If you’ve set up an Estonian company, it’s essential to know where and how to find your Estonian company information. Whether you’re looking for your registration number or tax number or simply need an English version of your registration certificate, this guide will walk you through everything you need to know.

After registering your company in the Estonian Business Register, you will receive an email from the court with your company registration code (8 digits) and other registration details. The registry code (registrikood in Estonian) is your Estonian company number, and no other identification is used in Estonia to identify legal entities.

The court’s email is in Estonian and English, and registration details (also called a registry card or registrikaart in Estonian) are enclosed as a PDF document in Estonian.

The email subject would look like this: “Menetlustoimingust teavitamine, registriasi Ä xxxxxxx, Your company name OÜ (registrikood xxxxxxxx)”.

Email content would look like this in English:

We hereby inform you that Ruling No. Ä xxxxxxxx concerning Your company name OÜ (registry code: xxxxxxxx) was adopted in the Registration Department of Tartu County Court on Month DD, YYYY. An uncertified transcript of the document is attached to this e-mail as a PDF file. Sincerely, Registration Department of Tartu County Court, Pikk 32, 44307, Rakvere

Finding Your Estonian Company Information

The Estonian Business Register provides free access to your company’s core information, including the registration code, legal address, shareholders, and directors. You can easily access this by visiting the Business Register website and searching by company name or registration code.

Once you’ve located your company, you’ll be able to view:

– General information (status, share capital, registration date, period of financial year…)

– VAT number if registered for VAT in Estonia

– Annual accounts submitted

– Shareholders and beneficial owners

– etc

This is essential when starting business relationships with partners who want to verify your company’s existence and good standing.

Estonian company information

Finding Your Estonian Company Tax Number

In Estonia, a company tax number is the same as your company’s registration code. This can be found on the registration certificate or any official document from the register. If a foreign service provider requests that you present the company’s unique taxpayer number (TIN), type your company registration code.

Suppose a service provider asks for the company’s VAT registration number. In that case, you should know that it is optional to have a VAT registration in Estonia if your company stays below the annual threshold of taxable supply (currently 40 000 euros per calendar year). Therefore, having an Estonian VAT number to access any service with your Estonian company should not be compulsory.

You may also apply for a voluntary VAT registration without exceeding the 40 000 euros threshold. So, suppose you want to register for VAT in Estonia. In that case, you can apply for voluntary registration without turnover or wait until your taxable turnover in Estonia surpasses 40 000 euros per calendar year. Since 1 January 2024, the standard VAT rate has been 22%.

You can register for VAT by logging into the Unicount Dashboard and ordering the VAT registration service. Learn more about registering for VAT in Estonia here.

Accessing Your Estonian Company Information in English

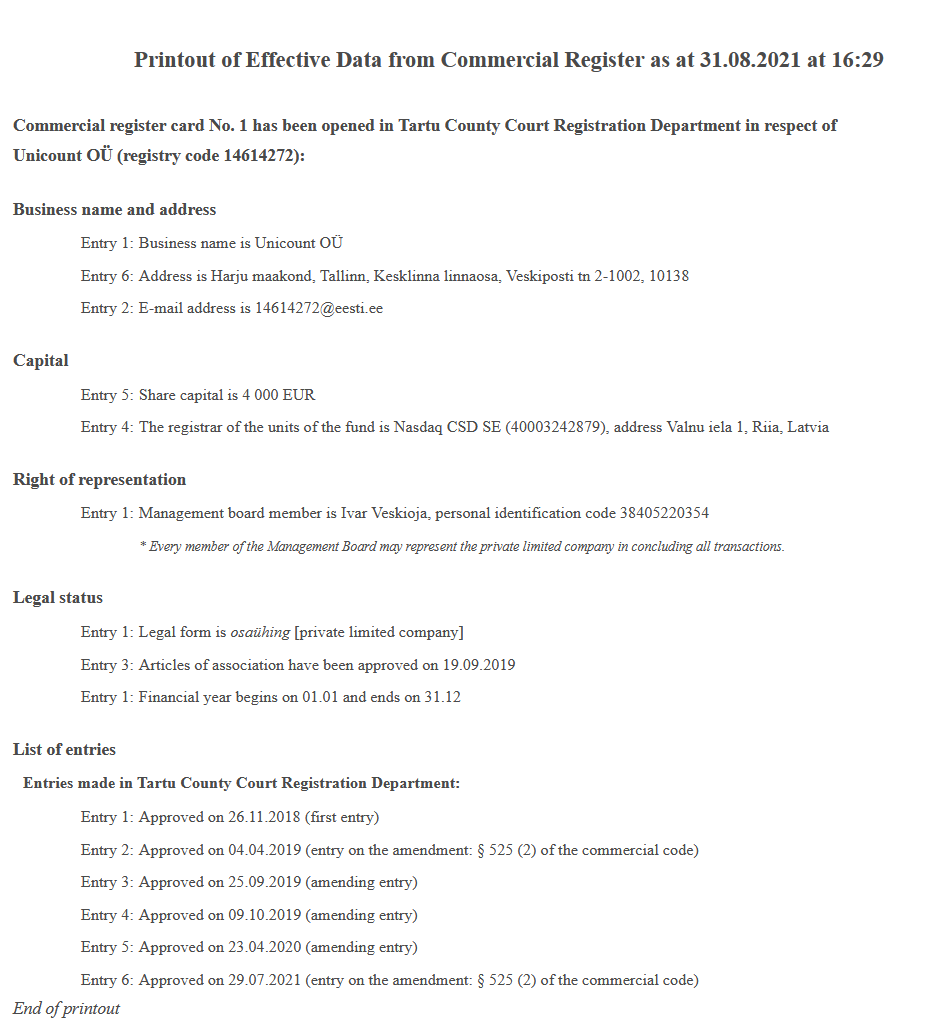

You may sometimes need your company’s registration certificate in English, especially for accessing international services or when signing up with financial institutions. Electronic PDF registration certificates are available for free from the Estonian e-Business Register. This is what a machine-translated registration certificate looks like in English:

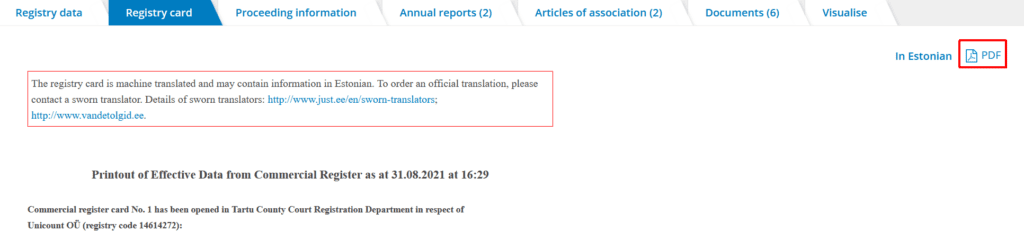

To get the certificate:

1. Go to the e-Business Register and search for your company name or registry code.

2. In the company view, click on the registry card icon.

3. Then click on the PDF icon in the top right corner to download.

The registry card is machine-translated and may accidentally contain information in Estonian too. For certified paper documents, you should contact one of the notaries in Estonia. The Estonian Business Register does not issue certified paper documents.

Keeping Everything in One Place by Using Unicount Client Dashboard

When you subscribe to Unicount virtual office services, you can access the Unicount Client Dashboard. This ensures that you always have quick access to your Estonian company information, as well as all the legal correspondence with authorities and the support of our team. Whether for legal purposes or tax compliance, having a partner who can explain the incoming messages from authorities can save you time and ensure your business runs smoothly.

Managing your company details through Unicount services is incredibly convenient. To access your account:

1. Head over to the Unicount website

2. Click on log in in the top right corner. You will see the Client Dashboard login page

3. Access the Client Dashboard by using an ID card, Mobile ID or Smart ID

Once inside, you can manage various aspects of your company, from ordering certificates to updating contact information. This makes it easy to keep your business details up-to-date without hassle.

Thanks for reading!

If you have more questions, check out Unicount extensive support articles or contact us directly for personalized advice.