Estonian OÜ annual report 2025 for e-Resident

Every Estonian OÜ must submit an annual report once a year. For e-residents, this is one of the most important compliance obligations. Even if your company had no activity, the report still needs to be filed correctly and on time.

The deadline for most founders is 30 June 2026. Many e-residents wait until spring, but December is the period when experienced founders secure their annual report service to avoid queues, prevent mistakes, and keep costs predictable.

This guide explains what the annual report contains, how the legal process works, and why preparing early is especially important for remote founders.

How to prepare your Estonian annual report on time as an e-Resident

Estonia does not wait for overdue filings. If an OÜ fails to submit its annual report, the Business Register begins a formal process that can lead to warnings, penalties, and eventual removal from the register.

Founders who manage their companies from abroad benefit from preparing early. This gives enough time to gather the required documents, fix gaps, and make sure everything is accurate well before the deadline.

Early preparation ensures that your accountant can review bank statements and expense documents calmly, rather than during the busy reporting season. Most issues that cause delays appear because documents are missing or sent too late.

Aastaaruanne explained: The main elements of an Estonian annual report

An Estonian annual report gives a clear overview of your company’s financial situation. The structure depends on company size, but most e-resident companies qualify as micro or small.

The report usually includes the following sections.

Management Report

Optional for micro companies but helpful for credibility. Provides a short overview of business activity during the year.

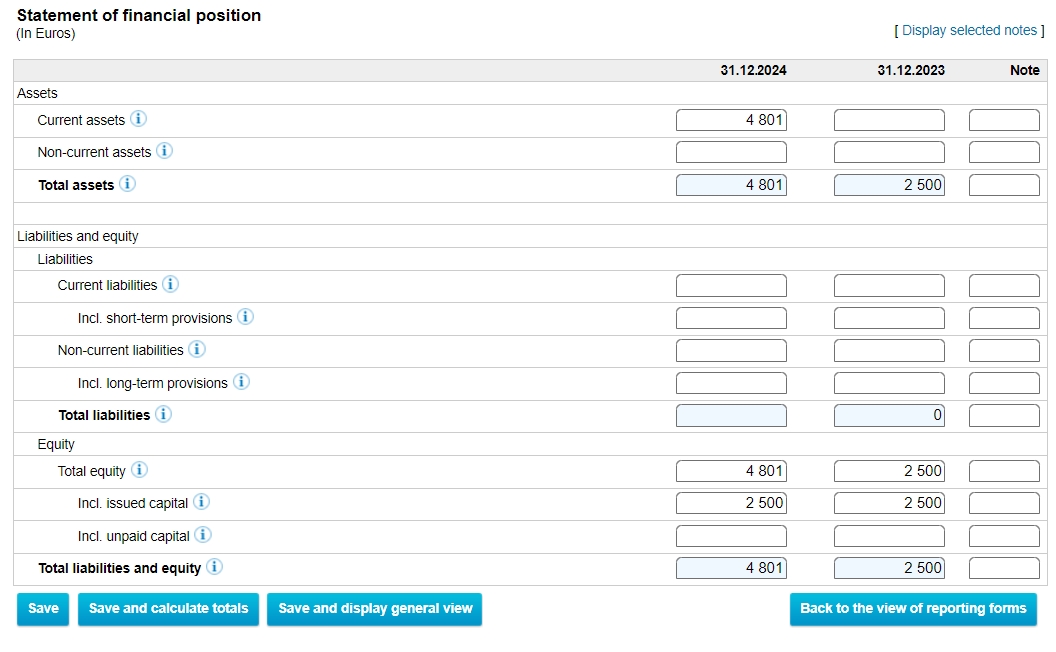

Balance Sheet

Shows assets, liabilities, and equity at the end of the financial year.

Profit and Loss Statement

Summarises income and expenses to show the financial result for the year.

Notes to the Accounts

Includes accounting policies and other required explanations.

Additional components for larger companies

Cash flow statement and an auditor’s report when the law requires it.

Reports are submitted in Estonian, although the online environment is easy to navigate. Even companies with no activity must file their report.

Annual Report deadline in Estonia and penalties for late submission

According to the Estonian Commercial Code, companies must submit their annual report within six months of the end of the financial year. For most OÜs the deadline is 30 June.

Late submission can result in notices, penalty payments, and repeated reminders. In more serious cases the Business Register may begin deletion proceedings. This affects the company’s ability to operate and can also complicate future e-residency renewals.

Preparing early helps avoid these risks and gives founders more control over the reporting process.

Should you file your OÜ annual report yourself or hire an accountant

Founders with inactive companies sometimes submit the annual report themselves by using templates in the Business Register. For a dormant OÜ this is possible, although accuracy is still important.

Active companies benefit from professional help. Estonia has strict accounting rules, especially when VAT is involved. Incorrect classifications or missing documents often cause delays that are easier to resolve when an accountant is involved.

A professional service ensures that the report complies with Estonian accounting standards and that the submission is handled correctly and on time.

Why e-Residents order their annual report service in December

By December most founders already have a clear idea of what the financial year looks like. It becomes easier to check whether documents are complete. Bank statements, invoices, and expenses are easier to gather before the new year begins.

Ordering early ensures that your company receives a place in the accountant’s schedule. The workload increases significantly from January to June. Founders who wait until spring often face longer queues, higher seasonal fees, and more pressure to resolve missing documentation quickly.

Early preparation avoids these problems and results in a smoother reporting process.

How Unicount supports e-Residents with annual reports

Unicount works with e-residents who manage their companies entirely online. Annual reports are prepared by experienced accountants who ensure accuracy and full compliance with Estonian requirements.

The process includes a clear explanation of needed documents, early review of bank statements, confirmation of balances, preparation of the full annual report, and submission to the Business Register. Everything is handled digitally, which is ideal for founders who live outside Estonia.

Checklist for a smooth annual report submission

To prepare your annual report efficiently, make sure you have the following.

• Full-year bank statements

• Expense documents stored and accessible

• Sales invoices and contracts if applicable

• Details about assets or loans

• Notes about any exceptional transactions

Providing this early helps prevent last-minute issues and ensures that the report is completed accurately.

Submit your 2025 annual report with confidence

The deadline may be in June, but December is the most effective time to organise your annual report service. You avoid the reporting season rush, reduce the risk of errors, and enter the new year with one of your key obligations already planned.

Unicount can prepare and submit your annual report for you. Early preparation gives you peace of mind and keeps your company fully compliant.