If you’re running an OÜ (private limited company) in Estonia, submitting your annual accounts is a crucial task that keeps your business compliant with Estonian laws. Your service provider has probably started bombarding you with warnings a few months before the actual deadline to avoid any late filing penalties.

This guide will explain annual accounts, why they matter, and how to prepare them properly, ensuring your company stays in good standing. Annual accounts are public documents affecting how business partners and anyone else checking on your finances assess your company.

What are the Annual Accounts?

Annual reports (or annual accounts, as we explain them to our clients, in Estonian “aastaaruanne”) are mandatory financial information submissions for all Estonian companies. These accounts provide a detailed picture of your company’s financial activities during the past financial year and are publicly available through the Estonian Business Register for free. Transparency is a key value in Estonia’s business environment, and public access to this information enhances trust among potential business partners, creditors, and investors.

Even if your company hasn’t been active, submitting annual accounts remains essential. This legal obligation isn’t just about avoiding fines or deletion; it’s also about maintaining your company’s reputation and compliance status. You will quickly learn that a qualified accountant is probably unwilling to submit your annual accounts based on the bank balance statement. The reason is that the Estonian Accounting Act requires you to keep all the documents for seven years after the end of the financial year, and all expenses must be linked to source documents. We recommend using good online expense management software such as Envoice.

Moreover, submitting the annual report promptly has benefits beyond compliance. For instance, dividends can only be distributed after the accounts are submitted, so handling this early can facilitate smoother financial planning.

Estonian Legislation

The Estonian Commercial Code defines the legal framework for submitting annual accounts. According to the law, every company registered in Estonia must submit annual accounts, regardless of whether it conducted any business during the year. The responsibility falls on the company’s board members, who can be personally liable for non-compliance.

The level of detail required in the reports depends on the size of the company:

- Micro and Small Enterprises: Can submit simplified reports.

- Medium and Large Enterprises: Must submit complete reports, which include additional financial statements and notes.

All Estonian OÜs must submit annual accounts to the Estonian Business Register within six months after the end of the financial year, which means most companies must file by June 30 if their financial year follows the calendar year.

Failure to submit on time can result in penalties, starting with fines and potentially leading to the company’s deletion from the Business Register. Board members could face personal financial consequences, including fines ranging from €200 to €3200.

What’s Included in the Annual Accounts?

The complexity of the annual accounts varies based on the size and nature of your company. The reporting requirements are simplified for micro and small enterprises, but the key elements remain consistent.

Management Report

This overviews your company’s operations, including investments, development activities, and any significant events that could impact future performance. Management reports are not mandatory for micro companies, but we still suggest writing one if you think someone may be interested in how your company is performing. Even one sentence is fine.

Two Mandatory Financial Statements

Balance Sheet

A balance sheet (called a “statement of financial position” in the e-Business Register) is a snapshot of your company’s assets, liabilities, and equity at the end of the financial year. For example, your Current Assets may include cash in the bank account, publicly traded stocks, or receivables such as invoices clients have not paid you yet, and Non-Current Assets could be long-term investments or property.

Profit & Loss Statement

A profit & loss (PL) statement (called income statement in the e-Business Register) shows your company’s annual revenue and expenses, helping assess profitability. Revenue minus operating expenses such as raw materials and other expenses gives the Operating Profit (Loss). Adding interest income or other financial gains results in Profit (Loss) Before Tax.

Other Financial Statements

Cash Flow Statement

A cash flow statement is not mandatory for micro and small company accounts. It presents an overview of how cash flows in and out of your business, covering operating, investing, and financing activities. It is a reliable source of information for many investors to analyse the stocks of listed companies as it shows the best of how the company is doing. The reason is that the balance sheet and income statements of large companies can include many subjective opinions and estimates, such as how to account for sales invoices that clients have not paid and may never pay, how much privately traded assets are worth and how to depreciate (expense) capital investments such as machines and software. The quote that sums up these subjective choices is, “Cash is a fact, accounting is an opinion”.

Notes to Financial Statements

Notes provide additional information and context to the financial figures and must include certain required disclosures, such as mandatory accounting policies, Labor expenses, and Related Party transactions. Related party transactions can be anything from shareholder loans to companies and persons related to the shareholder or director to business transactions between companies belonging to the same shareholders.

Auditor’s Report

Larger companies or those subject to mandatory audits must include an auditor’s report to verify the accuracy of the financial statements.

Understanding and Preparing Annual Accounts

Proper preparation of your annual accounts starts with gathering and organizing all relevant financial data. Here’s how the two core financial statements are prepared, using examples to explain specific elements and calculations. Please note that all figures are always reported in euros. If you hold or trade in other currencies, you need to convert to euros using the exchange rate of the balance date. Original accounts must be submitted in Estonian, but you can produce English-language copies by selecting them in the e-Business Register.

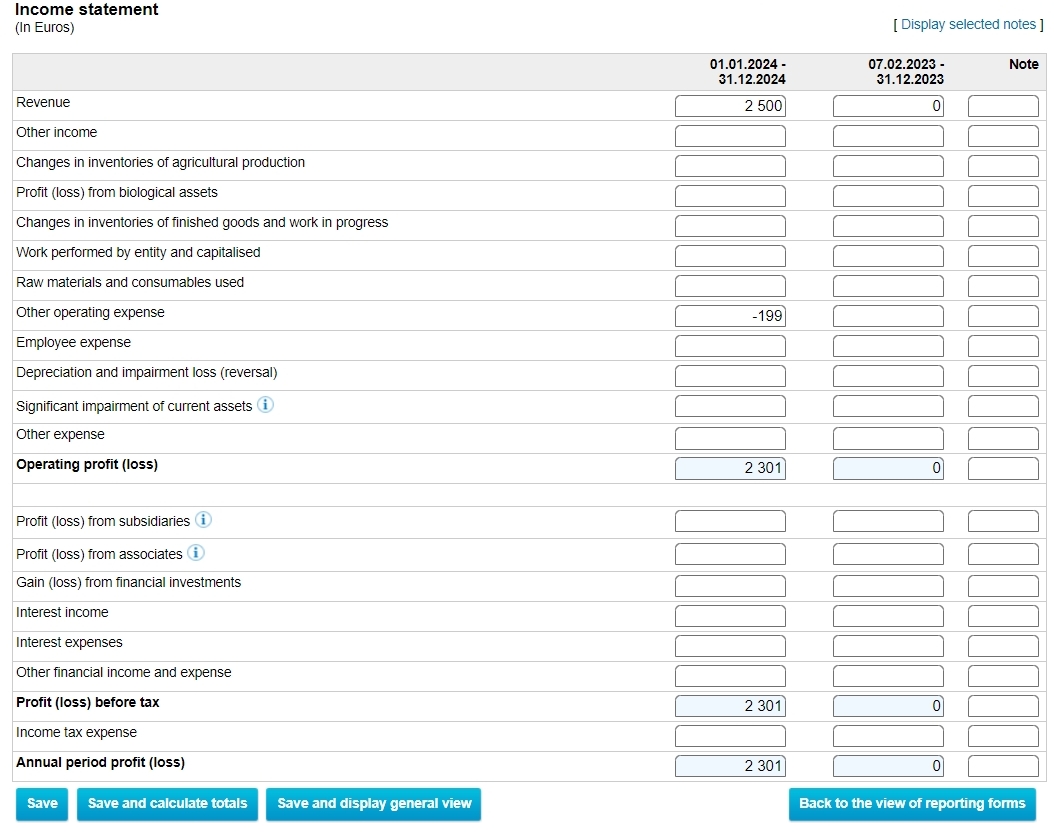

Profit & Loss Statement (Income Statement)

This statement summarizes your company’s revenue and expenses. Key elements are Revenue, Cost of Goods Sold, Labor cost, etc.

Operating profit would be calculated as Revenue minus all operating expenses, resulting in an Operating Profit.

Adding interest income/cost and other financing-related items gives the Profit Before Tax, which can be much higher if you earn interest or have capital gains, or vice versa.

In this sample PL statement, we have a company that recorded (but maybe did not yet receive to bank) a sales 2500 euro invoice but also recorded their first expense. Operating profit would be 2500 euros minus the first expense recorded, which was probably already paid by company card. So, the total profit before tax would be 2500-199=€2301. Estonia has no annual corporation tax, so the annual profit is unaffected by tax.

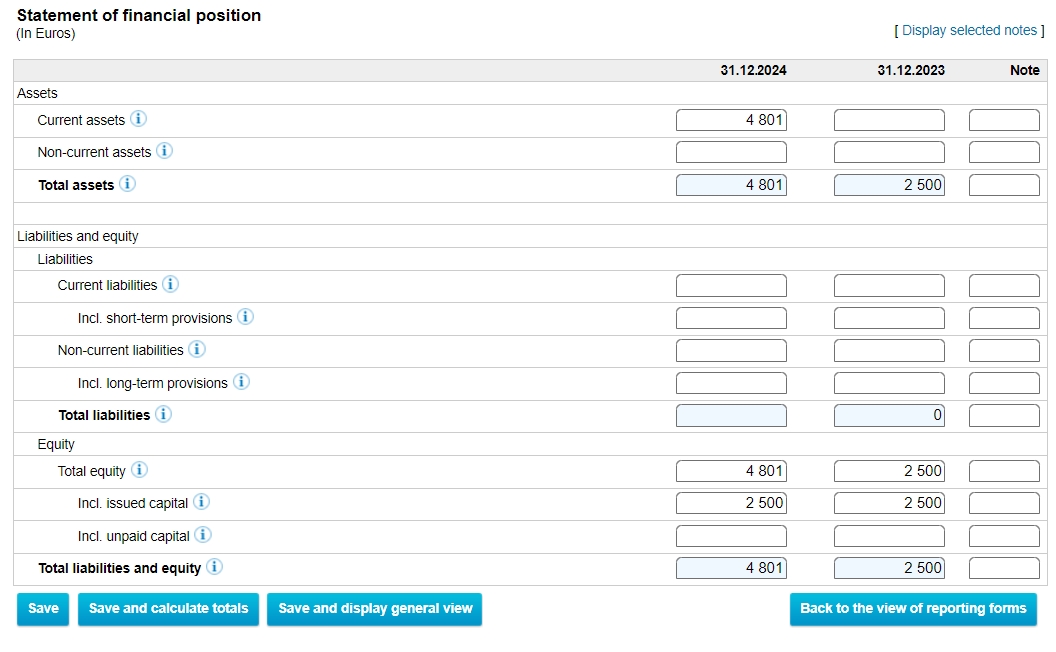

Balance Sheet (Statement of Financial Position)

This statement shows what the company owns (assets) and owes (liabilities) and the equity held by shareholders. Key elements are Current Assets and Non-Current Assets, which sum up as Total Assets.

Equity includes issued share capital and retained earnings and should equal your total assets minus liabilities. Liabilities can be shareholder loans, credit card debts or unpaid invoices from your suppliers.

In this sample balance sheet, we have a company that paid up share capital of 2500 euros, recorded (but maybe did not yet receive to bank) a sales 2500 euro invoice, and recorded their first expense as 199 euros.

Current and total assets would be 2500 euros of cash paid to the company bank account by the shareholder for the shares, plus 2500 euros that the company’s first client must pay minus 199 euros for the first expense recorded and probably already paid by the company card.

So, the operating profit that equals retained earnings in this sample (2500-199=€2301) will make the total equity with zero liabilities 2500+2301=€4801. Equity is simply the net value of the company for its shareholders.

A balance sheet helps to assess your company’s financial health. The management board is responsible for keeping the company solvent. The annual accounts balance sheet is how the public knows if the company is becoming insolvent. Reporting that the company has equity below half of the registered share capital triggers the court’s demand to improve the company’s solvency by injecting more capital, etc.

What can go wrong?

The most common mistake is simply missing the reporting deadline. This can result in fines and company deletion. Set reminders and start the process a few months before with your accountant. Double-check all numbers, ensure your accounts are correctly reconciled, and disclose all bank accounts to your accountant. Missing bank statements can lead to false data being submitted to the register, even if your accountant did the best work possible.

Stay organized and maintain all financial records throughout the year to avoid the struggle before the due date. Consider using accounting or expense management software to automate the process and minimize errors.

If in doubt, a professional accountant can save you time and ensure accuracy for those who have not studied tax and corporate finance in Estonia.

Outsourcing vs. Doing Annual Accounts Yourself

Deciding whether to handle your annual accounts yourself or outsource the task depends on several factors, including the complexity of your financial situation and your comfort level with Estonian accounting standards.

Outsourcing: Hiring an accountant can save you time and stress, especially if your company has been trading actively. Accountants familiar with Estonian law will ensure everything is done correctly, helping you avoid mistakes that could lead to fines.

Doing It Yourself: If your company hasn’t been active or you have straightforward financials, you can handle the submission using our manual. However, be aware that even minor errors can lead to an offence because of false data submitted, so proceed cautiously.

In a nutshell

Submitting your annual accounts is vital to maintaining your Estonian OÜ’s compliance. Whether you handle it yourself or hire an accountant, ensuring that your report is accurate and submitted on time will keep your company in good standing and avoid costly penalties. Consulting with a professional is always a smart move if you’re unsure.

By following these guidelines, you can confidently navigate the annual reporting process and keep your business on the right track.

Thanks for reading!

If you have more questions, check out Unicount extensive support articles or contact us directly for personalized advice.