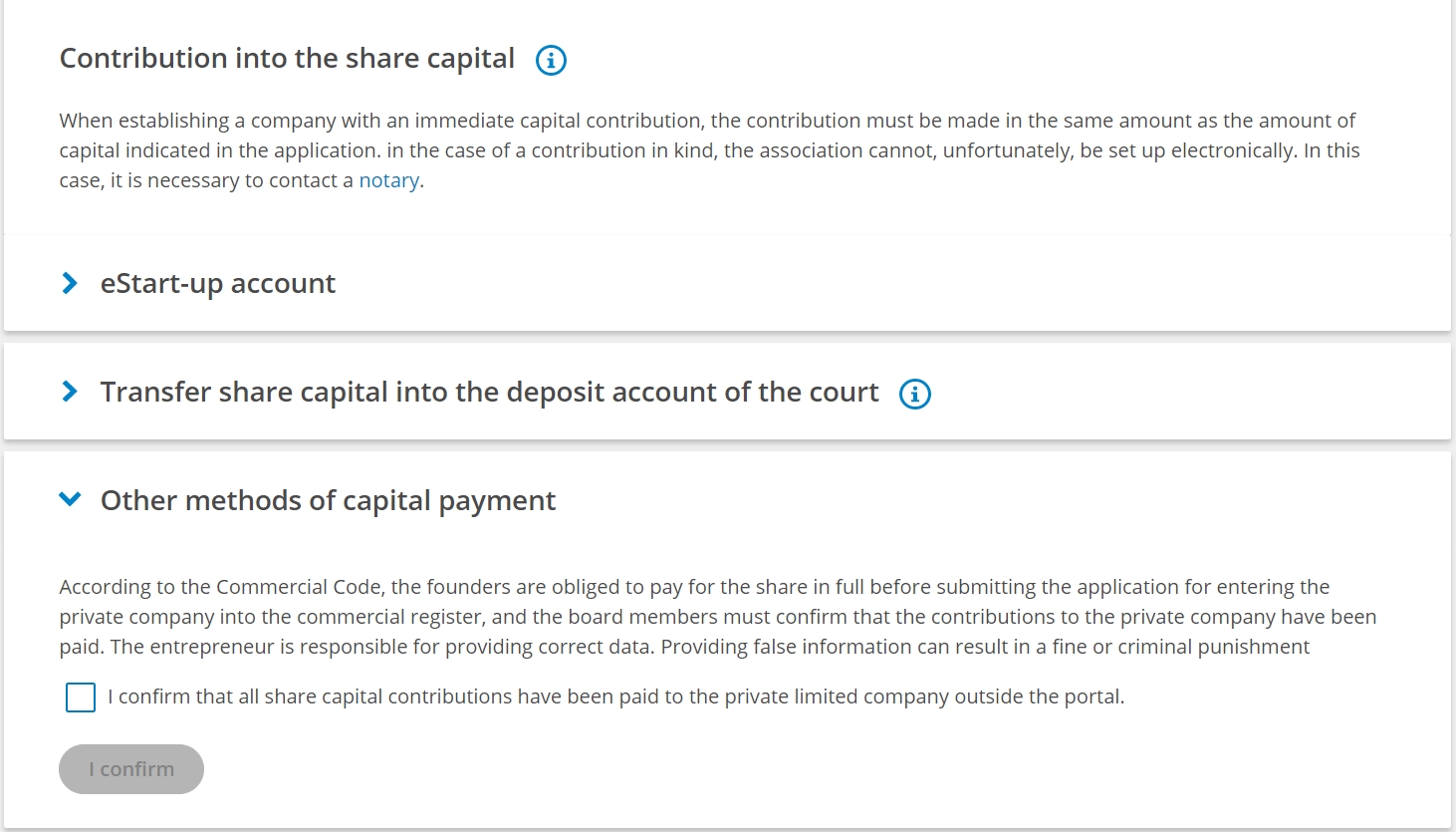

As a fun fact, after the option for postponing your share capital payment was removed there is now a controversial Commercial Code clause (§ 141) that says how company share capital payment should be made. Well, it should be paid before registration to a business bank account. In reality, very few e-resident companies get access to a pre-registration startup bank account in an Estonian bank. Foreign financial institutions are not ready to open a business account before your company registration is done. This means that founders just need to confirm that share capital is paid or use a court deposit account. e-Business Register reminds you that submitting false data is an offence. When using an API service such messages are not displayed.

Share capital requirements for existing companies

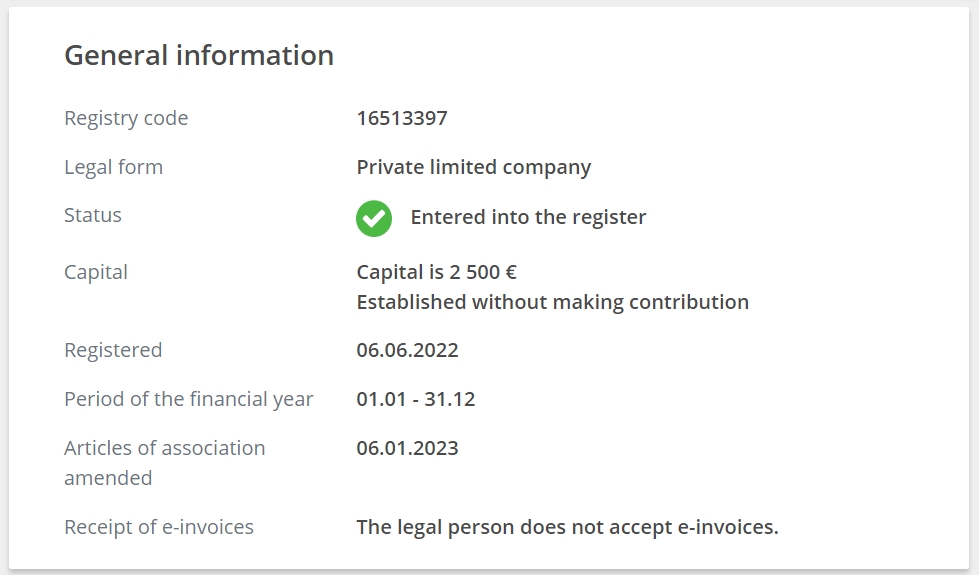

Some of our clients have asked us what happens to the share capital of companies registered before 1 February. Well, it depends on whether you as a shareholder already paid and registered the minimum share capital of 2500 euros or you left it unpaid. We assume that most active companies have minimum share capital deposited and registered. For some time the official information given to e-residents was, that you have to pay it after the company registration. Still, theoretically, there can be limited companies registered as long back as 2011 when postponing the share capital payment was first introduced in Estonia. It is easy to check your share capital amount and status by typing your company name or registry code into the search box on the e-Business Register. “Established without making a contribution” means that shareholders have either not paid for their shares or the board has not registered their payments.

I bring out some good reasons for registering your share capital if you have not done it already. Also, there are some legal nuances you should know before rushing into reducing your registered share capital of 2500 euros to 1 cent.

What to do when you have paid for your shares

If you already paid for your shares, you can either do nothing even if your registered share capital is way more than the legal minimum of 1 cent, or you can reduce your share capital to redistribute the excess equity back to shareholders. This should be done with caution though, as there are other Estonian laws that may limit the upside of having a company share capital below 2500 euros. Those details are not so well known so I discuss these later in the article. Also, when reducing share capital you are required by law to notify all creditors and announce the decision in the official gazette ametlikudteadaanded.ee.

Also, share capital payments and reductions need to be reflected on the social and income tax reports (TSD) the next month after the transaction happens.

What to do if you have not paid for your shares

If you have not paid for your shares you still have a liability equal to the nominal value of your share in the company. The bad news is that you cannot reduce the liability to 1 cent instead of 2500 euros direct. First, you need to deposit the unpaid share capital to the company business bank account and register it with the Business Register and tax office. The good news is that you do not need to show any documents to prove that you have paid for your shares to the company business account in an EEA-licensed financial institution. Until the end of 2018, the business bank account had to be an Estonian credit institution which essentially means a bank. It was a major obstacle for e-residents who were not accepted as clients by Estonian banks.

The requirement to prove that you have deposited the money to the company bank account only applies if the company’s total share capital is more than 50 000 euros. Then the court wants to see a certificate from your business banking service provider either signed digitally or sent on paper with an inked signature.

As a minor fix shareholders can now make capital injections by offsetting their liability towards the company with undistributed dividends the company owes to its shareholders. This means that your accountant needs to declare a dividend of 2500 euros which creates a corporate income tax liability of 625 euros. The same social and income tax return (TSD) can then also show the same amount as a share capital deposited by shareholders. Before it was supposed to be an actual payment from the company that you deposited back to the company.

Special for startups

If you are a startup and want to assign shares to investors or employees, you can also increase your share capital to 10 000 euros and then change company articles unanimously to remove the requirement for the Estonian notary to confirm share transfers. We have described this option in our article “How to add shareholder to a limited company in Estonia“. When doing changes to your company articles it appears on top of your articles as a tickbox “I would like to waive the formal requirement for a disposition for the transfer and pledge of a share”. In English, this sentence means that all shareholders agree that the management board can keep the list of shareholders. The board can then make changes in the cap table by just submitting the new shareholder’s data to the Business Register through an online application and no e-resident card is required for the new shareholder.

So what are the other laws saying?

Estonian Bankruptcy Act § 29 (9)1 makes shareholders of a private limited company with a share capital below 2500 euros liable for the fees and expenses of the temporary trustee in a bankruptcy proceeding. For example, if the share capital of a private limited company is 1 euro and the company does not have enough assets to cover the trustee fees and expenses, the potential liability of the shareholders is still collectively 2500 euros.

Also, Estonian Commercial Code § 176 describes the required steps when the net assets of a private limited company are reduced to less than one-half of the share capital. The shareholders can then either 1) reduce or increase share capital so that net assets would form at least one-half of the share capital, 2) implement other measures to make net assets of the company form at least one-half of the share capital, 3) dissolve, merge, divide or transform the private limited company, or 4) submit a bankruptcy petition.

When you have a company with a paid share capital of 1 cent you would be therefore theoretically already in conflict with this requirement when a liability of 2 cents is recorded on your books without an equal sales invoice of 2 cents to make up for a decrease of net assets.

To make you feel better, Estonian entrepreneurs running private limited companies only find out about this requirement when their accountant is doing financial year closing balances. Closing balances are reported with the annual accounts to the Business Register by 30 June. This is when you may get an automated message from the registration department of the Tartu County court because your company is not having the required level of net assets. As the annual accounts are reported 6 months after the closing of the financial year you may as well then present your new balance sheet that looks better than the one from 31 December.

Thanks for reading!

We hope you enjoyed this article. If you have more questions check out our extensive collection of support articles.