As Estonia navigates the challenges of recession, high inflation, and increased defence spending, the new coalition government is considering significant changes to its tax policies. These adjustments are part of the coalition agreement aimed at balancing the state budget and ensuring alignment with the eurozone deficit requirements of 3%. For future e-resident founders looking to start their companies in Estonia, understanding these potential tax hikes may be relevant before making the expenses.

Critical Elements of the Coalition Agreement

One of the coalition agreement’s most significant components is the planned VAT and income tax rate increase. By 2026, Estonia’s VAT can increase by another 2%, from 22% to 24%. This hike is expected to generate substantial revenue to address the government’s budgetary shortfall, driven by rising defence spending and an inflationary environment in an economic recession for the past ten quarters.

For e-residents, this potential VAT increase will directly impact the cost of business services in Estonia if your company is not registered for VAT to reclaim outgoing tax. If selling to Estonian B2C customers, you could refigure your pricing strategies. While this tax change may not directly impact non-resident businesses, the increased costs could influence the broader business environment and consumers.

Annual Corporate Income Tax: A Change in Direction?

The coalition agreement outlines plans to increase the income tax from 22% in 2025 to 24% in 2026. This would apply similarly to corporate dividends and personal income, such as director’s fees, salaries, or personal capital gains.

Estonia has long attracted international entrepreneurs with its innovative 0% corporate income tax on retained earnings, which allows businesses to reinvest profits tax-free. Introduced by the Reform Party in 2000, this policy was a key driver behind Estonia’s reputation as a business-friendly destination within the European Union. Companies were only taxed on profits when distributed as dividends, promoting growth and reinvestment. However, this advantageous tax system is under fire in the current coalition agreement. The 0% tax on retained profits remains in place for 2025, as no tax can be changed less than six months before the start of the tax year.

The coalition agreement included a new “security tax” proposal for 2026, a 2% annual corporation tax that would apply regardless of whether profits are distributed. This tax was intended to raise additional revenue for national defence initiatives, but no legislation has been brought forward yet. As of now, this security tax remains a proposal, and its future is uncertain.

Finance Minister’s Payroll Tax Proposal: A Spin?

Adding uncertainty to this unprecedented step is a new 15 August proposal from Reform Party Finance Minister Jürgen Ligi, who has suggested replacing the 2% corporate income tax on annual profits with an additional payroll tax. This proposal represents a significant shift from the coalition agreement published on 19 July 2024.

However, Ligi’s proposal has faced criticism from within the coalition itself. Social Democrats Vice Chairman Tanel Kiik expressed concerns that the proposal is “unclear” and warned that taxing employment further could discourage job creation. Employers in Estonia already pay relatively high employment taxes compared to companies without employees, and the concern is that additional payroll taxes would benefit companies that avoid hiring people under the Employment Act.

Jürgen Ligi’s payroll tax proposal can be seen as an attempt to address Estonia’s fiscal challenges without abandoning the Reform Party’s legacy of 0% annual corporate income tax. However, it remains to be seen how this proposal will evolve in the face of opposition and whether it will garner enough support to become legislation.

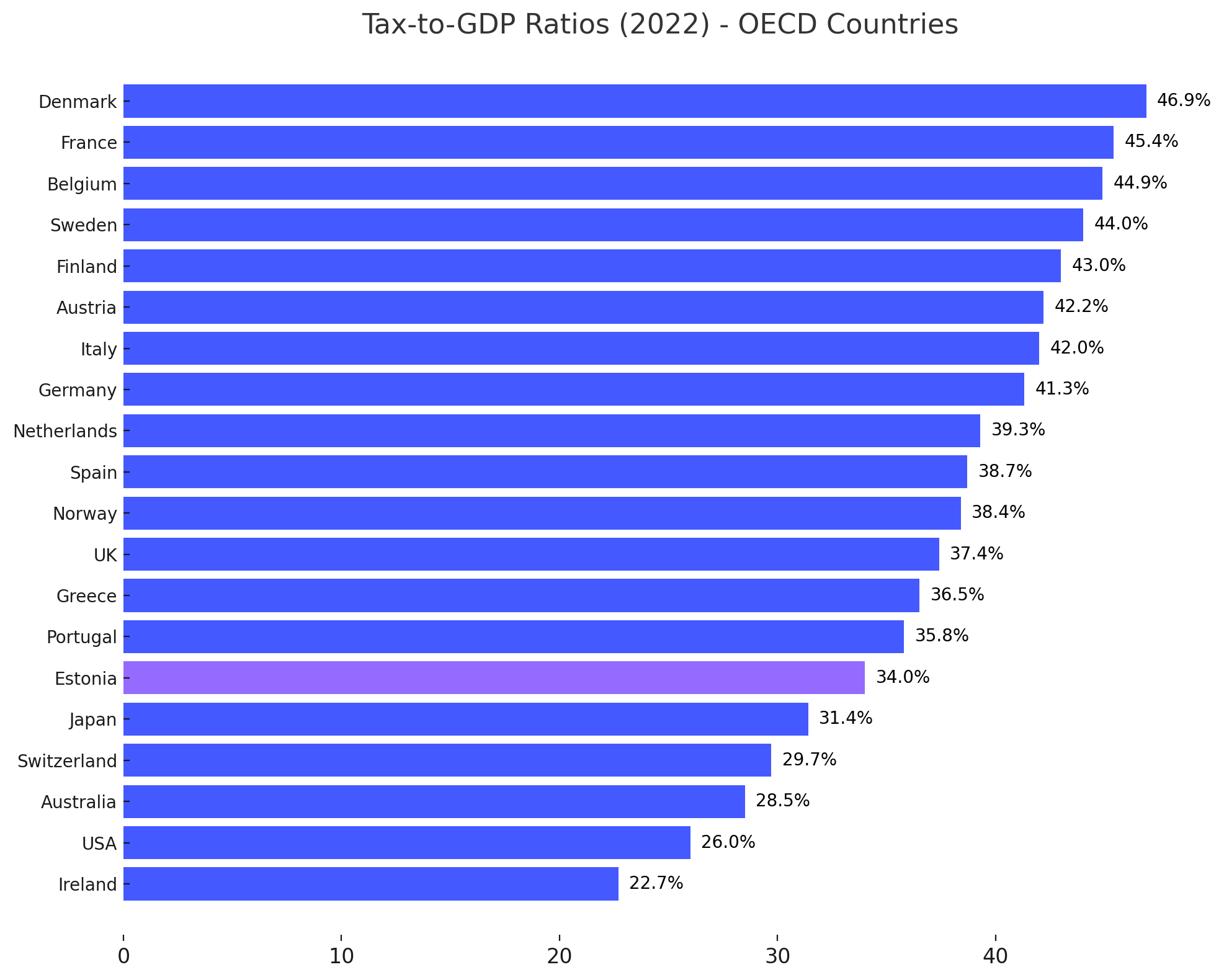

Estonia’s Tax-to-GDP Ratio: A Look at OECD Comparisons

Estonia’s tax-to-GDP ratio is relatively low compared to other OECD countries. According to the OECD 2022, Estonia’s tax revenue as a percentage of GDP was approximately 34% in recent years, below the OECD average of around 34.4%. This relatively low tax burden has been part of Estonia’s appeal to international businesses, particularly those looking for a favourable environment for reinvestment and growth.

However, as Estonia seeks to address growing fiscal challenges, the planned tax increases could bring its tax-to-GDP ratio closer to the OECD average. While Estonia still maintains some of Europe’s most attractive corporate tax policies, these new measures could reduce its competitive edge.

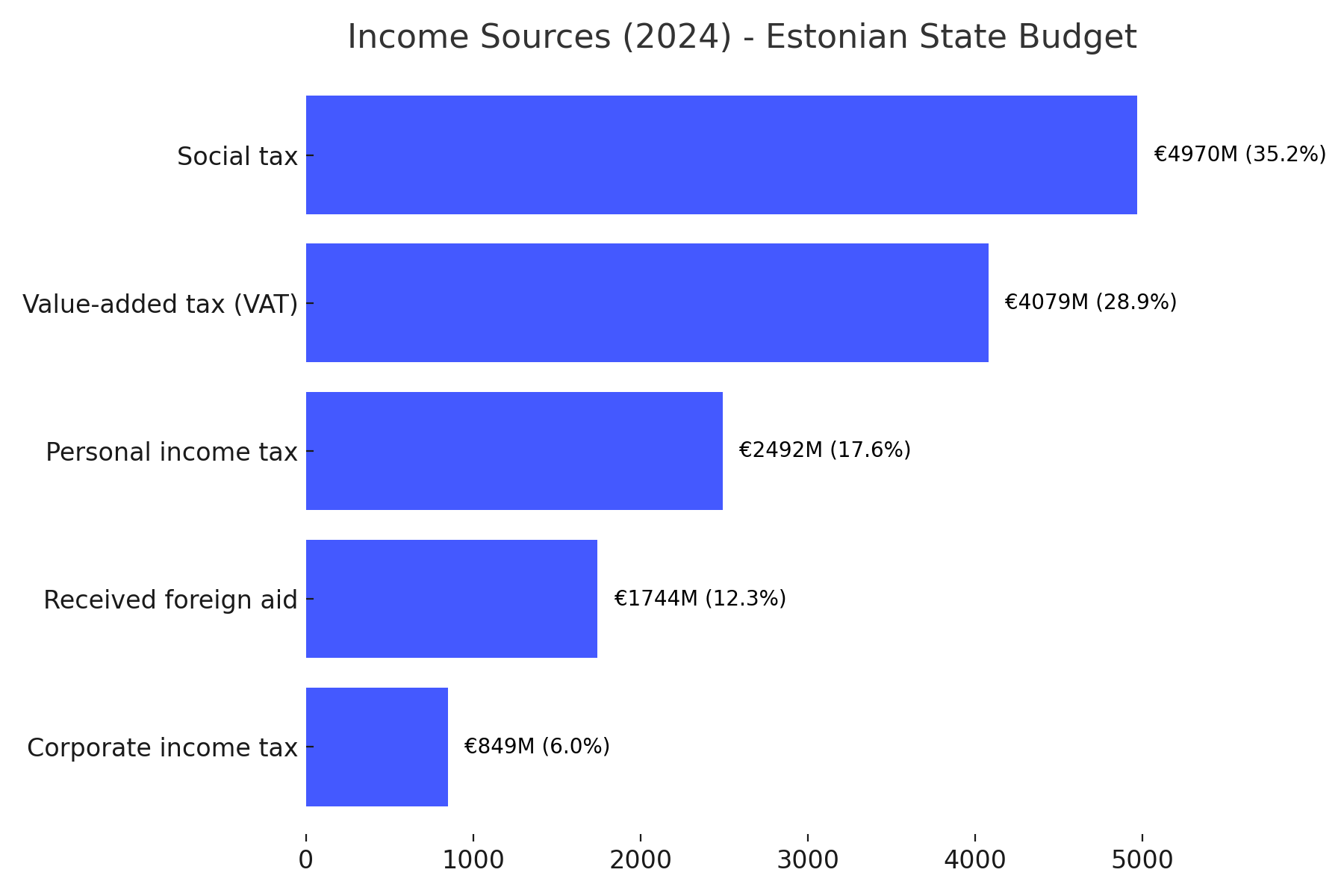

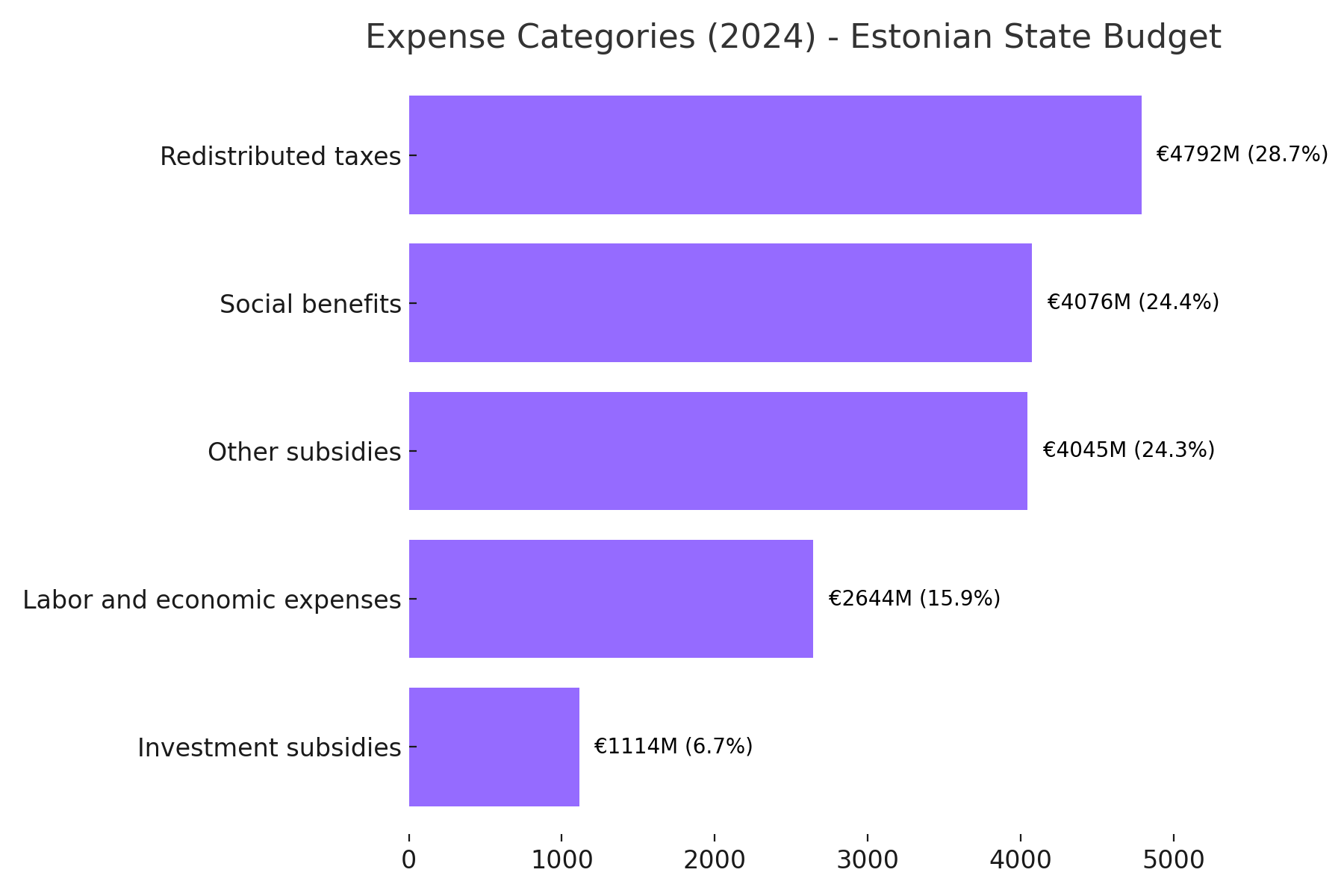

Structure of the Estonian State Budget: Income and Expenses in Percentages

The 2024 Estonian state budget amounts to approximately €16.8 billion in revenues and €17.7 billion in expenditures, with a €1.7 billion deficit. The budget reflects the government’s focus on maintaining security and economic growth while addressing fiscal imbalances.

Social protection remains the most significant expenditure, driven by the costs of pensions and welfare programs, followed by substantial health care and education investments. Defence spending continues to grow, reflecting Estonia’s commitment to regional security amid ongoing geopolitical challenges, mainly due to the Russian war of aggression against Ukraine. This category now represents around 9% of the budget, with an allocation of over €1.3 billion.

What next?

We encourage all our e-resident clients to consult with tax professionals and adjust their business strategies accordingly. The upcoming changes may feel daunting, but with the proper planning, your Estonian company can continue to thrive.

For more detailed guidance on managing your company’s tax obligations in Estonia, check out our articles on dividend distribution, VAT registration, and how to choose the right accounting services. Our team is here to help you stay compliant and successful in Estonia’s evolving tax landscape.

Thanks for reading!

If you have more questions, check out Unicount extensive support articles or contact us directly for personalized advice.