Da Estland mit den Herausforderungen der Rezession, hoher Inflation und gestiegenen Verteidigungsausgaben konfrontiert ist, erwägt die neue Koalitionsregierung bedeutende Änderungen in ihrer Steuerpolitik. Diese Anpassungen sind Teil des Koalitionsvertrags, der darauf abzielt, den Staatshaushalt auszugleichen und die Anforderungen des Eurozonen-Defizits von 3 % einzuhalten. Für zukünftige E-Residenten, die ihr Unternehmen in Estland gründen möchten, könnte das Verständnis dieser potenziellen Steuererhöhungen vor der Investition von Relevanz sein.

Wesentliche Elemente des Koalitionsvertrags

Eines der bedeutendsten Elemente des Koalitionsvertrags ist die geplante Erhöhung der Mehrwert- und Einkommensteuersätze. Bis 2026 könnte die estnische Mehrwertsteuer um weitere 2 % von 22 % auf 24 % steigen. Diese Erhöhung soll erhebliche Einnahmen generieren, um das Haushaltsdefizit der Regierung anzugehen, das durch steigende Verteidigungsausgaben und ein inflationsbedingtes Umfeld in einer seit zehn Quartalen anhaltenden Rezession verursacht wird.

Für E-Residents wird diese potenzielle Mehrwertsteuererhöhung die Kosten für Unternehmensdienstleistungen in Estland direkt beeinflussen, wenn Ihr Unternehmen nicht für die Mehrwertsteuer registriert ist, um Vorsteuer zurückzufordern. Wenn Sie an estnische B2C-Kunden verkaufen, könnten Sie Ihre Preisstrategien neu ausrichten. Während diese Steueränderung nicht direkt Unternehmen ohne Wohnsitz betrifft, könnten die gestiegenen Kosten das allgemeine Geschäftsumfeld und die Verbraucher beeinflussen.

Jährliche Körperschaftsteuer: Eine neue Richtung?

Der Koalitionsvertrag sieht eine Erhöhung des Einkommensteuersatzes von 22 % im Jahr 2025 auf 24 % im Jahr 2026 vor. Dies würde gleichermaßen für Unternehmensdividenden und persönliches Einkommen wie Geschäftsführervergütungen, Gehälter oder private Kapitalgewinne gelten.

Estland hat lange Zeit internationale Unternehmer mit seiner innovativen 0-%-Körperschaftsteuer auf einbehaltene Gewinne angezogen, die es Unternehmen ermöglicht, Gewinne steuerfrei zu reinvestieren. Eingeführt von der Reformpartei im Jahr 2000, war diese Regelung ein Schlüsselfaktor für Estlands Ruf als unternehmensfreundliches Ziel innerhalb der Europäischen Union. Unternehmen wurden nur dann besteuert, wenn Gewinne als Dividenden ausgeschüttet wurden, was Wachstum und Reinvestitionen förderte. Dieses vorteilhafte Steuersystem steht jedoch im aktuellen Koalitionsvertrag zur Diskussion. Die 0-%-Steuer auf einbehaltene Gewinne bleibt bis 2025 bestehen, da keine Steuer weniger als sechs Monate vor Beginn des Steuerjahres geändert werden kann.

Der Koalitionsvertrag enthält auch einen neuen Vorschlag für eine „Sicherheitssteuer“ ab 2026, eine jährliche Körperschaftsteuer von 2 %, die unabhängig davon gelten soll, ob Gewinne ausgeschüttet werden. Diese Steuer sollte zusätzliche Einnahmen für nationale Verteidigungsinitiativen generieren, aber bisher wurde noch keine Gesetzgebung vorgeschlagen. Derzeit bleibt diese Sicherheitssteuer ein Vorschlag, und ihre Zukunft ist ungewiss.

Vorschlag des Finanzministers zur Lohnsteuer: Ein neuer Ansatz?

Für zusätzliche Unsicherheit sorgt ein neuer Vorschlag vom 15. August des Reformparteien-Finanzministers Jürgen Ligi, der vorgeschlagen hat, die 2%ige Körperschaftsteuer auf Jahresgewinne durch eine zusätzliche Lohnsteuer zu ersetzen. Dieser Vorschlag stellt eine erhebliche Abweichung vom Koalitionsvertrag dar, der am 19. Juli 2024 veröffentlicht wurde.

Ligins Vorschlag wurde jedoch innerhalb der Koalition kritisiert. Der stellvertretende Vorsitzende der Sozialdemokraten, Tanel Kiik, äußerte Bedenken, dass der Vorschlag „unklar“ sei, und warnte davor, dass eine höhere Besteuerung der Beschäftigung die Schaffung von Arbeitsplätzen behindern könnte. Arbeitgeber in Estland zahlen bereits vergleichsweise hohe Beschäftigungssteuern im Vergleich zu Unternehmen ohne Arbeitnehmer, und es wird befürchtet, dass zusätzliche Lohnsteuern Unternehmen begünstigen würden, die die Einstellung von Mitarbeitern vermeiden.

Ligins Vorschlag zur Lohnsteuer kann als Versuch gesehen werden, Estlands finanzielle Herausforderungen anzugehen, ohne das Erbe der Reformpartei einer 0-%-Jahreskörperschaftsteuer aufzugeben. Es bleibt jedoch abzuwarten, wie sich dieser Vorschlag angesichts des Widerstands entwickeln wird und ob er genügend Unterstützung findet, um gesetzlich verankert zu werden.

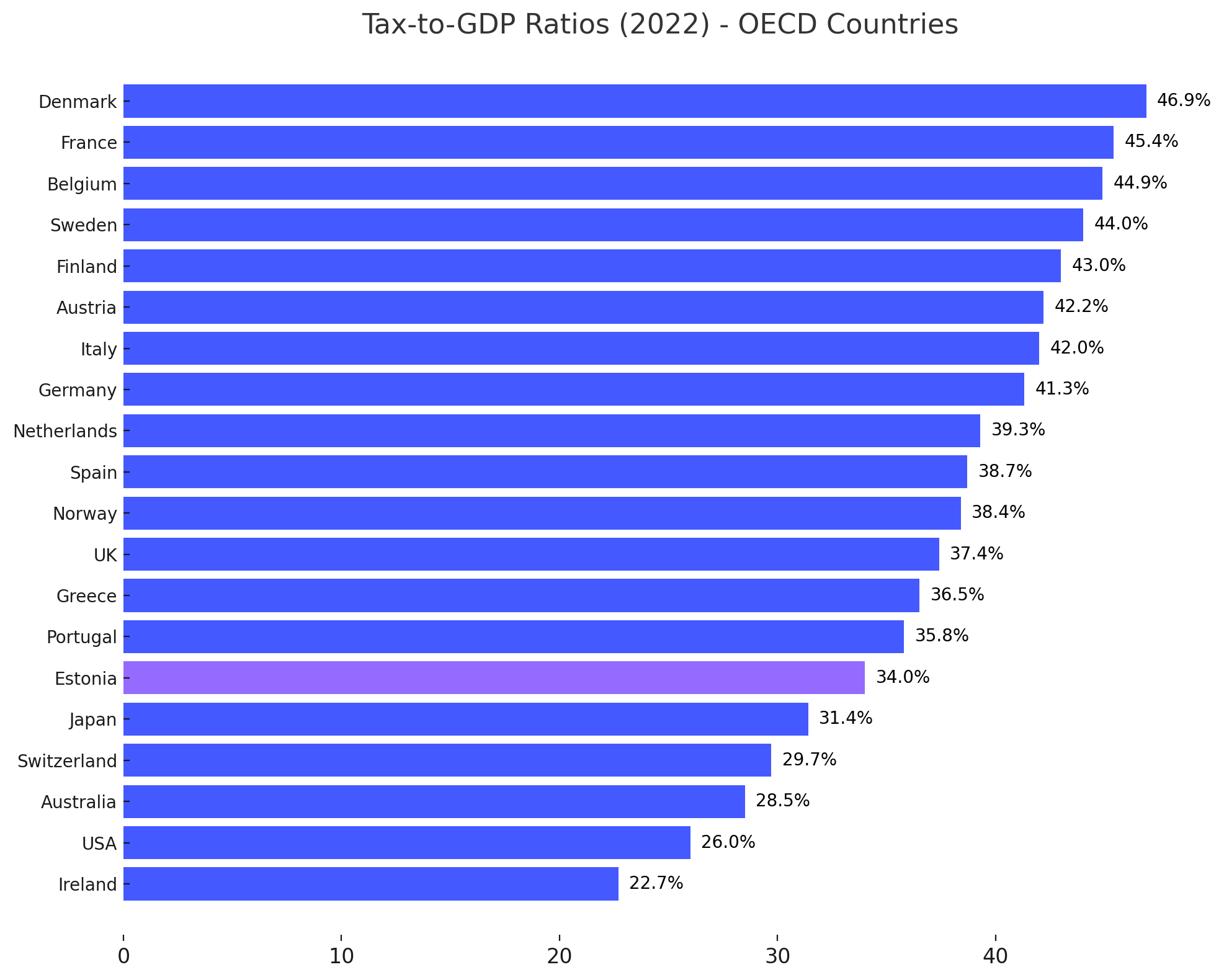

Estlands Steuerquote im Vergleich zu OECD-Ländern

Estlands Steuerquote im Verhältnis zum BIP ist im Vergleich zu anderen OECD-Ländern relativ niedrig. Laut der OECD 2022 lag Estlands Steueraufkommen als Prozentsatz des BIP in den letzten Jahren bei etwa 34 % und damit unter dem OECD-Durchschnitt von rund 34,4 %. Diese relativ niedrige Steuerbelastung ist Teil von Estlands Attraktivität für internationale Unternehmen, insbesondere für jene, die ein günstiges Umfeld für Reinvestitionen und Wachstum suchen.

Da Estland jedoch versucht, die wachsenden finanziellen Herausforderungen zu bewältigen, könnten die geplanten Steuererhöhungen das Steuer-BIP-Verhältnis näher an den OECD-Durchschnitt bringen. Während Estland weiterhin einige der attraktivsten Unternehmenssteuerregelungen Europas beibehält, könnten diese neuen Maßnahmen seinen Wettbewerbsvorteil verringern.

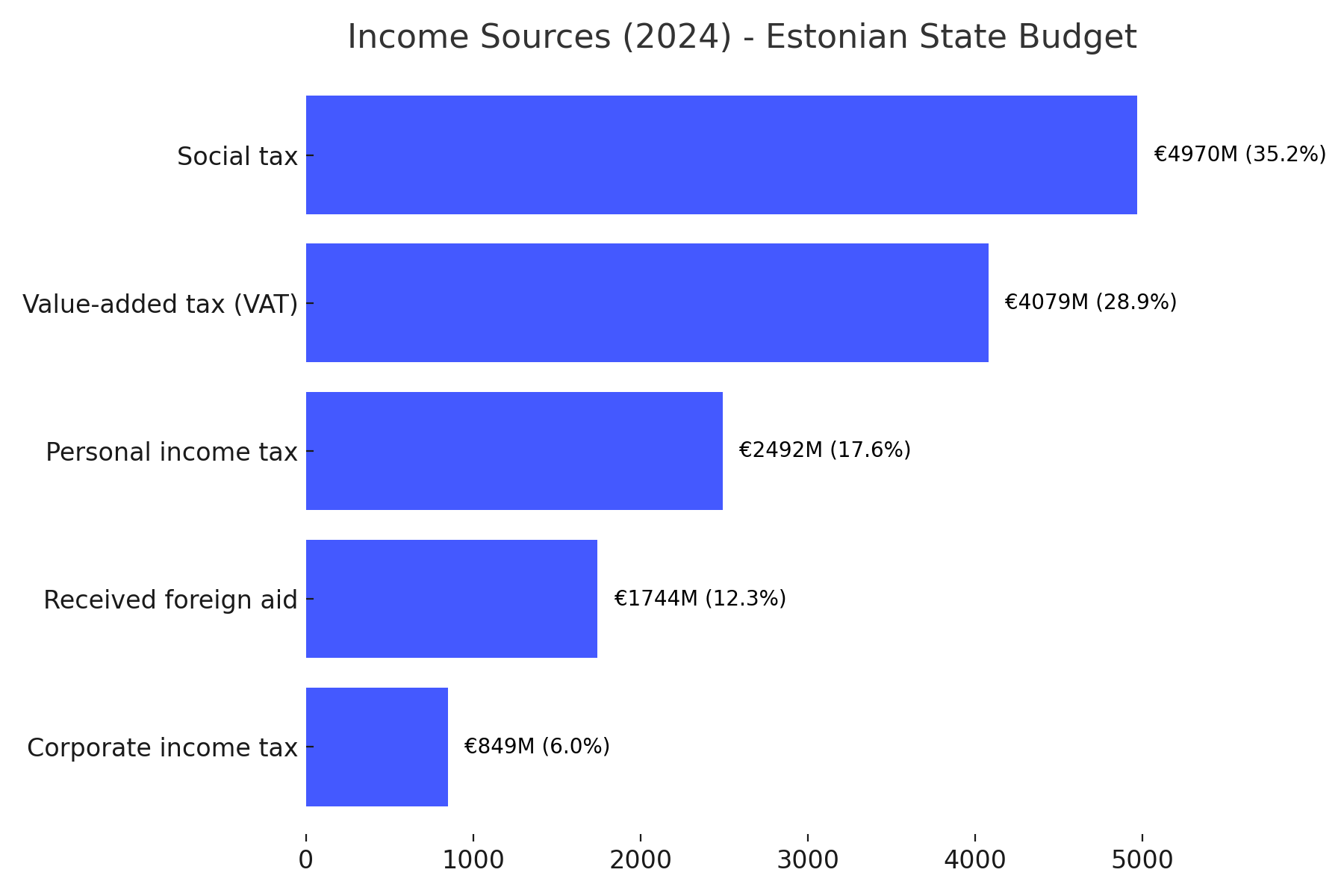

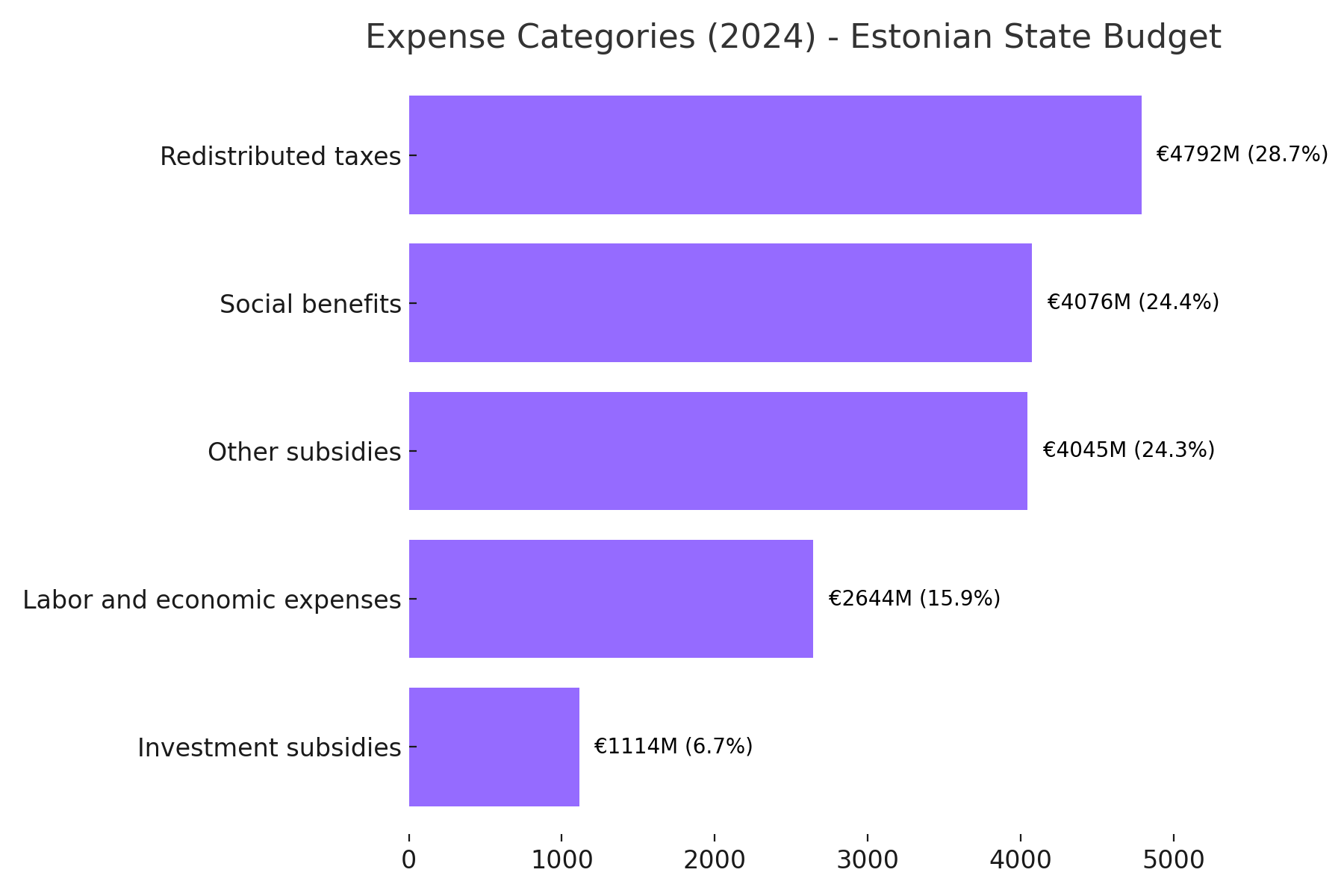

Struktur des estnischen Staatshaushalts: Einnahmen und Ausgaben in Prozent

Der estnische Staatshaushalt 2024 beläuft sich auf etwa 16,8 Milliarden Euro an Einnahmen und 17,7 Milliarden Euro an Ausgaben, mit einem Defizit von 1,7 Milliarden Euro. Der Haushalt spiegelt den Schwerpunkt der Regierung wider, Sicherheit und Wirtschaftswachstum aufrechtzuerhalten und gleichzeitig die Haushaltsungleichgewichte anzugehen.

Soziale Sicherheit bleibt der größte Ausgabenposten, getrieben durch die Kosten für Renten und Sozialleistungen, gefolgt von erheblichen Investitionen in das Gesundheitswesen und die Bildung. Die Verteidigungsausgaben wachsen weiter, was Estlands Engagement für die regionale Sicherheit angesichts der anhaltenden geopolitischen Herausforderungen widerspiegelt, insbesondere aufgrund des russischen Angriffskriegs gegen die Ukraine. Diese Kategorie macht nun etwa 9 % des Haushalts aus, mit einer Zuweisung von über 1,3 Milliarden Euro.

Was kommt als Nächstes?

Wir ermutigen alle unsere E-Resident-Kunden, sich mit Steuerfachleuten zu beraten und ihre Geschäftsstrategien entsprechend anzupassen. Die bevorstehenden Änderungen mögen entmutigend erscheinen, aber mit der richtigen Planung kann Ihr estnisches Unternehmen weiterhin erfolgreich sein.

Für detailliertere Anleitungen zur Verwaltung der Steuerpflichten Ihres Unternehmens in Estland lesen Sie unsere Artikel zur Dividendenausschüttung, Mehrwertsteuerregistrierung und wie Sie die richtigen Buchhaltungsdienste wählen. Unser Team steht Ihnen zur Verfügung, um Ihnen zu helfen, in Estlands sich wandelnder Steuerlandschaft konform und erfolgreich zu bleiben.

Danke fürs Lesen!

Wenn Sie weitere Fragen haben, sehen Sie sich die umfangreichen Support-Artikel von Unicount an oder kontaktieren Sie uns direkt für eine persönliche Beratung.