You can register a company in Estonia with Unicount in five minutes. Once you receive your company registration notification, here are the first steps you’ll probably want to take with your new company.

First of all download your registration certificate and shareholders data in English. These documents are often useful, especially when applying for banking, payment providers, or other services. Downloading them is free and takes just a minute or two.

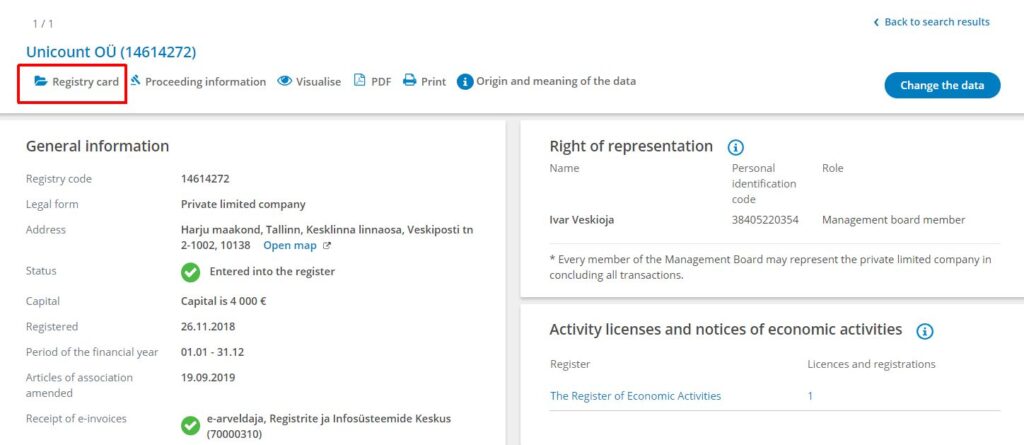

For the registration certificate, go to the Estonian Business Register, search for your company then select “Registry card”. This takes you to the registry card view where you can download machine translated English version as a PDF.

For the shareholders certificate, log into the Estonian Business Register using your e-resident digital ID card or Smart-ID. Then search for the name of your company. You can then select the tab for ‘Registry data’ and print to PDF ‘General data’. This creates a PDF with more details than the public registration certificate, including information about shareholders and founders.

Set up your Smart-ID account

Estonia’s digital ID cards may be famous around the world, but most Estonians actually now use their mobile phones for regular digital signing instead. This is now also available to e-residents as an app called Smart-ID, which you can set up with your e-Residency digital ID. You can then leave your card and reader at home and don’t have to pull out a laptop every time you want to digitally sign. It even works if your digital ID card is lost or expired. Read more here.

Set up your spam proof company email with eesti.ee

You’ve just registered a new Estonian company but before you can even announce the launch of your business to the world, your company has already started receiving spam emails. This is a common complaint among e-residents and international residents of Estonia.

This happens because your company email is now listed publicly on the Estonian Business Register, which then also sells these details to other companies. However, there’s a nifty little solution that is commonly used by Estonians.

Please note that starting from 1 February 2023 Unicount does not reveal your email to the Business Register if you ordered virtual office or contact person service when registering a company via Unicount. You can be sure that no spam reaches your personal and company email inserted during the registration. You can set up your company’s spam proof eesti.ee email in the Business Register whenever you wish to do so. Until then your company’s public email is the spam proof email of Unicount (mailmycompany0@gmail.com) and Unicount forwards all the necessary government emails.

Register the beneficial owners

Estonia has a very transparent business environment, which is important for ensuring that Estonian companies are trusted globally even if they are run by location-independent e-residents. A key part of that transparency is ensuring it’s clear who controls each and every company. As an Estonian company director, you are legally obliged to declare your company’s so-called ‘beneficial owners’, which could include someone who owns or controls more than a quarter of the company indirectly. This must be done by everyone after starting a company through Unicount, even if you are the only owner, and it must be updated within 30 days whenever there is a change to your company’s beneficial owners. It’s easier than it sounds. It sounds a bit confusing, but it’s very easy to do. Check out how here.

Set up your business bank account

It’s important to keep your personal and business banking separate. You have a range of options for business banking and there is no right solution for everyone as it will depend on you and your company’s circumstances. Be sure though to choose a banker provider that is based in the European Economic Area so you can register your share capital and can issue a Mastercard or Visa card for your company expenses.

The most popular bank in Estonia for e-residents is LHV, although setting that up requires a visit to a branch in Estonia, which is obviously tricky during a global pandemic. However, there are multiple options from the fintech sector that you can apply for entirely online, such as Wise, Payoneer or Paysera. You can also apply with your local bank in your own country, which may be more likely to issue you with an account even for an Estonian company if you have a good existing relationship with them.

Choose an accountant

Unicount is the easiest way to establish an Estonian company online, and now we also provide monthly accounting service and tax reporting in Estonia. Some e-residents may not need monthly accounting if they are not registered for VAT in Estonia or not even trading yet, but we can help when you do need tax reporting and every trading company will at least need an accountant for their annual report.

Understand your tax obligations

E-Residency is not tax residency. However, some companies belonging to e-residents do pay taxes in Estonia, while some don’t. That depends on whether you have a permanent establishment in another country. For personal tax residency, this won’t change unless you actually live in Estonia for at least 183 days over the course of a period of 12 consecutive calendar months. You can learn more on the e-residency website and if you have any doubts at all about your tax obligations then consult a qualified accountant.

Register Estonian company fo VAT

You have to register Estonian company for VAT in Estonia when your company earns more than €40,000 of taxable income in a calendar year. Before that, registering is optional and whether you benefit from that depends on the VAT amount on goods and services you buy. When you are ready, you can ask your accountant to complete your company’s VAT registration or you can do it yourself. We do not recommend submitting the monthly VAT reports on your own though. This is something a qualified accountant in Estonia should do. Please note that you could be liable for VAT registration in other EU countries where you have a permanent establishment or goods delivered.

Capitalize your Estonian company

Your company may need to spend money to make money. If so, there are three ways to inject some capital into your company. The first option is depositing the amount of share capital declared when registering a company. Legally you should do it before your company is registered but obviously, most e-residents would struggle to find a financial institution that will open a business bank account before your company is registered. Only local banks in Estonia enable this for resident founders.

Until 31 January you had to pay in and register the minimum share capital of 2500 euros. You will need to do it still before your company can pay out dividends if your company was registered before 1 February 2023.

The second is to make a shareholder loan at zero interest rate for which you can digitally sign a contract between yourself and your company.

And the third is, of course, to get your first clients to make their pre-payments. Good luck!

Thanks for reading

We hope you enjoyed this article. If you have more questions check out our support articles here.