Last week, we outlined the key responsibilities of Estonian e-residents in 2025 and how Unicount helps you stay compliant. But what happens if an e-resident, or the director of an Estonian OÜ, misses their legal and business duties?

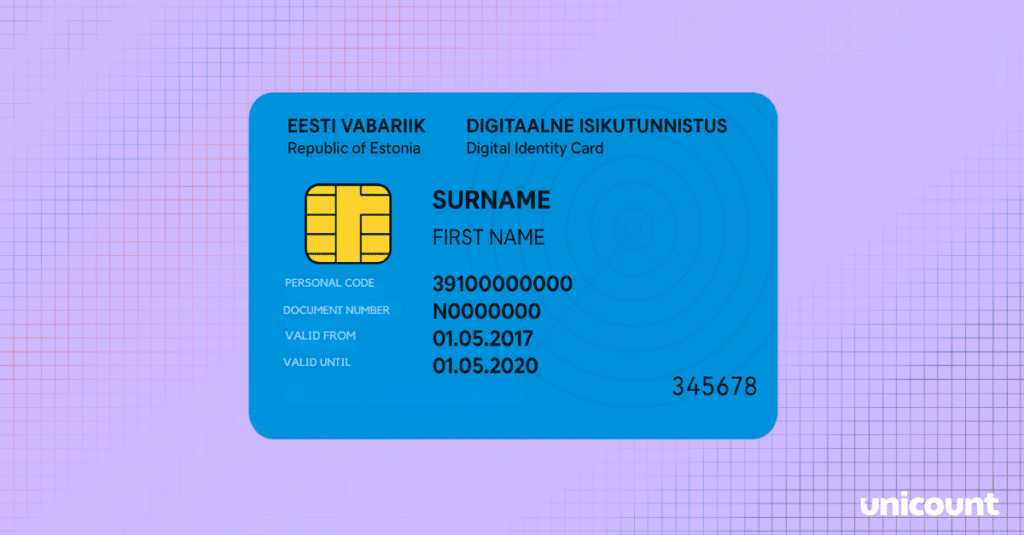

Estonian e-Residency offers entrepreneurs a chance to run a trusted EU company fully online, but with that freedom comes responsibility. Failing to comply with Estonia’s legal and accounting requirements can lead to serious consequences, from administrative fines to losing your e-Residency digital ID altogether.

Suppose you are an e-resident in Estonia or plan to apply in 2025. In that case, this comprehensive guide from Unicount explains what happens if you do not meet your obligations and how to avoid penalties that could harm your business and digital status.

What happens if you ignore your e-Residency responsibilities?

Neglecting your e-Residency obligations or Estonian company duties can trigger various sanctions depending on the severity and duration of non-compliance.

Here’s what can happen if you fail to meet your e-Residency requirements in 2025:

- Administrative fines and penalty notices from the Estonian Business Register or Tax and Customs Board.

- Temporary or permanent suspension of your e-Residency digital ID card, blocking access to e-services.

- Company fines or forced deletion from the Estonian Commercial Register (starting from €200 and rising to €3,200 or more).

- Personal liability for unpaid taxes, debts, or unresolved creditor claims.

- Loss of access to digital signing, tax filing, and company management tools.

- Revocation of e-Residency status by the Estonian Police and Border Guard Board.

- Reputational damage, making it harder to open EU bank accounts or re-register a company in the future.

Common compliance mistakes and their consequences

1. What happens if I don’t file annual report in Estonia?

One of the most common mistakes among e-residents is missing the annual report deadline.

If your company does not submit its Estonian annual report within six months after year-end, the Business Register may:

- Issue an official warning.

- Impose fines up to €3,200 or higher for continued non-compliance.

- Start deletion procedures for your company.

- Fine board members personally for negligence.

- Block renewal of your e-Residency digital ID.

2. Company data requirement for Estonian company

Outdated Company Data or Missing Contact Information

Failing to update your company details, such as the registered address, contact person, or beneficial owners, can lead to penalties and legal issues.

If your Estonian OÜ doesn’t have a valid contact person or updated management details, authorities may:

- Send official warnings and apply fines.

- Prevent you from receiving legal notifications (causing missed deadlines).

- Accelerate company deletion from the register.

- Create problems with banks or Estonian service providers.

3. Estonian company tax penalties

Tax non-compliance and reporting issues

Incorrect or missing tax declarations can result in audits, financial penalties, and even forced company closure. The Estonian Tax and Customs Board may report non-compliance to international authorities.

Even if your company is deleted, tax obligations and creditor debts remain and directors can still be held responsible.

What happens if my e-Residency is revoked?

Losing your e-Residency status: The ultimate consequence

In severe cases, the Estonian Police and Border Guard Board may revoke your e-Residency status.

This can happen if:

- Your company is deleted for non-compliance.

- You repeatedly ignore Estonian business laws.

- You breach the integrity standards of the e-Residency program.

Losing your e-Residency means:

- No access to Estonian e-services or banking.

- Automatic closure or deregistration of your Estonian company.

- Inability to digitally sign or manage business operations.

- Difficulty reapplying for e-Residency in the future.

How to avoid fines and company deletion as an e-Resident

Staying compliant as an Estonian e-resident in 2025 doesn’t need to be difficult, it just requires consistency and professional support.

Unicount helps e-residents meet all legal obligations effortlessly by:

- Tracking annual report and tax deadlines for your company.

- Helping to update your company and personal data with Estonian authorities.

- Handling accounting, reporting, and tax registrations.

- Providing expert help if you receive warnings or penalty notices.

- Keeping you informed about regulatory updates that may affect your business.

Frequently Asked Questions about e-Residency non-compliance

What should I do if I receive a penalty notice in Estonia?

Log into the e-Business Register or e-Tax portal immediately, review the notice, and contact your service provider (like Unicount) for help.

Does company deletion remove debts?

No. Even if your Estonian company is deleted, debts and tax obligations remain enforceable against directors.

Can I lose my e-Residency card?

Yes. Repeated violations can lead to revocation of e-Residency, cutting access to all e-services and your company’s digital management tools.

Conclusion: Protect your e-Residency and business with Unicount

Neglecting your Estonian e-Residency responsibilities can lead to serious legal and financial consequences.

By staying proactive and working with trusted partners like Unicount, you can keep your company compliant, avoid unnecessary fines, and continue enjoying the benefits of Estonia’s world-leading digital business environment.

Ready to protect your e-Residency status and business?

Contact Unicount for expert guidance and ongoing compliance support.